Uncertainty is the main certainty

The economic outlook for 2020 is characterized by more uncertainty and risks than we have seen in the past. Whether it is global trade, Brexit, Hong Kong, or even more structural changes like disruptive new technology, ageing or climate change, times are turbulent and there is a lack of clarity. And 2020 does not appear to bring much relief, given the coronavirus outbreak and the US-Iran confrontation.

Uncertainty rules

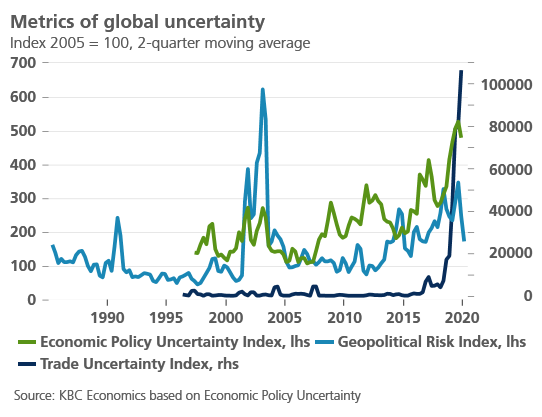

Many people are concerned that uncertainty has reached unprecedented levels in recent years. However, feelings of uncertainty are as old as mankind and therefore we can question whether indeed uncertainty is peaking. In practice, it’s not easy to measure the state of uncertainty objectively. Often, one has to rely on indices that gauge the frequency of usage of particular words related to uncertainty. The figure below illustrates three of them, each with a global focus.

First, the Economic Policy Uncertainty Index, developed by three American economists (Scott Baker, Nicholas Bloom and Steven Davis), tracks the number of press articles that use buzzwords related to economic and political uncertainty. Additionally, it measures the number of tax laws set to expire and the spectrum of disagreement among economists: the more dissent, the higher the index. It’s now hovering around its highest level since the first calculation in 1997. Drivers of policy uncertainty are associated, amongst others, with monetary policy, increased regulation and protectionism, and the challenges stemming from new technology, ageing and climate change.

Second, the Geopolitical Risk Index, constructed by Dario Caldara and Matteo Iacoviello at the US Federal Reserve Board, counts the occurrence of words related to geopolitical tensions in leading national and international newspapers. The index spiked during the Gulf War, after 9/11, during the 2003 Iraq invasion, during the 2014 Russia-Ukraine crisis and after the Paris terrorist attacks. More recently, a heightened level of geopolitical risk was seen since the start of the Trump presidency, amongst others linked to trade tensions under his reign. On top of that, other factors like the uncertain Brexit outcome, instability in the Middle East and the turmoil in Hong Kong are also increasing geopolitical risk.

Finally, the IMF’s Trade Uncertainty Index is a third metric of prevailing global uncertainty, linked specifically to trade. The index goes back to the mid 1990s and is based on the number of times the word uncertainty is mentioned in the Economist Intelligence Unit Country Reports in proximity to a word related to trade. The index shows trade uncertainty in the past year has risen sharply, mainly due to the US-China trade war escalation, after having been stable at low levels for about 20 years.

In general, all uncertainty indicators are currently at very high levels. An important side note is that one can only compare historical data as far as the history of the data reaches. In the past, there were periods during which uncertainty was likely even higher (e.g. during the World Wars or the oil crises in the 1970s). Nevertheless, the past two decades are the most relevant to compare current uncertainty levels with.

Enemy of the business cycle

History has shown that heightened uncertainty has the potential to negatively impact economic growth. This has also been the case over the past year. Corporate sentiment indicators have been declining globally, for a large part reflecting the uncertainty caused by trade disputes and political uncertainties such as Brexit. Amidst high uncertainty, there have been regular spikes in risk aversion on financial markets, causing increased flows to so-called safe havens and lower long-term bond yields. The resulting caution in central banks’ policy stances, contributed to lower bond yields.

2020 is not likely to bring (much) relief. Negotiations on the EU-UK trade relations are likely to be difficult. And despite the likely pause in the US-China trade war, trade protectionism will remain in place. Together with continued geopolitical uncertainty and unpredictable policy making becoming the new normal, this implies uncertainty undoubtedly is here to stay.