Oil on track to hit $100 a barrel

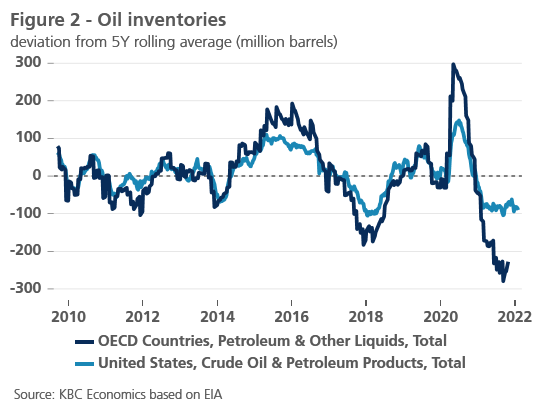

Since the start of the year, Brent crude has increased to $95 a barrel (+20% year-to-date) and we see a solid chance that oil could hit $100 a barrel for the first time since 2014 (figure 1). Most recently, oil prices have spiked due to rising geopolitical tensions between Russia and Ukraine. With Russia being the second largest producer/exporter of crude oil in the world, there is growing concerns about possible disruptions to the flow of oil supplies. However, what is even more important is that the oil market has been bolstered by constructive fundamentals, highlighted by a sharp decline in global inventories (figure 2).

On the one hand, this reflects robust oil demand, driven by incremental gains in the US, where oil consumption is currently trending at an all-time high, despite rapidly rising Omicron cases. With demand for road transport fuels having largely normalised in aggregate, jet fuel is likely to play a more prominent role in an incremental demand boost going ahead. Overall, we expect global oil demand to recover further in the year and reach its pre-pandemic level by late 2022.

On the supply side, the OPEC+ alliance maintains its scheduled 400,000 barrels per day output hikes. However, higher targets do not necessarily mean higher output. Indeed, some member states are increasingly unable to keep the pace of output increases due to capacity constraints. At the same time, the US shale response to a higher oil price environment remains relatively subdued due to stricter capital discipline in place in the period after the outbreak of the pandemic. In addition, lower-than-expected drilling activity appears to reflect growing costs from the green transition.

All in all, we have significantly upgraded our outlook and now expect oil prices to average $90 a barrel in 2022, up from $71 a barrel seen last year. With short-term risks being tilted to the upside, the oil market appears particularly vulnerable to supply disruptions given a low supply cushion. At the same time, we continue to monitor closely the signs of possible demand destruction from elevated oil prices (especially in some emerging markets) that could curb the oil rally.