Euro current account surplus points to investment shortfall

According to the IMF, the euro area current account surplus will be well again above 3% of GDP in 2018. Such a high surplus is a relatively new phenomenon for the euro area. Apart from the increase in the German surplus, this also reflects the regained competitiveness of a number of vulnerable euro area member states. However, the high and persistent surplus is not unambiguously positive. It is largely due to the weakness of the European investment dynamic, which is not making full use of available savings. This structural investment deficit undermines the long-run growth potential of the European economy.

Largest surplus in the world

The current account of the balance of payments of the euro area showed a surplus of 3.5% of GDP in 2017. According to the IMF’s latest forecast, the surplus will also be well above 3% in 2018. In absolute terms, the external surplus of the euro area has become the largest of the world, larger than that of China and Japan.

Put simply, the current account balance, or in short the external balance, measures the income flows between an economy and the rest of the world. Specifically, it takes into account the trade balance for goods and services, international dividend and interest payments and other international transfers. An economy with a current account surplus earns on balance more from its transactions with the rest of the world than it spends on them.

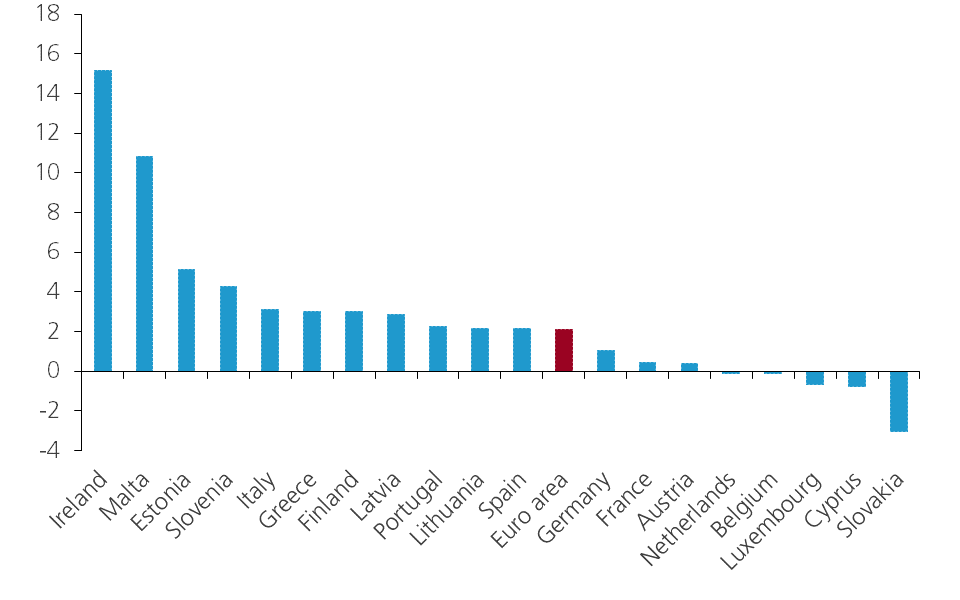

Such a surplus is a relatively new phenomenon for the euro area. Since the introduction of the euro in 1999 until 2011, the current account was broadly balanced. Only then did a persisitent surplus arise, which moreover increased steadily. The most important contribution comes from the surplus on the trade balance for goods and services. As shown by figure 1, that improvement was not only the result of a further increase of the German surplus, but also of an improvement in most other euro area countries. This reflected, among other things, a significant fiscal consolidation in response to the sovereign debt crisis. This slowed down domestic demand and thus also import growth. In addition, significant labour and product market reforms were carried out in peripheral euro area countries in order to restore their international competitiveness. Later, in 2014, a significant fall in oil prices contributed as well, by reducing the energy bill for the euro area.

Figure 1 - Change of current account balance 2012-17 (in percentage points of national GDP)

Mercantilistic fallacy

From a mercantilistic point of view, this external surplus is positive news for the euro area. After all, it is an indication of the regained competitiveness of its economy. That is also the reasoning of German policy makers, who use this argument to justify the persistently large German surplus on its national current account (around 8% of German GDP).

However, when an external surplus becomes excessive and structural, it can also have negative welfare effects, both for the economy itself and its trading partners. For example, the persistently high German external surplus has done nothing to contribute to the economic recovery of the crisis-hit euro countries. Their external deficits had to be unilaterally reduced by drastically restricting import growth, at the expense of their economic recovery. One of the lessons learned is that the European Commission now also considers excessive external surpluses, such as the German one, as a violation of the rules of the Macroeconomic Imbalance Procedure.

Investment deficit

Within the national accounts, total national savings, per definition, equal investments in a closed economy (i.e. without trade). In an open economy, any imbalance between savings and investments will be matched by transactions with the rest of the world. A savings surplus or deficit is then reflected in a surplus or deficit on the current account of the balance of payments.

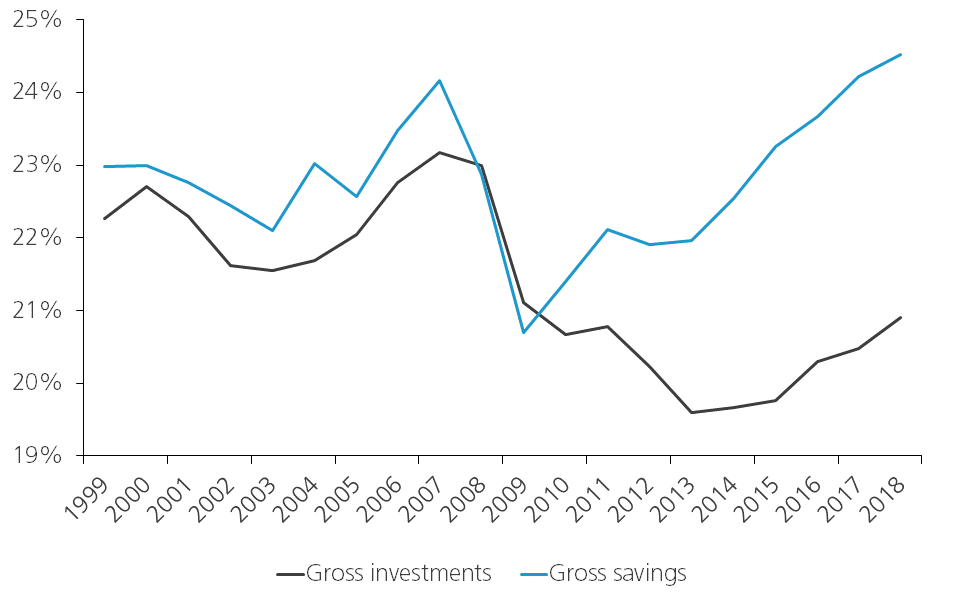

As can be seen from figure 2, the current account of the euro area was broadly in balance as long as savings and investments were aligned. The period of an increasing external surplus broadly coincides with the period in which the investment ratio lagged behind. While the national gross savings ratio has again exceeded its pre-crisis level, the investment ratio is still well below.

Figure 2 - Gross national savings and investments in the euro area (in % of GDP)

The current account surplus is, therefore, to a large extent a reflection of a shortfall of investments. Sooner or later, this inevitably has negative consequences for productivity growth. This happens at a time when productivity growth is needed to help to counterbalance the economic costs of an ageing population. The Japanese economy has long proven that this approach can be a viable option.

In sum, what we need is a higher investment ratio in the euro area, both in the private and public sector, which will reduce the current account surplus again in the coming years. Thanks to the higher investment demand, this would not weigh on short-term economic growth. On the contrary, it would give a much-needed boost to the longer-run growth potential of the European economy.