US house prices no reason for concern yet

House prices in the US have been rising sharply for some years now, reminding us of the financial crisis. An important question therefore is whether the US housing market has entered the danger zone again. In our opinion, it’s too early to sound the alarm. Most metrics of price valuations indeed are still some way from returning to the overheated levels of 2006. In particular, housing affordability, although under pressure as mortgage rates are rising, remains elevated. Also, the current debt position of US households differs from the rapid growth until 2007. Since that year, the debt-to-income ratio has fallen sharply and, currently, debt payments of households are at an historically low level.

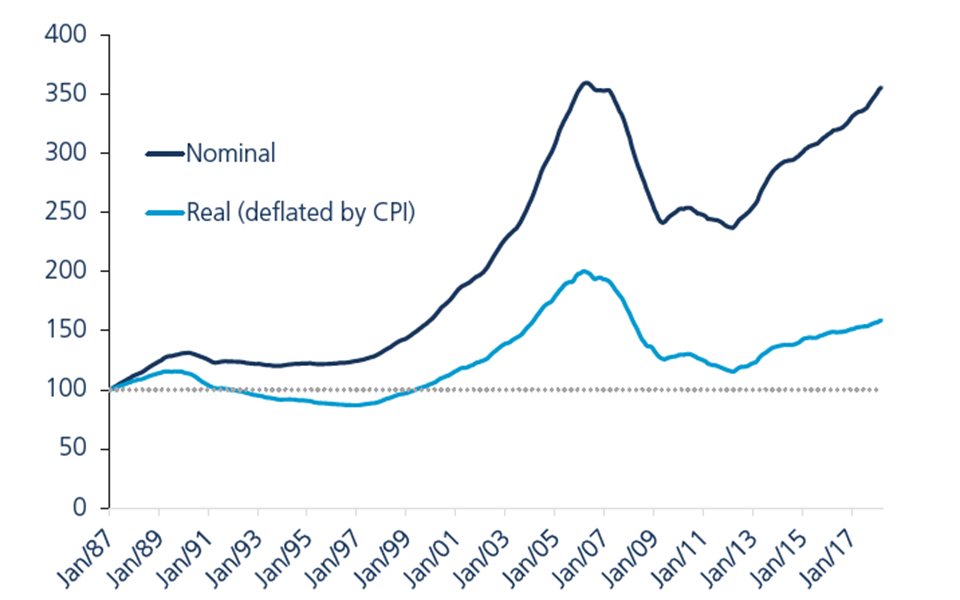

Based on the often-cited Case-Shiller price index, nominal house prices in the US rose by 6.5% per year between 2012 (the low reached after the bubble burst) and 2017. Prices nationally are now again around the high seen during the price bubble of 2006 (figure 1). The robust pick-up in economic growth, resulting in strong jobs growth, and an imbalance between demand and supply are largely the cause for the uptick in housing inflation. Home-building in the US has clearly been increasing, but remains below levels necessary to compensate for the strong level of demand.

Figure 1 - Long-term development of US house prices (S&P/Case-Shiller index, 10-city composite, January 1987 = 100)

Source: S&P/Case-Shiller

Prices have not become overheated (yet)

Despite the strong dynamics, one should not exagerate the developments on the US housing market. Firstly, the momentum of the recent price rise should be put into broader perspective. Its pace has been significantly slower than the one before 2006. Between 2001 and 2006, prices rose by 14% per year on average, which is double the figure registered between 2012 and 2017. Moreover, in real terms (i.e. corrected for the development of the general consumer price index) house prices in early 2018 are still more than 20% lower than at their peak in 2006. Also, looked at from an international perspective, the develoment of US house prices since 2012 has been roughly in line with the OECD average. The other important Anglo-Saxon markets - the UK, Canada and Australia - for instance have shown much sharper price increases over that period.

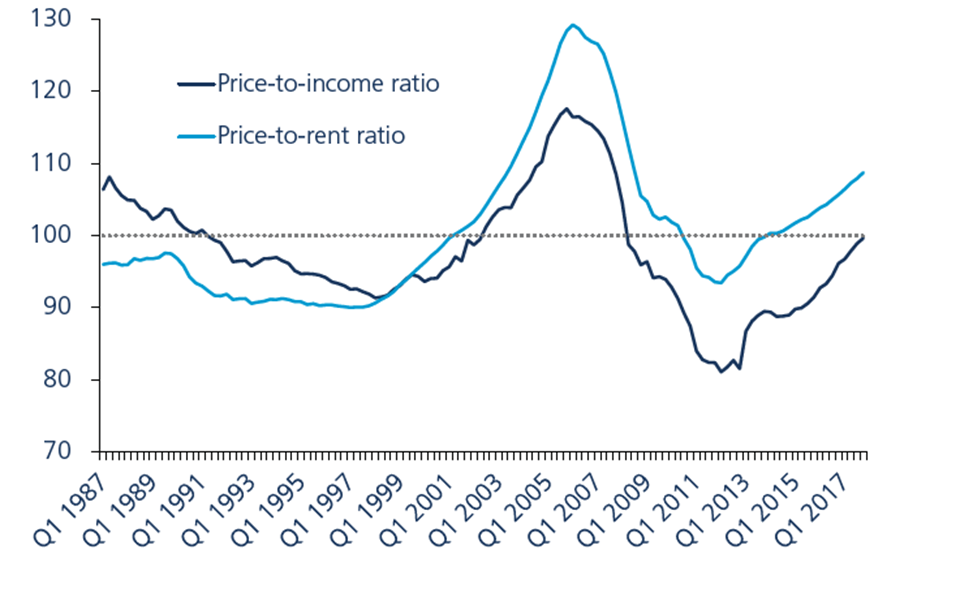

Secondly, the valuation of average US house prices seems still fine at this stage. Traditional metrics - i.e. the ratio of house prices to income or rents - suggested at an early stage that US properties were overvalued in the run-up to the financial crisis. After 2000, the price-to-income ratio and the price-to-rent ratio rose to levels well above their long-term average. After the bubble had burst in 2006, both ratios fell until 2012 to levels below the historical average. They have been rising since then, but are still some way from returning to the overheated levels of 2006 (figure 2). Both ratios moreover were still below the OECD average at the end of 2017.

Figure 2 - Ratio of US house prices to household income and rents (standardised, average 1987-2017 = 100)

Thirdly, housing affordability remains elevated, despite being under pressure as mortage rates are rising in tandem with the progressive rate hikes by the Fed and the increase in the 10-year Treasury yield (figure 3). Also, 85% of the applications over the last 10 years have been for fixed rate mortgages, which suggests that the majority of existing mortgages will not be impacted by rising interest rates.

Figure 3 - US housing affordability index (measure whether or not a typical household earns enough income to qualify for a mortgage loan on a typical home)

Finally, current debt trends of US households differ from the rapid growth until 2007. Asset bubbles are particularly dangerous when accompanied by sharply rising debt. This was observed in the run-up to the financial crisis: mortgage loans outstanding climbed from 62% of disposable income to nearly 100% in 2007. Since 2007, the debt ratio has fallen to 70%, well below its long-term trend (figure 4). Since 2014, mortgage loans in dollar terms have again increased, but not quickly enough to raise the debt ratio. As a result of higher interest rates, debt payments as a % of disposable income increased slightly in recent years, but remain at an historically low level.

Figure 4 - US private households’ mortgage debt position

Soft landing most likely scenario

Summing up, we can conclude that it is too early to ring the alarm bells for the US housing market. In the most likely scenario, the normalisation of interest rates and a reduction in excess demand will put house price appreciation on a weaker trajectory. In such a scenario, the market is heading for a soft landing. This country-level view does not preclude the possibility of a different conclusion at the individual states’ level, however. Price dynamics indeed vary tremendously within the country, with state-specific factors often playing an important role.