Shopping in Belgium is relatively expensive but some nuance is needed

The prices of many consumer goods are much higher in Belgium than in its neighbouring countries. Price differences are particularly high for products that are traditionally bought in supermarkets. The differences are partly due to the preferences of certain consumers, for example for good service or specialised shops. There is nothing wrong with that in itself. However, there are additional explanations for the high prices, in particular high taxes, strict regulations and the pricing strategy on the part of retailers. For consumers who are price-sensitive, the high prices in Belgium are accompanied by the frequent use of discount coupons. If these were taken into account in the comparison, the price difference with neighbouring countries would probably be somewhat lower. Also, price-sensitive consumers are increasingly shopping across borders. From a macroeconomic point of view, cross-border consumption means a substantial loss of activity and employment for Belgium.

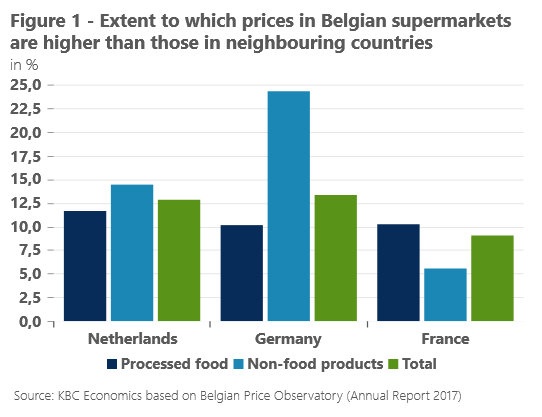

According to Eurostat, prices of consumer goods in Belgium in 2018 were 6% higher than the eurozone average. Shopping in Belgium is also relatively expensive compared to neighbouring countries. A detailed comparison by the Belgian Price Observatory in 2017, based on identical products, shows that price differences in supermarkets compared to neighbouring countries are well above 10% (Figure 1). In the Netherlands and Germany in particular, consumers pay significantly less than in Belgium. The differences with the neighbouring countries are also said to have increased compared to a previous detailed comparison in 2013.

Various (not always correct) explanations

The persistently higher prices are striking. The high number of points of sale in Belgian retail trade and the arrival of new players, such as the Albert Heijn supermarket chain, should indeed encourage competition and downward pressure on prices. The fact that prices in Belgium remain high is attributed to several reasons in the literature. Some of these, however, only apply partially, or not at all. This is, for instance, the case for tax differences. The standard VAT rate in Belgium (21%) is higher than in Germany (19%) and France (20%), but the reduced rate (6%) is lower than that in the Netherlands (increased to 9% at the beginning of 2019) and Germany (7%). As a result of increases in recent years, Belgian excise duties are now significantly higher than those of the three neighbouring countries, however. Other taxes, such as the sugar tax and environmental and packaging taxes, can also influence the price difference with its neighbours.

The high prices are often also explained by the high labour costs. However, this is unjustified. According to Eurostat, the Belgian retail trade (NACE 47) has a higher labour cost per employee compared to the Netherlands and Germany (not France), but this is more than compensated by its higher productivity. Thus, the level of unit labour costs does not explain the higher Belgian prices. On the other hand, since 2008, unit labour costs in the retail sector in Belgium have increased significantly faster than in the three neighbouring countries, meaning that the comparative advantage has diminished.

On the other hand, the Belgian retail sector does have a strong comparative disadvantage in terms of regulation compared to neighbouring countries. This may dampen competition in the sector, with an upward impact on consumer prices. The relatively strict regulations concern, among other things, stricter rules on opening hours, on promotions and on permits to start a new activity. The OECD's Product Market Regulation indicator illustrates this. In 2018, the indicator for the Belgian retail sector was at 2.52, while the figure for neighbouring countries was only 0.97 (the Netherlands), 0.48 (Germany) and 2.00 (France). The Belgian score is only a smidge away from the worst score in Europe, that of Italy (2.79).

Differences in geographical scale are another explanation for the relatively high Belgian prices. Compared with neighbouring countries, Belgium has a smaller surface area and thus a smaller market. Together with the strict legislation on product labelling, this results in retailers receiving less good purchase prices and conditions from international manufacturers and suppliers. This then translates into higher prices for the consumer.

Champion on discount coupons

Finally, the higher prices may also be a result of the deliberate strategy employed by Belgian retailers. The Belgian Price Observatory refers in this respect to the fact that the most important player on the Belgian market, Colruyt, pursues a strategy of price follower, whereby its prices are adjusted to the lowest in the region. The strategy of other players is to distinguish themselves more by providing good service to less price-sensitive consumers, e.g. by focusing on quality and a strong local presence. This strategy is not conducive to competition based on pricing. As a result, retailers in Belgium on average have a rather high price-cost margin. Eurostat figures confirm that the profitability of retail trade in Belgium has been consistently higher than in Germany and France over the past decade, but lower than in the Netherlands.

The strategy and the associated higher prices likely explain why discount coupons and loyalty cards are so popular in Belgium. According to figures from HighCo DATA, a specialist in promotional marketing, Belgium is top of the European ranking of countries where residents use the most coupons. This implies price discrimination, whereby different customer groups pay different prices. Price-sensitive consumers cut coupons and save points on loyalty cards, others do not. The fact that many consumers actually pay the higher prices means that Belgians are on average less price-sensitive than citizens in neighbouring countries. This is probably partly due to specific preferences, such as those for national brands, good service and specialised shops. There is nothing wrong with that in itself, but it does help to maintain higher prices in Belgium. A question is whether the frequent use of coupons by price-sensitive consumers does not lead to an overestimation of prices in Belgium. The available data on price levels from Eurostat and the Belgian Price Observatory do not take account of indirect promotions and discounts, such as coupons and loyalty cards. If this were the case, the price difference with neighbouring countries would probably be somewhat lower.

The high prices have a number of negative consequences. For households, they imply a reduction in their purchasing power (notice that the price difference with neighbouring countries also persists in purchasing power parities). For retailers, they support their margins, but this advantage is increasingly being cancelled out by a fall in turnover as a result of increasing purchases abroad. Cross-border shopping in Belgium is simple because half of the citizens live less than 50 km from a border of one of its neighbouring countries. According to the research bureau GfK, one third of Belgian households make regular purchases abroad. In 80% of cases, price is the main reason. In 2018, Belgians are reported to have spent almost 5% more in supermarkets across the border. In addition to local purchases, they are also increasingly buying from online retailers abroad. According to Eurostat, 39% of Belgians bought from a foreign online retailer in 2018, compared to 33% of the Dutch, 18% of the Germans and 27% of the French. From a macroeconomic point of view, this flight of consumption across the border causes a considerable loss of activity and employment.