Donald Trump’s potential reelection presents an important downside risk to GDP growth

Read the publication here or click to open the PDF

Abstract

2024 is a major election year as 76 countries are scheduled to hold elections. None of these elections will be as consequential as the US presidential election on 5 November, however. The probability of a Trump victory is elevated, and the economic consequences could be significantly negative. Donald Trump proposes a more extreme policy agenda than in 2016 on trade, immigration, the independence of US institutions and the US role in the wider world. He is also likely to face less opposition from his administration, US Congress and the court system during a possible second term. Furthermore, the economic and geopolitical environment have altered dramatically, making a potential second Trump term more problematic than his first term.

It is obviously still possible that Donald Trump’s plans are just campaign rhetoric and that he will drastically moderate his positions if he were to be reelected (as is often the case). That said, if he were to (partially) execute his plans, Donald Trump’s reelection could have a major impact on the US and global economy. His tariff and migration plan and his threats to central bank independence could drive the economy in stagflation. Furthermore, his presence in the White House could increase the likelihood of certain geopolitical risks such as a Chinese invasion of Taiwan. Therefore, though American voters mostly see Donald Trump as a better steward of the economy than Joe Biden, KBC Economics tends to disagree and we thus view President Biden as the better choice for the economy.

Introduction : the biggest near-term threat to the economy might come from across the Atlantic.

Our economic forecasts are subject to substantial downside risks next year. Central banks could keep monetary policy tighter than expected to avoid an inflationary rebound. China’s real estate crisis could further spiral out of control. The war in the Middle East could escalate, driving up energy prices and (again) threatening global supply chains. However, according to KBC Economics, the biggest near-term threat to growth might come from across the Atlantic. We consider a Trump victory in the 2024 US presidential elections as both a material probability event and, in case it materializes, one with a high (downside) impact.

Non-marginal odds of a Trump reelection

That the reelection of Donald Trump has a significant probability is quite obvious. Donald Trump is leading his closest Republican primary challenger by a nearly insurmountable 53 percentage points. He won the Republican Iowa caucus and New Hampshire primary convincingly. Furthermore, he is even leading the most likely Democratic candidate, Joe Biden, by around 1 percentage point in head-to-head polls for the general election. This explains why betting markets give him a more than 45% chance to win the US presidency (see figure 1). While still early days, these signals suggest a material probability that Donald Trump would be elected as the ‘new’ US president.

Trump II’s impact on the economy

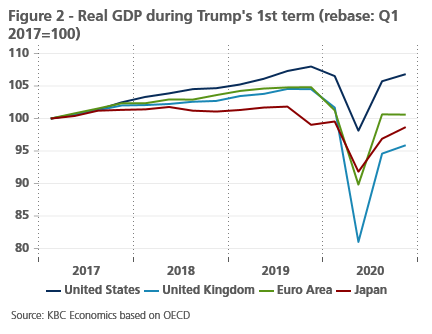

That a second Trump victory would have such a negative economic impact is less obvious at first glance. During Trump’s first term, America’s GDP well outperformed its peers (see figure 2), while inflation remained well below the Fed’s 2% target. Polls show voters currently trust Trump more on the economy than President Biden (by a margin of around 10 percentage points).

Nonetheless, we see a risk that a second Trump term could yield vastly different results, for three reasons. First, his economic proposals are becoming much more extreme. Second, his administration is likely to be more effective in implementing these proposals. Third, the global economic and geopolitical environment is now much more complicated than it was during his first term.

Donald Trump’s views have turned more extreme

Take his views first. Donald Trump’s policy agenda holds four policy stances which would hurt the US and global economy. He is a firm opponent of free trade, immigration, independent institutions and US engagement in the wider world.

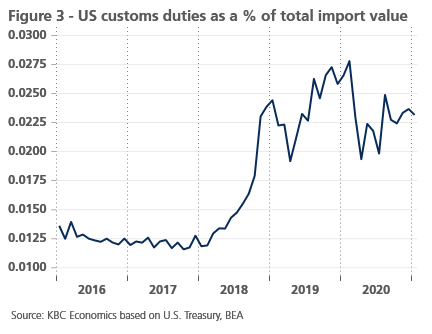

Trump’s stance on free trade has always been clear. During his first term, Trump pulled the US out of the Trans-Pacific Partnership trade agreement and launched major trade wars, not only with China, but also with allies such as the European Union. Customs duties almost doubled during his first term as a result (see figure 3). These tariffs almost certainly had negative effects on the US economy, as they increased cost to US consumers and importers. Economic researchers estimate that the US-China trade war reduced US GDP by a range of 0.3%-0.7% in 2019.1 However, it is worthwhile to mention that President Biden did not change trade policy in any fundamental way, as additional trade barriers (notably in high-tech) were introduced in his term as well (see further).

Yet Trump’s latest proposals go much further. He now wants to impose a 10% levy on all US imports, effectively quadrupling tariffs. Analysis by The Economist estimates that this measure would cost each American household an average of 2000 USD a year2. This estimate obviously excludes the potential retaliation from America’s trading partners. A global trade war would unfortunately be highly likely if he were to execute this plan.

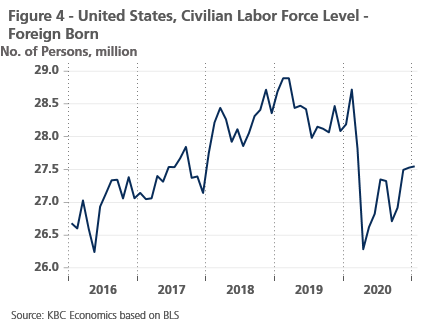

On immigration, Donald Trump’s views are also clearly restrictive. During his first term, Donald Trump partially built a border wall along the Mexican border, tightened visa requirements, tried to ban refugees and travelers from seven Muslim countries and separated children from their parents at the US-Mexico border. Nonetheless, net migration continued to be positive during his first term and despite the covid crisis, the foreign-born civilian labor force even increased (see figure 4).

Again, his proposals have become much more radical now. Not only does Donald Trump want to restrict migration as much as possible, he also plans to round up all illegal immigrants currently living in the US, place them in camps along the Mexican border and then deport them3. That would be highly disruptive, not only from a human perspective, but also to the US labour market. Undocumented immigrants make up around 5% of the US workforce.4 Rounding them up would cause massive labour shortages and operational disruptions, especially in sectors where they are overrepresented such as construction, agriculture and hospitality.

Donald Trump’s proposed trade and migration policies would not only severely hamper growth, but also cause upward inflationary shocks. These inflationary impulses could be exacerbated by his disrespect for US independent institutions, in particular towards the Fed. During his first term, Donald Trump repeatedly criticized the Fed (mostly via Twitter). This had important impacts on financial markets. According to research, the probability of a 25bp rate cut increased by an implied 8.6% per negative tweet5. Though Trump won’t be able to appoint new members to the Federal Reserve Board of Governors during a second term, he will likely appoint a more dovish central Fed Chair in 2026. Donald Trump already confirmed he would not reappoint Fed Chair Powell.6

He also wants to replace bureaucrats in federal departments with political allies (see further). This could affect economic data provided by the Bureau of Labor Statistics and the Bureau of Economic Analysis and make it more politically tainted and unreliable, complicating the Fed’s decision-making process. That would be very problematic. If inflation were to spike again as a result of Donald Trump’s tariff or migration policies, an independent and effective Fed would be more needed than ever to re-anchor inflation to the 2% target.

A final cause for concern is Trump’s isolationism. Donald Trump was already an isolationist president during his first term. He then regularly threatened to leave the NATO alliance, abandoned his Kurdish Syrian allies and signed an agreement to withdraw the US from Afghanistan. Nonetheless, overall, the US military presence abroad remained broadly intact during his first term7.

Trump could, however, be more isolationist during a second term. He refused to say whether he would provide military support to Taiwan in case of a military invasion (during NBC News and Fox News interviews), saying “Why would I say that? You’re giving away all your options”8. This is in contrast to Joe Biden’s clear commitment to defend Taiwan in case of an invasion9. Needless to say, continued US support is the most important deterrent for a Chinese invasion of Taiwan. If China were to invade, the world would lose a.o. its most important semiconductor manufacturing hub: 90% of advanced semiconductors are made in Taiwan.

On Ukraine, Donald Trump has declined to commit to military assistance, and claimed he will simply solve the conflict “in 24 hours.” A likely withdrawal of US financial and material support for Ukraine in a second Trump term could potentially allow Russia to become victorious in Ukraine and allow it to militarily threaten other neighboring states.

Donald Trump is likely to be less reigned in during a second term

Not only have Trump’s views turned more extreme, he’s also more likely to be able to execute his plans in his second term, as he is likely to face less opposition from courts, Congress and his administration.

During Trump's first term, several of Trump’s executive orders, including his Muslim ban, were challenged in courts. Though Trump’s new plans are still likely to face opposition in courts, the opposition might be somewhat less strong. During Trump’s first term, Trump managed to nominate a significant number of district court judges and almost as many Appeals court judges as two-term president Barack Obama. He flipped numerous Appeals courts from leaning progressive to leaning conservative in the process. Trump’s most impactful judicial nominations were in the Supreme Court, however. When Trump started his term, the Supreme Court was politically balanced. Yet during his term, Donald Trump replaced 3 out of 9 Supreme Court judges, giving the court a solid 6-3 conservative majority. The US courts should still function as an independent branch and judge cases on their merit, but as more judges share his Republican ideology, his executive orders might face less opposition.

Trump is also likely to face more a friendly Congress in a second term. During his first term, he regularly faced opposition from ‘traditional’ Republican legislators to pass his legislative plans. Senator McCain e.g. famously blocked his efforts to repeal Obamacare. Nowadays, the Republican party has become more Trumpian as many Republican Congressmen and Senators need his support during Republican primaries. For illustration, roughly a third of current Senators and Congressmen still support his claims that the 2020 US presidential election was rigged. Trump is thus likely to face less Republican opposition to his legislative proposals during a second term.

Trump is also likely to face less opposition within his administration. During his first term, the MAGA movement was in its infancy and Trump thus had to rely on the Republican Party to staff his administration. Many appointees turned out be hostile to his policy proposals. Today, a new ecosystem of Trump-friendly think tanks, such as the America First Policy Institute are not only drafting policy proposals, but also (already) vetting people to fill jobs in his administration based on their loyalty to Donald Trump and his agenda.

Furthermore, Donald Trump plans to reshape the US federal civil service by revoking the Pendleton Act. This act makes the appointment of federal government jobs merit-based (via competitive exams). The act also makes it unlawful to fire or demote most federal employees for political reasons. Even if unlikely, revoking this act would allow Donald Trump to replace independent and competent federal employees with loyalists, allowing him to more easily implement his plans and reducing independent checks on his power.

The global economic and geopolitical environment is much more complicated

A final reason why Donald Trump’s political plans would be more economically damaging is the changed nature of the global economic and geopolitical environment. During Trump’s first term, the US was still recovering from the Global Financial Crisis and was, according to some observers, still in a so-called balance sheet recession. This is an environment where private household and corporations are saving heavily to restore their balance sheets (see figure 5). During balance sheet recessions, interest rates are close to 0 (making central bank policy less effective) and the government is a borrower of last resort. Government spending thus has a big stimulative effect on the economy during these periods.

During his first term, the Tax Cuts and Jobs Act caused a major widening of the US deficit. As the US was still in a balance sheet recession, this provided a welcome boost to the economy, in effect compensating the negative impact of his trade and migration policies.

Today, as the US is not in a balance sheet recession anymore, further government spending has less of a stimulative effect and will mostly fuel inflation. Donald Trump will thus have no way to compensate for the negative effects of his trade and migration policies.

Furthermore, the geopolitical environment is more unstable today. With two major wars (in Europe and the Middle East) and growing instability in Africa, an engaged US is more needed than ever. Furthermore, in China, Xi Jinping has fully consolidated his power now (and even abolished term limits). He might thus be more tempted to invade Taiwan to cement his legacy in the coming years.

Don’t compare me to the Almighty, compare me to the alternative

Obviously, Donald Trump is not running unopposed and to assess his impact on the economy, it is useful to also compare him to his main opponent, current President Joe Biden.

It is important to note that Donald Trump’s and Joe Biden’s economic policies share similarities. Both presidents have run enormous deficits during their times in office (see figure 6) and they both have followed protectionist policies. Joe Biden kept the Trump tariffs largely in place and his three major bills (on infrastructure, chips and climate) mandate around 1.7 trillion USD in subsidies over a period of ten years. These subsidies will also create major market distortions.

Nonetheless, President Biden and Trump have substantially different views on migration, the importance of independent institutions and the US role in the world. Furthermore, even on trade, President Biden has not made proposals that are as radical as Trump’s 10% import tariff.

On top of that, President Biden might be less likely to be able to pass further subsidy plans in a second term. He faces a conservative Supreme Court and is likely to lose his Democratic majority in the US Senate. Democrats now only have 51-49 majority and have to defend three seats in states that Donald Trump won by 8% or more. In case of a Trump victory, in contrast, the Republican party is highly likely to have a government trifecta.

Conclusion

It is obviously still possible that Donald Trump’s plans are just campaign rhetoric and that he will drastically moderate his positions if he were to be reelected (as is often the case). That said, if he were to (partially) execute his plans, Donald Trump’s reelection could have a major impact on the US and global economy. His tariff and migration plan and his threats to central bank independence could drive the economy to stagflation. Furthermore, his presence in the White House could increase the likelihood of certain geopolitical risks such as a Chinese invasion of Taiwan. Therefore, though American voters mostly see Donald Trump as a better steward of the economy than Joe Biden, KBC Economics tends to disagree and we thus view President Biden as the better choice for the economy.

1US-China Trade War: Trump's Deal May Not Cover Cost of Trade War - Bloomberg

2 Trump’s tariff plans would be disastrous for America and the world (economist.com)

4 What we know about unauthorized immigrants living in the U.S. | Pew Research Center

5 Threats to central bank independence: High-frequency identification with twitter - ScienceDirect

6 Trump says he would not reappoint Powell to lead Federal Reserve | The Hill

7 Trump Didn’t Shrink U.S. Military Commitments Abroad—He Expanded Them | Foreign Affairs

9 Biden says U.S. forces would defend Taiwan in the event of a Chinese invasion | Reuters