Positive economic evaluation for Macron’s reform policies

The French economy is facing a number of structural problems, including declining competitiveness and derailing public finances. These structural weaknesses suppress economic growth potential and led to a gap with a number of other EU countries. With the introduced and planned reforms, President Macron and his government are trying to take the bull by the horns. There has already been a lot of public protest against the measures. From a macroeconomic point of view, however, President Macron does receive a good evaluation. After all, the reforms will most likely increase France’s growth potential in the longer run.

French President Macron had a difficult time in recent months. A scandal about one of Macron’s bodyguards led to two motions of distrust in the French Parliament against the government – which were eventually rejected. In addition, three of the ministers in his cabinet have already resigned. Strike waves and protests were regularly in the news, and in the polls Macron’s popularity among the French population is declining month by month. Despite all this negativity, there is still reason for (economic) optimism though.

Structural problems…

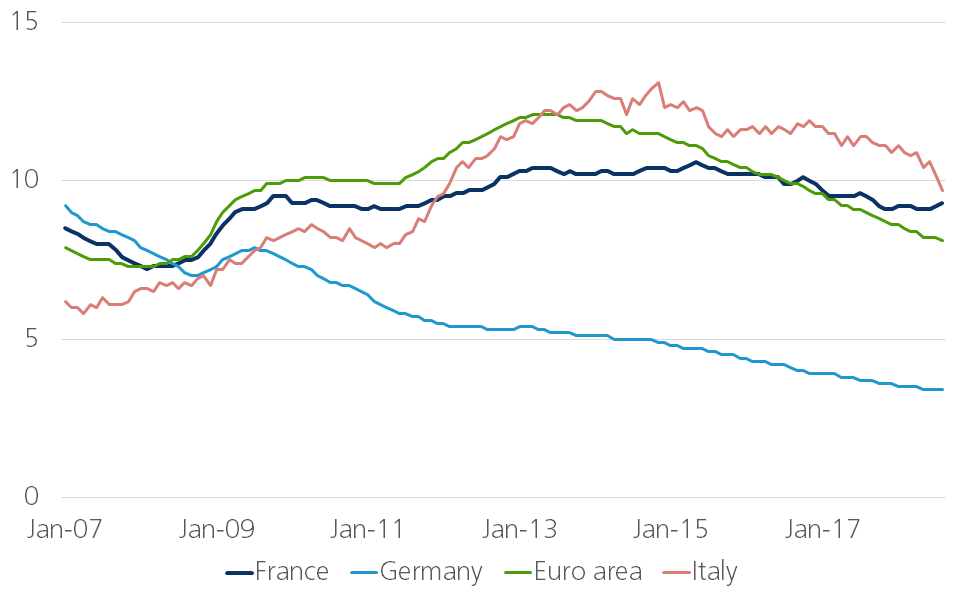

The French economy suffers from a number of structural problems that suppress its economic growth potential. A major cause of this is the challenges on the French labour market. A mismatch between the education system and the skills that companies consider important, together with limited incentives to work, has contributed to high structural unemployment in France. As a result, the decline in the French unemployment rate since the euro crisis has been limited compared to other countries in the euro zone (Figure 1). In addition, France is struggling with a competitiveness problem. France’s market share in world trade has steadily declined since the early 2000s. This was not the case in comparable countries such as Germany and Spain. The growing importance of emerging markets has made it more difficult for all developed economies to maintain their market share on the global market. However, France was not able to compensate for this due to domestic factors. A high tax burden on labour, labour market rigidities and the lack of a French specialisation in high-tech sectors that are relatively less exposed to price competition led to the decline in competitiveness. The main consequence has been a current account deficit on the balance of payments since the financial crisis. Moreover, the high level of public debt is a risk to France’s growth prospects. As a result, there is little budgetary room for manoeuvre in the event of a negative economic shock. Especially after the euro crisis, with the exception of the most recent quarters, these structural problems caused French economic growth to lag behind the euro area’s.

Figure 1 - Decrease in the French unemployment rate remained limited since the euro crisis (in % of active population, harmonised)

…versus Macron’s reform policies

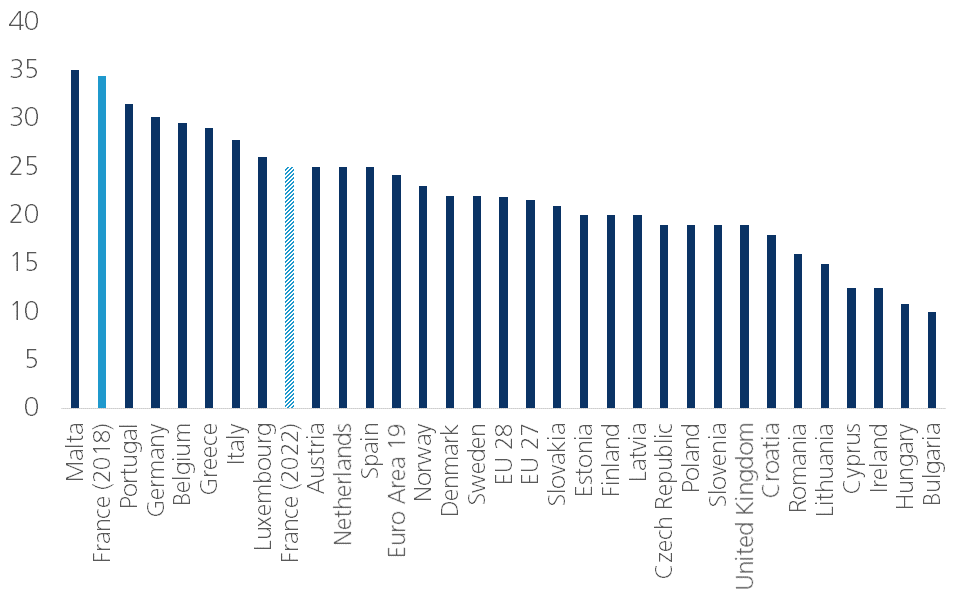

As promised during his election campaign, President Macron’s government took the bull by the horns soon after the presidential and parliamentary elections in 2017. In the autumn of that year, the government carried out a first wave of reforms. In order to reduce the lack of flexibility in the labour market, small businesses were able to enter into wage agreements with employees at the company level. Moreover, the dialogue with social partners was streamlined. In addition to labour market reforms, the government also tackled the high tax burden. At the beginning of 2018, the corporate tax rate for small enterprises was reduced from 33.3% to 28%. By 2022, a rate of 25% (excluding surcharges) will apply to all enterprises. While France is still ranked as one of the countries with the highest corporate tax rates, the tax rate cut, if no policy changes are made in the other countries, will bring France closer to the euro area average (Figure 2). A reduction in social contributions should reduce the large wedge between employer labour costs and employee net wages. Thus, the challenges on the French labour market have been addressed very quickly and already to a large extent by Macron’s reform policies. Furthermore, there are still a lot of reforms in the pipeline. The agenda includes, amongst other things, a reform of education and training systems with a stronger focus on vocational training and traineeship programmes.

Figure 2 - Corporate tax rate reduction makes France more competitive (statutory corporate income tax rate, in %, 2018)

Positive impact in the longer run

Macron’s party has an absolute majority in the French Parliament. Moreover, the opposition is still weak after last year’s election defeat. From that angle, there are hence relatively few obstacles that could thwart Macron’s reform programme. The dissatisfaction among the population will likely not stop the French government either. Macron and his ministers have repeatedly said that falling popularity scores will not prevent them from continuing the reform agenda. And that is a good thing. Although the future reforms will not be well received by everyone, they are much needed to further tackle the structural weaknesses of the French economy. From a macroeconomic point of view, President Macron is therefore doing a good job. When the positive impact of the reforms seep through completely, which can take several years, France’s growth potential is likely to increase in the longer run. The French people might not give the president and government a good evaluation, but from an economic point of view we say: Carry on like this!