Is the price correction of Swedish houses a canary in the coal mine?

While the property market elsewhere in Europe generally still performs strongly, house prices in Sweden fell in 2018. The correction follows a long period of impressive price increases and barely a drop during the financial crisis ten years ago. Swedish real estate still seems to be overvalued to this day and the mortgage debt of Swedish families is peaking. Some EU countries, especially Luxembourg and Austria but also Belgium, the Czech Republic and Slovakia, more or less share similarities with the Swedish situation and can learn lessons from it. Cautious lending and additional regulation to limit credit risks are needed.

European housing markets have been doing very well in recent years, mainly thanks to low interest rates and a favourable economic climate. According to Eurostat figures, the annual rise in house prices in the third quarter of 2018 exceeded 5% in 18 of the 28 Member States of the European Union. However, there are also some countries, notably Italy and Sweden, where prices are falling. Italy in particular has been a remarkable outlier in the last decade. House prices in the country have fallen almost continuously since 2009, partly due to its relatively weak economic growth. Debts in the real estate sector have in recent years accounted for almost half of the problem loans at Italian banks.

Swedish housing market most overvalued

In Sweden, the ongoing price correction of real estate is more recent. The annual change in the prices of existing homes became negative in the first quarter of 2018 and further deepened to -4.3% in the third quarter. Throughout 2015, 2016 and 2017, prices had risen by 14.8%, 9.0% and 6.4% respectively. The boom in the Swedish property market had been going on for some time, with particularly strong price increases in the capital Stockholm. Adjusted for general inflation, apartments there have become seven times more expensive since the mid-1990s.

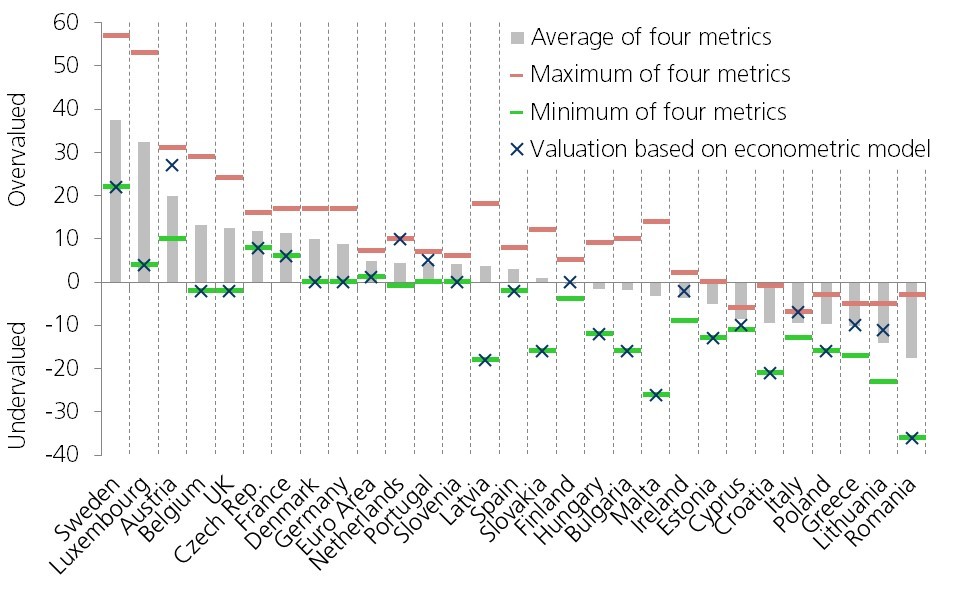

There are several explanations for the strong price development of Swedish real estate until 2017. Strong real wage increases, falling interest rates and tax cuts increased households’ disposable income. In addition, strong, demographically driven demand for real estate was for a long time offset by a too limited supply of new homes. However, these factors cannot fully explain the exuberant price increases since the mid-1990s. This is apparent from all kinds of valuation metrics. According to the average of four measures calculated by the European Central Bank, the estimated overvaluation of the Swedish housing market in the third quarter of 2018 was almost 40%. This is the highest figure of all EU countries (Figure 1).

Figure 1 - Over- or undervaluation of the European housing markets (in %, valuation metrics calculated by the ECB, Q3 2018) (*)

Swedish house prices have now suddenly started to fall mainly due to stronger housing construction in recent years. The share of construction investment in GDP rose from 3.5% in 2013 to almost 6% in 2018. In 2018, Sweden added around 60,000 new homes, the highest figure in 30 years and around 6% of the housing stock. Especially in large cities, the situation has changed to a saturation of the apartment market. According to the National Board of Housing, Building and Planning, an estimated 60,000 more homes will be added this year.

Will others follow the Swedish correction?

Housing construction is often a time-consuming activity in many countries because of the many regulations and required building permits. This can lead to a boom-bust scenario on the housing market. After all, it often takes a long time before supply can meet the additional demand, as a result of which prices tend to rise (too) steeply. Once the supply of new homes starts to rise, it often surpasses demand, especially since the high prices meanwhile stimulate the construction industry even more. Moreover, as soon as the general economic climate deteriorates, as is currently the case, families become more cautious about buying real estate, which accentuates the mismatch between supply and demand.

As in Sweden, the demand for housing in other EU countries (approximated by the number of households) has increased more than supply (reflected by the number of housing units) over the last decade. This was the case in Luxembourg, the UK, Ireland, Spain, the Czech Republic, Slovakia, Hungary and Slovenia, and has also been accompanied by strong price increases in recent years. With the exception of Luxembourg, supply (measured by the number of building permits or finished dwellings) has recently increased in those countries, similar to Sweden. The increased construction activity is in fact a general European phenomenon. It is seen elsewhere, such as in Belgium and Austria, despite less or no housing shortages in recent years. However, this does not necessarily imply an exaggerated construction rage in all these countries. Accordingly, it will not necessarily lead to a sudden price correction, as in Sweden. In Central Europe in particular, construction activity, although picking up, still faces strong headwinds from a tight labour market and long permit procedures.

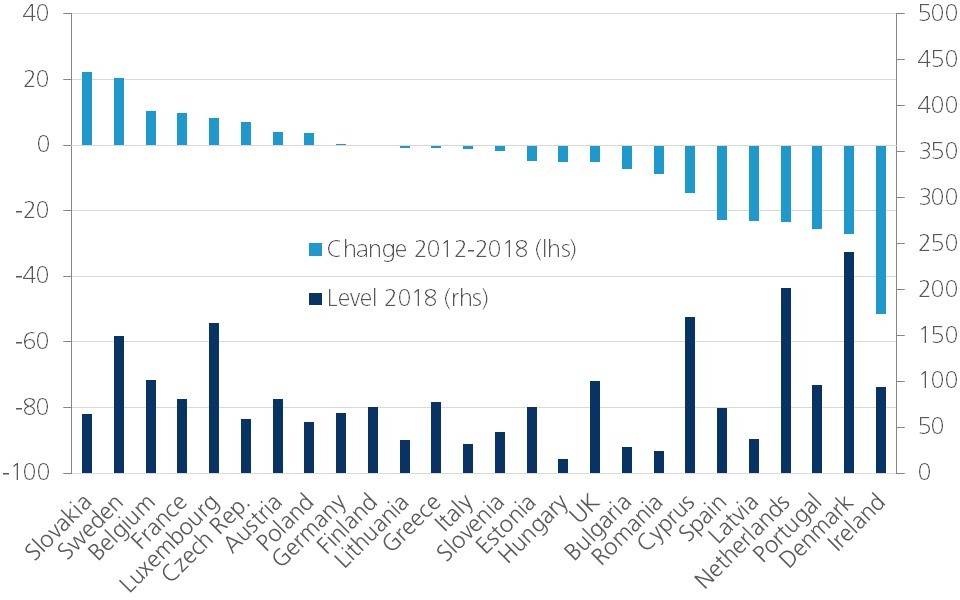

Figure 2 - Level and change of households’ mortgage debt (in % of disposable income)

On the other hand, this does not mean that we need not worry at all. Whether house prices will correct elsewhere as well, also depends on market valuation, the debt position of households and the general financial and economic situation. In addition to overvaluation and the increased supply, the sharp increase and high level of mortgage debt among households also explain the current Swedish situation (Figure 2). The Swedish government has already taken measures to limit credit risks, such as capping credit relative to the purchase price. Given the still considerable overvaluation and the expected deterioration of economic fundamentals (i.e. lower GDP growth and somewhat higher interest rates), this suggests to us that the price correction in the Swedish housing market could continue for some time to come.

With regard to the overvaluation of the housing market and/or household mortgage debt, Luxembourg and Austria in particular, but also Belgium, the Czech Republic and Slovakia, are in the spotlight (Figures 1 and 2). The situation calls for extra prudence in lending and additional regulation to limit credit risks. The aim should be to avoid a sudden reversal of the housing market situation in these countries. Such risk is more pronounced in the event of a new financial or economic shock such as a jump in interest rates or unemployment.