US GDP shrank in Q1

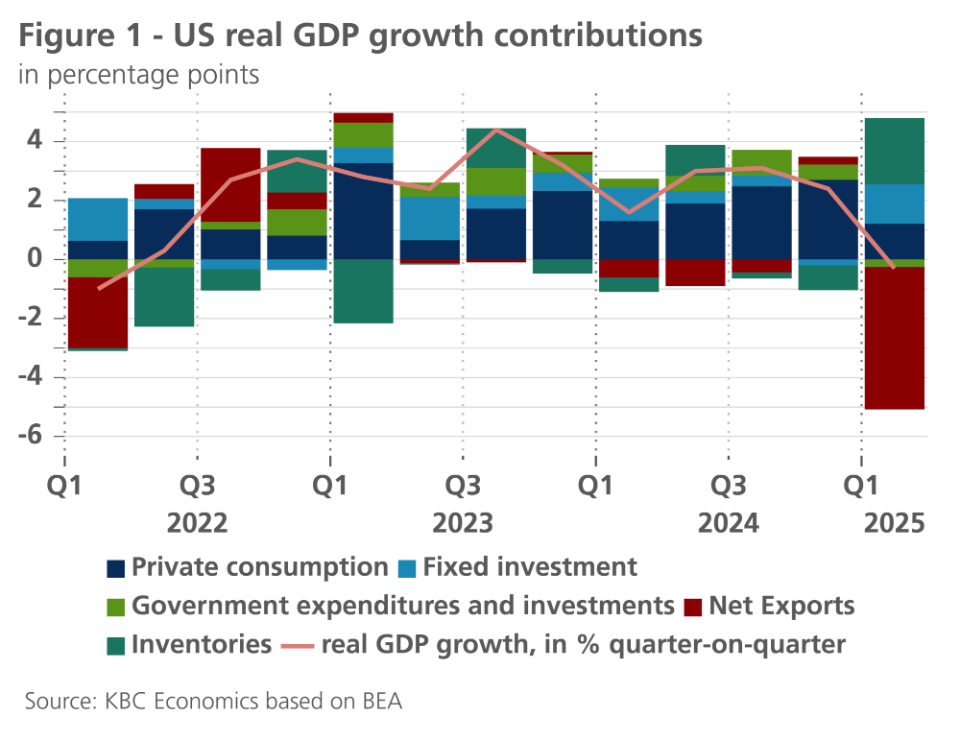

US economic growth turned negative last quarter, the first negative figure in 3 years. US growth decreased by 0.1% quarter-on-quarter (see figure 1). The decline was primarily caused by an astonishing 1.2 percentage points negative quarter-on-quarter contribution from net exports (though government spending made a small negative contribution as well). Underlying, imports surged by 10.3% quarter-on-quarter. This was largely the result of imports being pulled forward in time due to (the anticipation of) higher trade tariffs (so called front-loading).

The negative net exports contribution was counterbalanced by positive contributions elsewhere. Notably, inventories made a positive quarter-on-quarter contribution of 0.6 percentage points, as warehouses are being filled with imported goods. In a similar vein, equipment spending made a strong 0.3% percentage points quarter-on-quarter contribution, likely due to an increase in foreign-made equipment. Information processing equipment made a particularly big contribution. Given the uncertain business climate, this elevated equipment spending is unlikely to be repeated in the coming quarters. Other fixed investments, such as non-residential structures, intellectual property products and residential investment made more modest contributions.

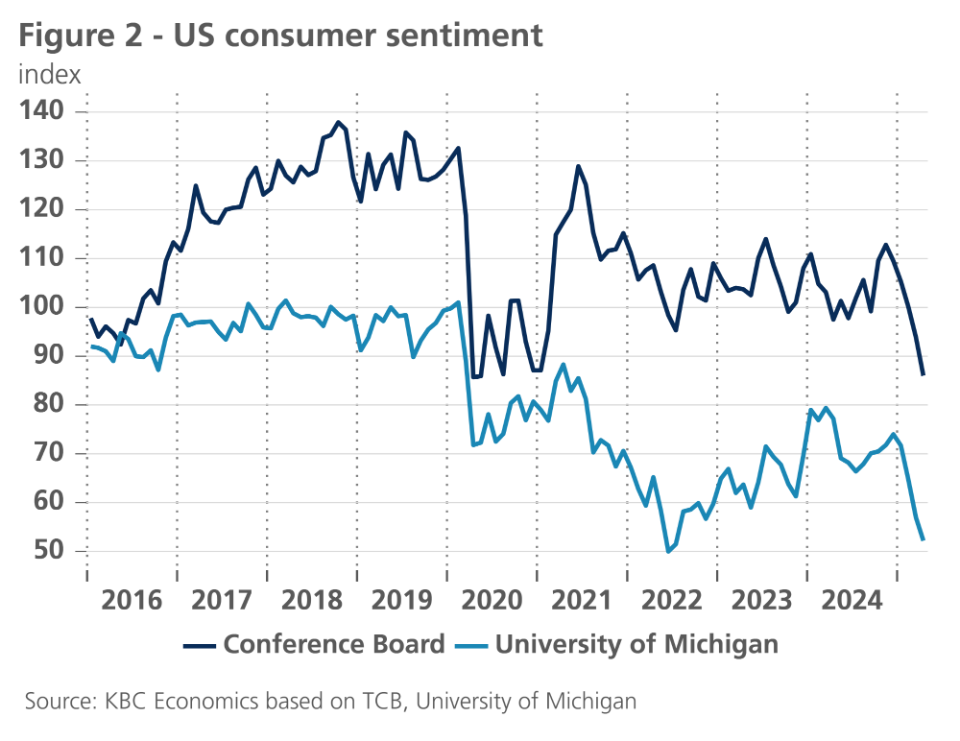

The most worrisome figure in the GDP report was the low contribution of consumer spending. Indeed, despite continued tariff-induced anticipatory spending, consumer spending only made a 0.3% quarter-on quarter contribution (down from 0.65% last quarter). Durable goods spending declined by 0.85% quarter-on-quarter due to lower vehicle spending. Services spending also made a lower contribution, in large part because a 1.5% quarter-on-quarter drop in food services and accommodation spending. Though this drop could partially be weather-related, it could also be a sign that consumers are starting to cut back on non-essential spending. Indeed, recent drops in consumer sentiment (see figure 2) suggest consumer spending is likely to remain subdued in the coming quarters.

The disappointing performance of the US economy stands in contrast with other major economies. The euro area also published its GDP figure this week, showing that Q1 GDP increased by 0.4% quarter-on-quarter. Though this was partly due a large 3.2% increase in Irish growth, the euro area GDP excluding Ireland still increased by a decent 0.3%. China’s economy also surpassed expectations last month, increasing by 5.4% year-on-year (also partly linked to front-loading in the US though). This quarter, it seems that US exceptionalism has been reversed.