New-build deserves better

Belgium’s housing stock is amongst Europe’s oldest, yet the government encourages renovation rather than new-build, through measures including subsidies and a lower VAT rate. It is still not sufficiently recognised that building new homes is often a better solution than renovation – especially when it comes to energy efficiency. Contrary to popular belief, the price of new-build homes has not risen faster in the past decade than that of existing homes. Building more new homes is a good thing. All the same, sufficient backing needs to be given to demolition and rebuilding, to minimise the use of scarce new building land and to avoid a potential surplus of homes.

Belgians like to say that they are born with a ‘brick in the belly’ – a mentality reflected in the country’s high level of home ownership. According to Eurostat, 71.3% of the Belgian population lived in a self-owned home in 2016, compared to a euro area average of 66.4%. This appetite for real estate is also reflected in the high number of transactions. According to the Belgian notaries’ association, 2017 was the busiest year ever for the Belgian property market. It is striking that secondary market activity is more dynamic than that for new-build. For some time now, families have increasingly preferred to purchase an existing home rather than having one built. Secondary housing market sales have been rising in Belgium by an average of 1.8% a year since the mid-1990s, compared to just 1.3% a year in the number of issued building permits. Apartment-building continued to do quite well, with the exception of the crisis years, but house-building has shown a downward trend (see Figure 1).

Figure 1 - New-build and renovations in Belgium (building permits, in numbers)

Source: KBC Economic Research based on data from FPS Economy

Need for more renewal

Belgian homes are among Europe’s oldest, with an average age of 52 years. According to the government agency FPS Economy, no less than 38% date from before the Second World War, and a quarter were actually built before the First World War. New house builds are currently running at less than 1% of the total existing housing stock annually. As a result, more than a million homes in Belgium are not of sufficiently high quality and have to contend with serious problems in terms of damp, insulation and so on. Above all, the housing stock has not kept pace with current energy standards. Average residential energy consumption in Belgium is 40% higher than in the Netherlands, for instance, and more or less equal to that in the much colder Finland. Renovation subsidies – which tend to be expensive – for improvements like roof insulation and double glazing have helped to some degree, but only affect about 10% of the housing stock.

The relatively limited preference for new-build compared to the purchase of existing homes, is thought to reflect the affordability of new dwellings. An accusing finger is often pointed at the ever-tighter energy-performance demands and regulations that new-build has to meet. The higher rate of VAT (21% compared to 6% for renovation) is another factor. For a substantial proportion of Belgians seeking a home of their own, this means that they opt to purchase (and, where necessary, renovate) an existing home rather than having a new one built.

Tobin’s Q

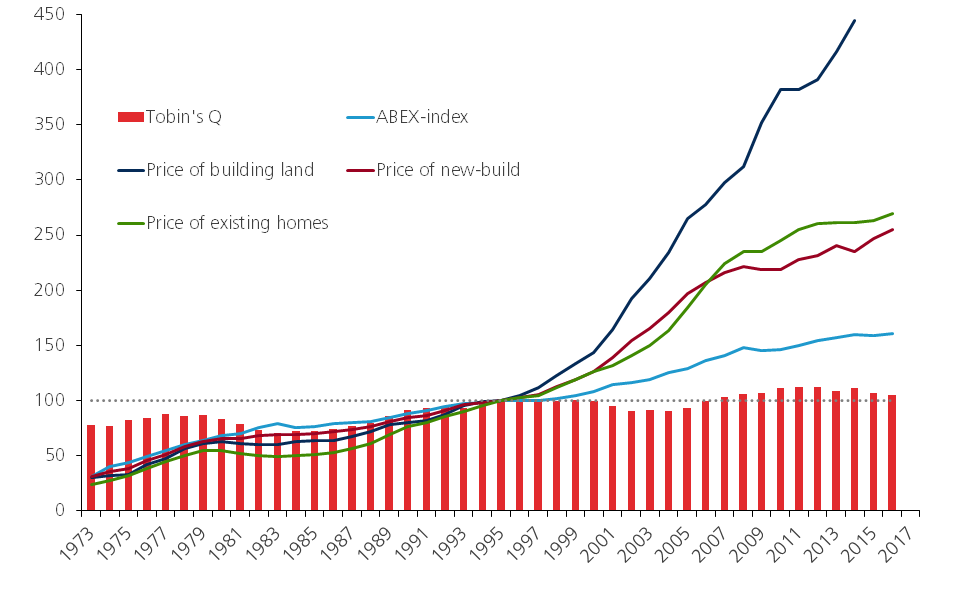

When choosing between purchasing an existing home and building a new one, families have to weigh up the price of the two alternatives. Economists refer to the ratio between the price of existing and new homes as Tobin’s Q. The higher it is, the more attractive it is to build, and vice versa. Figure 2 shows how the ratio has developed for the Belgian market, along with the numerator (the price of existing homes) and the denominator (the price of new-build). FPS Economy has been publishing new home prices since 2005. We constructed an approximate index for the years before that ourselves by taking the average of the ABEX index and the price of building land. The ABEX index tracks movements in the cost of building a new home.

The pattern of secondary market prices ought to reflect that of building land prices and construction costs in the long term. They can, however, part company in the short term, as supply takes time to respond. The slightly rising Tobin’s Q in Figure 2 shows that the prices of existing homes have risen slightly faster in the past decade than those of new-build homes. This defies the perception that new-build has become a lot more expensive compared to existing homes. While it is true that new-build is often more expensive in absolute terms, the difference is offset by the higher energy efficiency. Since the mid-1990s, meanwhile, new-build price trends have been largely determined by the sharp increase in the price of building land. The ABEX index of construction costs has risen considerably more slowly and actually increased less in the past decade than the general consumer price index.

Figure 2 - Tobin’s Q for the Belgian housing market (1995=100)

Source: KBC Economic Research based on data from FPS Economy and ABEX

The slightly higher Tobin’s Q has caused investment in construction to pick up again in Belgium in recent years. New-build has related chiefly to apartments and to a far lesser extent to new houses (Figure 1). The increase in new-build is good insofar as it contributes to a more energy-efficient residential stock. There is still too little recognition that building new homes is often a better solution. Old, poorly insulated dwellings are all too frequently ‘half renovated’ and would be better demolished and replaced by new-build. Consequently, there is no good reason for government policy to favour renovation over new-build, as is currently the case.

It is likewise important for sufficient backing to be given to demolition and rebuilding, to minimise the use of scarce new building land. This will also prevent the creation of surplus housing. The slower increase in the number of households and the more robust pace of home-building means that the ratio of dwellings to families has been rising again since 2012. If the rate of new-build seen in recent years is maintained, we are heading towards a surplus of homes. And that is not a good thing either...