Pension reform in Brazil: high hopes quickly dashed

Market participants and politicians alike have long recognized the need for a more sustainable pension system in Brazil in order to stabilize the surging public debt ratio. However, unfortunate economic developments and a corruption scandal that left few Brazilian politicians unscathed have complicated the process. With the election of President Jair Bolsonaro in October 2018, markets once again began to hope he would push through an ambitious pension reform. This was likely overly optimistic from the outset, and developments over the past few weeks suggest market participants are starting to catch on. Pension reform in Brazil remains as complicated as ever, and the path to a likely watered-down version of the reform will be fraught with uncertainty.

Brazil’s growing debt burden

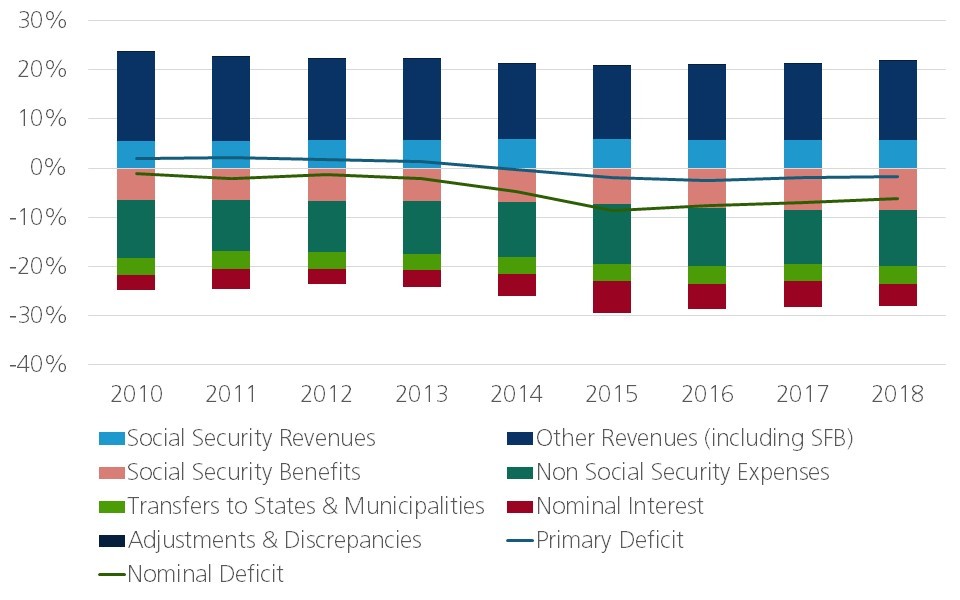

Brazil’s central government fiscal deficit deteriorated from 1.3% of GDP in 2012, to a peak of 8.6% of GDP in 2015, and has since improved slightly to 6.25% of GDP in 2018 (Figure 1). While an economic recession, stagnating net revenues and growing interest rate payments all contributed to the deficit, growing pension expenses have been an important culprit. Social security benefit payments grew from 6.6% of GDP in 2012 to 8.6% of GDP in 2018 and account for about 43% of all expenses. Meanwhile, contributions to the pension scheme have not kept pace. Given an aging population, and baring any reform of the pension system, this trend is likely to continue. The sizable deficit, of course, has consequences for government debt sustainability. Brazil’s gross government debt rose from 54% of GDP in 2012 to 77% of GDP in 2018. As a result, Brazil lost investment grade ratings on its sovereign debt from S&P and Fitch in 2015, and Moody’s in 2016.

Figure 1 - Brazil’s Fiscal Accounts (% of GDP)

Pensions are an important pillar of a strong social welfare system, making the tradeoff between fiscal stability and a generous pension scheme a politically sensitive topic. However, with the central bank already forecasting only tepid growth of 2.0% in 2019, failing to bring government debt and the deficit under control could weigh further on the economy and even tip it into another recession.

Fortunately, there are options for making the system more affordable for the state. For example, currently workers are able to retire after they have contributed to the system for at least 35 or 30 years (for men and women respectively). This effectively translates into a retirement age of 50-55 for some workers. Furthermore, benefits as a percentage of pre-retirement earnings for men are far higher in Brazil (70%) than the OECD average (53%), the ‘BRICS’ average (57%) or other Latin American peers (44%).1

A tricky subject made trickier

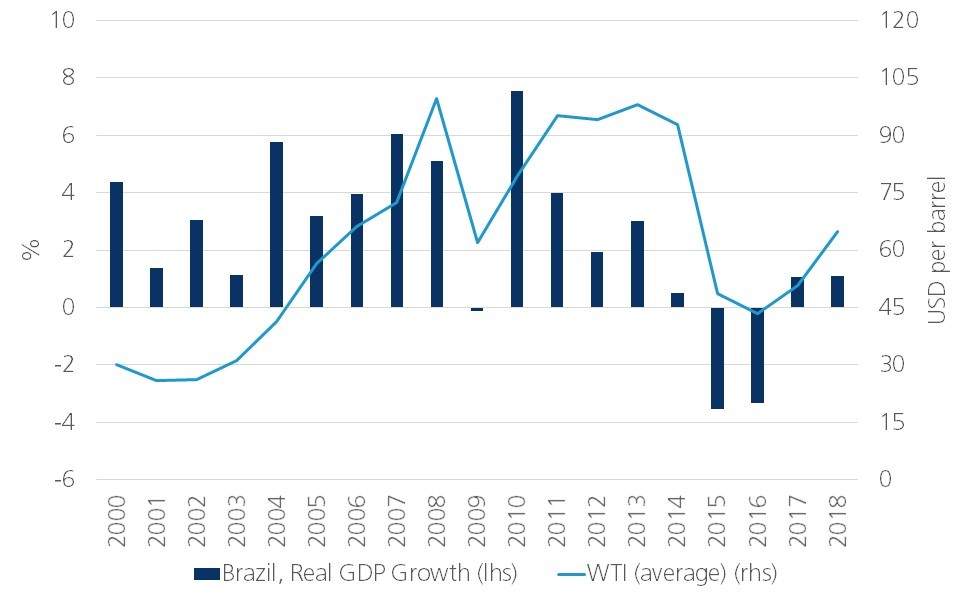

Despite the clear need for reform, a number of developments over the past several years have not made the process easier. First, the significant drop in commodity prices between 2014-2015 weighed heavily on the commodity-exporting nation. Real GDP growth fell from 3% in 2013 to -3.6% and -3.3% respectively in 2015 and 2016 (Figure 2). On top of that, in 2014 the corruption scandal known as ‘Operation Car Wash’ (or Lava Jato) swept through Brazil. Hundreds of corporate officials and politicians have since been charged in a racketeering scheme involving billions of dollars and the state-owned oil company, Petrobras. Former President Lula da Silva is in prison for corruption charges related to the investigation while former President Rousseff was impeached in 2016 on separate charges of illegally moving funds between government budgets (though the charges are not directly related to Lava Jato, the corruption scandal weighed on her popularity). Furthermore, just last month former interim President Temer was arrested (but later released) and faces corruption charges stemming from Lava Jato as well. This political and economic turbulence has not been conducive for passing ambitious legislation such as pension reform, which requires a change to Brazil’s constitution. Indeed, Temer abandoned his attempt at passing such reform as the 2018 elections approached.

Figure 2 - Brazil real GDP growth & oil prices

High hopes soon dashed

Brazilian assets rallied last year as it became increasingly clear now-President Bolsonaro was likely to win the election. The BRL appreciated 15% against the USD from its low on 14 September 2018 to a peak at the end of January 2019. Market participants were optimistic that he would make pension reform a priority. Indeed, in February his government presented a rather ambitious plan to Congress which would save BRL 1.2tn (USD 310bn) over 10 years. However, developments since then have reminded markets that passing such extensive legislation will be no picnic.

First, the Brazilian Congress remains very fragmented, and Bolsonaro’s party (PSL) only holds 5% of seats in the Senate and 11% of seats in the Chamber of Deputies (he needs 60% in each chamber to pass the reform). Current coalitions theoretically give the government this threshold, but the process will be long, and filled with negotiations that water-down the final savings from the reform. Furthermore, as Temer’s recent arrest highlighted, the Lava Jato corruption investigation is still ongoing and could complicate political cooperation. Indeed, Bolsonaro’s so-called ‘honeymoon’ period may be coming to an end earlier than optimistic investors had hoped. Recent polls show his administration’s approval rating has fallen to 34%. Meanwhile, there are reports of a growing political row between Bolsonaro’s supporters and key members of Congress. Finally, a less ambitious than anticipated military pension reform proposed by the government in March has been interpreted by some as a sign that Bolsonaro’s enthusiasm for pension reform is weaker than originally believed.

Market participants also appear to be ending their ‘honeymoon’ phase with Bolsonaro. The BRL has depreciated almost 4% against the USD since the reform was announced on 20 February and 1-month BRL volatility has spiked over the past two weeks (Figure 3). The market optimism regarding Bolsonaro and pension reform was likely too optimistic from the start, as the difficulties of passing such a reform within Brazil’s very complicated political landscape have not changed. Rather, the process will likely be a long and difficult political battle that ends with a much-diluted reform package.

Figure 3 - BRL spot rate and implied volatility

Footnotes:

- Based on OECD data on gross replacement rates for men. The replacement rate for women in Brazil is more on par with the OECD average at 53%. ‘Latin American peers’ refers to the average of Mexico, Chile and Argentina.