Oil price collapse: is this time different?

Oil prices are in a free fall. Despite the early October fears of oil shortages in global markets, the Brent price has dropped more than 30 % since then. The situation is strikingly reminiscent of 2014, when an 18-month price collapse started. Today, the oil market is also experiencing a sharp rise in production, supported by the second wave of the US shale oil revolution, as well as concerns about a downturn in the global economy. OPEC, and Saudi Arabia to be precise, face the same dilemma – protect their market share or raise prices. Given the Saudis’ thinner fiscal buffers and ongoing cooperation with Russia, this time production cuts at the December OPEC+ meeting are highly likely. This should stabilize prices and prevent a collapse similar to 2014-2016.

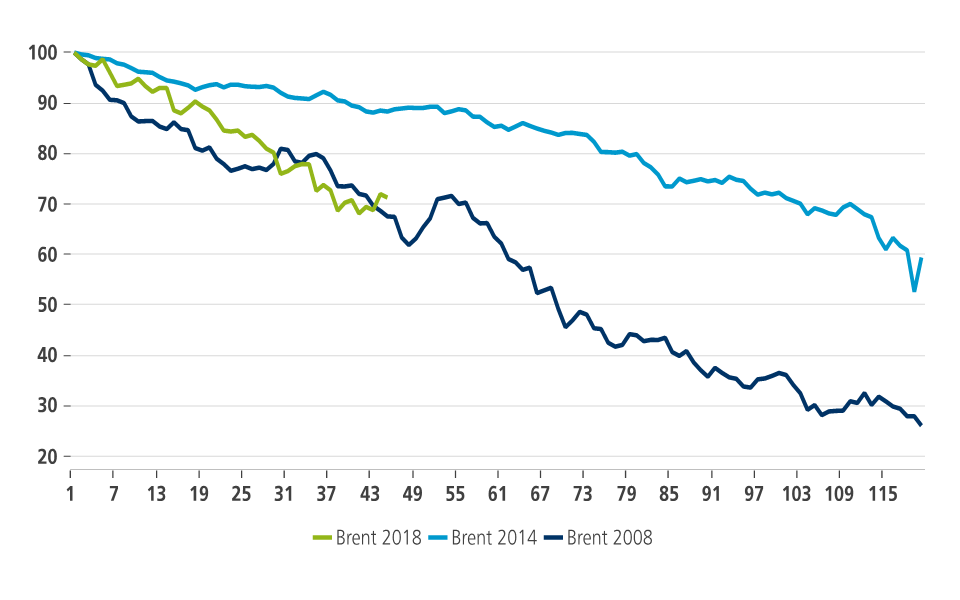

Even though oil prices hovered near $90 a barrel in early October, not even two months later the situation changed dramatically. Brent crude oil broke through $60 a barrel. Likewise, US WTI dipped below $50 a barrel. Compared to the latest downturn episode in 2014, the current one is even sharper as prices already declined by more than 30 % in just 40 days. What are the reasons behind such a massive price drop? In short, the market is concerned over excess supply in 2019.

Figure 1 - Current oil price drop comparable to that in 2008 but sharper than in 2014 (100 = start of the oil price fall, days)

Oil market sentiment has turned bearish, quite paradoxically, just as the US sanctions on Iran came into force. At the last moment, the US administration decided to relax the sanction regime and grant waivers for importing Iranian crude oil to 8 countries, including the largest importers, China and India. The fact that the current US sanctions are indeed miles away from the originally intended “toughest in history” is obvious from the figures available. The roughly 1 million barrels per day drop in production so far is in fact comparable to the effects of sanctions imposed by the Obama administration in 2012-2015.

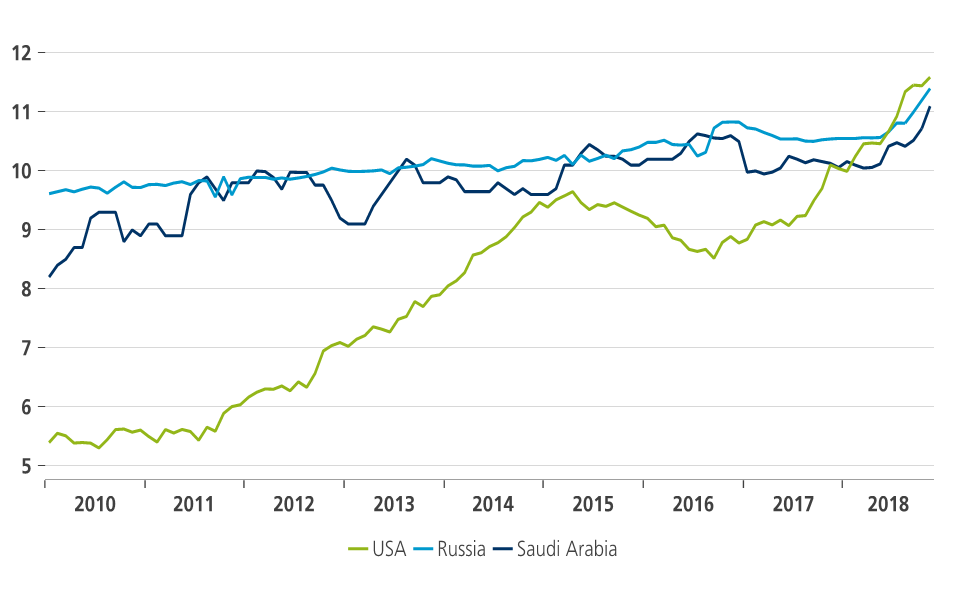

The oil market has also been paying close attention to the substantial increase in global oil supply. Both Russia, where domestic oil giants pushed for an output boost, and Saudi Arabia, which failed to resist pressure from President Trump (in the form of Twitter tirades against high oil prices), are producing at their historic highs, a total of 11.4 and 11.2 million barrels a day respectively. Compared to May figures, this stands for a combined increase of over 1 million barrels, i.e. more than agreed at the June OPEC+ meeting. Moreover, both Libya and Iraq pumped more oil than expected, while Venezuelan output has not collapsed as many have feared.

What is even more remarkable, however, is production growth in the United States. For the first time since 1974, the US has become the world’s largest crude oil producer, with output rising to 11.7 million barrels per day. Overall, the US production growth in 2010-2018 ranks as one of the largest in the history of the oil industry. This massive expansion is taking place on the back of the second wave of the shale oil revolution, which transformed the US oil sector with hydraulic fracturing technology and horizontal wells. Moreover, US producers emerged from the low price environment in 2014-2016 even stronger, as they reduced costs and improved productivity significantly. The recovery in oil prices since 2017 then incentivised producers to further expand their production.

Figure 2 - The US has become the largest crude oil producer in the world (million barrels per day)

In 2018, the US alone will thus meet the entire global oil demand growth of 1.5 million barrels per day. The epicentre of the current shale oil boom – the Permian basin located in Texas and New Mexico - is responsible for more than a third of the US production; since 2017 Permian production increased by 1.5 million barrels a day, the equivalent of total Norwegian output. Texas alone, with almost 5 million barrels a day production, would make up the world’s third largest oil producer. Despite the infrastructure bottlenecks, the shale oil boom is thus not losing steam.

Last but not least, the broader cross-asset sell-off has also weighed on oil prices in the last weeks. It particularly reflects concerns about the slowdown in global economic growth which has become less synchronised. The trade tensions between the US and China are still very much in place as well as the recent concerns about emerging markets. The recurrent question is of course the possible economic slowdown in China, the world’s largest crude oil importer, which plays a crucial role not only for crude oil but for commodity markets in general.

In many aspects, the current situation is reminiscent of 2014 when the first wave of the shale oil revolution culminated, and the global economy was losing pace. Recall that back then Saudi Arabia faced an unpleasant dilemma – should it protect its market share or keep oil prices higher? The Kingdom decided not to act as a swing producer alone and chose the first option. The well-known result was an eventual collapse of oil prices from $130 a barrel in June 2014 to below $30 a barrel in January 2016.

Today, Saudi Arabia is facing a similar dilemma. This time, however, it is likely to prefer the latter option. First, Saudi fiscal buffers are thinner. Foreign exchange reserves have fallen by 35% or $230 billion since 2014 and to balance the budget the Kingdom would need oil prices at $73 a barrel in 2019 according to the IMF. Second, the Saudis can build on the successful cooperation with Russia that started in 2017 and helped oil prices to recover. Although Russia may be less tempted to significantly cut production as its budget is not so heavily dependent on oil revenues, the relationship with Saudi Arabia is strategically important for President Putin and therefore worth preserving.

Saudi’s decision-making might be eventually most constrained by the domestic political backdrop related to the murder of journalist Jamal Khashoggi. Not only did it weaken their international position, on top of that, it gave Donald Trump leverage over Saudi Prince Mohammed bin Salman. Nonetheless, the option of not curbing production would probably result in a further fall in oil prices with severe economic repercussions. Therefore, we expect production cuts of 1-1.5 million barrels per day at the December OPEC+ meeting, even if the decision is implicitly rather than explicitly communicated. This should stabilize prices and prevent an oil price collapse as seen in 2014-2016.