US housing market: rising prices meet rising rates

The Fed is on its way toward orchestrating a cooldown of the US economy, with a 50-basis-point policy rate hike last week following an earlier 25-basis-point rate hike in March. The goal is to steer inflation and inflation expectations lower by quickly withdrawing policy support, hopefully without inducing a recession. One area where ultra-accommodative monetary policy has helped contribute to frothy price developments is in the US housing market.

Both rents and house prices are growing substantially, with rents in March 5.1% higher compared to a year earlier, and house prices in February 19.8% higher compared to a year earlier. The price dynamics related to rents have a more direct impact on consumer price inflation (with a 32% weight in the index), but there is less evidence that rent costs are, on net, inordinately high compared to pre-pandemic. For example, over the 24-month period between March 2020 and March 2022, rents are only up 7%, reflecting a sharp drop in rents at the beginning of the pandemic. A 7% increase in rents over a two-year horizon is in line with average price changes during the four years prior to the pandemic. If rents continue to rise at their recent pace, however, it will soon be a different story.

House prices, meanwhile, registered no comparable dip at the beginning of the pandemic and are up 34% compared to two years ago (in the run up to the Global Financial Crisis, the same metric peaked at 29% in late 2005). There are both supply and demand side factors at play. On the supply side, e.g., homeowner vacancy rates reached an all-time low of 0.8% in Q1 2022. On the demand side, mortgage interest rates also played an important role, dropping over the course of 2020 and 2021 to another all-time low of 2.8% for 30-year mortgages. With mortgage rates now spiking to levels not seen since 2009 (averaging 5.45% the first week of May), the sharp rise in house prices in recent years sets the stage for a complicated real estate market going forward.

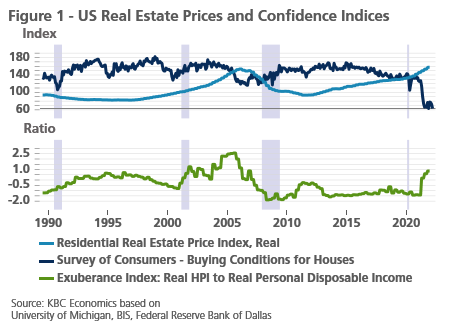

As Figure 1 illustrates, real house prices have increased sharply since the onset of the pandemic, especially relative to real disposable income. Real house prices relative to real disposable income is an important indicator of house price affordability; its sharp spike since March 2021 coincides with a sharp fall in a survey indicator that measures the consumer outlook for buying a house. Given current inflation and policy dynamics in the US, the affordability of buying a house is unlikely to improve in the coming quarters (all else equal). First, elevated inflation will continue to eat into real disposable income. Second, with the Fed set to further raise the policy rate at a rapid clip in the coming quarters and start winding down its balance sheet in June, mortgage interest rates are likely to remain elevated and could increase further. While the share of single-family mortgages with variable rates has been very low in the US in recent years (averaging 3.5% of mortgage originations since 2017 according to the Federal Housing Finance Agency) rising mortgage rates will make it more expensive for new buyers to finance the purchase of a house.

It is less clear what the above inflation and policy dynamics will mean for US house prices, however. Some cooling of the market would be a welcome sign for potential homebuyers and policymakers alike. But while higher interest rates and inflation may weigh on the demand side of the equation, low supply is also an important factor to keep in mind and may continue to support sharply rising house prices despite deteriorating affordability, at least in the near term.