Roaring twenties 2.0?

With the start of the vaccination campaigns, there is now light at the end of the covid tunnel. As the number of vaccinations increases, the need for strict lockdowns decreases. As a result, we can now look forward to the return of normal life and the economic recovery that goes with it. Some analysts expect an unusually strong recovery similar to that of the Roaring Twenties, the post-war and post-pandemic period at the beginning of the 20th century. While there are certainly parallels between the past and the present, there are also differences. And it is precisely these differences that lead us to expect a more moderate economic recovery in Belgium in the coming years.

Vaccinations spark hope

With the start of vaccination campaigns in the EU, enthusiasm is growing for the period after herd immunity will be reached. Many are eagerly awaiting the moment when curfews, half-closed borders and lockdowns will be replaced by exuberant celebrations and regained freedoms. In recent months, there have been repeated references to the period that followed the First World War and the Spanish flu epidemic. This period, nicknamed the ‘Roaring Twenties’, was characterised by strong economic growth in the US and later on in Europe, revolutionary innovations and social and cultural exuberance. It is highly likely that there will be a period of economic recovery after the covid crisis. But a growth scenario simular to that of the Roaring Twenties is unlikely. Instead, KBC Economics expects a more moderate scenario.

Consumer catch-up

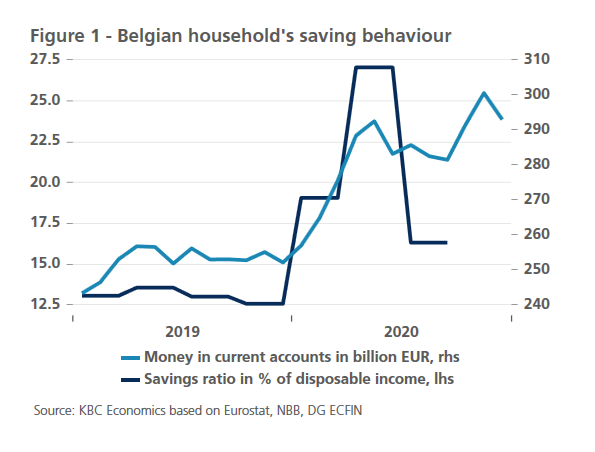

Private consumption will undoubtedly be an important driver of the coming economic recovery. A lot of money has been saved since the start of the covid crisis (see Figure 1). Current account balances held by Belgian households increased from 250 billion euros at the end of 2019 to 293 billion euros by the end of 2020. The savings rate rose to 27% in the second quarter before falling back to 16% in the third quarter, a level still well above the 2019 average.

According to an analysis by the European Central Bank, there were two main reasons for the rise in savings. On the one hand, increased uncertainty prompts people to save more as a precaution, for example out of fear for job losses. This is called precautionary saving. On the other hand, there have simply been fewer opportunities to spend money in recent months because of the compulsory closure of shops and the decline in consumption possibilities like social and cultural activities and travel. We call this compulsory saving, because it is forced upon consumers. According to the ECB, this category was the main reason for the increase in savings in the second quarter of 2020. This analysis was confirmed by the strong upward movement we saw in retail sales when the lockdown measures ended after the first two periods of shop closures. The fact that precautionary savings are, all in all, relatively limited compared to compulsory savings can be explained, among other things, by the many government measures taken to prevent job losses and/or limit temporary income losses.

These findings support the view that there will be pent-up demand in the future, but we should not be too optimistic just yet. The fact that compulsory savings are higher than precautionary savings does not alter the fact that the latter category has also risen considerably. In addition, precautionary savings will probably be more persistent than forced savings. Furthermore, the overall figures also hide differences between households. For many Belgians, it has become much more difficult or even impossible to save. A February consumer survey by the National Bank of Belgium revealed that 17% of households surveyed saw their household income fall by more than 10%.

Moreover, uncertainty about the future remains high. Even if we succeed in containing the coronavirus, it remains to be seen what impact the economic crisis will have on the economy and on employment. The generous support measures provided by governments will expire or be phased out over time. This will be a major tipping point for many companies that are artificially supported by various government measures such as cheap loans and a moratorium on corporate lending. This uncertainty is reflected in the employment component of various confidence indicators. Both consumers and companies see employment moving into negative territory in the coming months. Moreover, it is far from certain that consumers and producers - after all the damage suffered - will quickly erase this crisis from their memories. Because of the covid crisis, a pandemic is no longer just a theoretical concept, but rather a real risk that could impact decisions in the future.

Uncertainty could therefore weigh on consumer spending and on investment growth, especially for companies whose debt burden increased sharply and to unsustainable levels during the covid crisis. According to February’s ERMG survey, the average Belgian company expects investments to remain about 20% and 10% below normal in 2021 and 2022, respectively. Estimates vary widely between sectors, with the sectors hardest hit by the lockdowns as the main negative outliers, but all sectors show a negative investment outlook compared to normal. Governments are trying to cushion the investment fallout from the uncertainty with all sorts of support measures. One example of this is the Next Generation EU recovery fund, which includes sizeable investments that will be funded by the EU. The success of most plans, however, also requires a commitment from the private sector. In times of elevated uncertainty, this could be a limiting factor.

Technological breakthroughs

It takes more than just a recovery in demand to really make an economy boom. During the Roaring Twenties, there were some major upheavals that made strong economic growth possible. Increased automation made important products, such as cars and household appliances, affordable and the introduction of electricity into most homes also boosted consumption. It is definitely not unthinkable that there will again be major technological breakthroughs in the coming years - after all, a lot of extra money has been pumped into the world economy by central banks that could be used for innovation - but it is not certain either. There are plenty of potential candidates, such as advanced artificial intelligence, super batteries or new revolutionary medical technology, but it is impossible to predict if and when a technology will break through that can once again put growth into overdrive.

Moderate recovery

In our KBC economic forecasts, we assume that economic growth in Belgium will recover in 2021, but that the recovery will only really gain momentum in the second half of the year. Much depends on the course of the vaccination campaigns. In 2022, Belgian economic growth will remain solid, but it is unlikely that we will see a new Roaring Twenties scenario. However, this need not be a bad thing. There are reasons not to long for a new period of untamed growth and exuberance. After all, the Roaring Twenties were followed by the Great Depression, a period of extreme economic hardship.