Murky US recovery clouds swing states’ election outlook

The US presidential election is three weeks away, and despite former Vice President Joe Biden’s growing polling lead over President Trump, uncertainty surrounding the election is very high. Part of this uncertainty is due to concerns that the election results could be contested, but it also reflects the fact that a strong national polling lead, even at this stage, can’t guarantee the outcome of the race. Last minute surprises, error margins in forecasting models, and especially the importance of state-level results in the US election process are all important factors that could lead to a different outcome than what national polls suggest. Furthermore, economic developments have traditionally played an important role in presidential approval ratings and re-election chances. Indeed, a look at economic indicators in key battleground states suggests a clear trend: the worse a swing state’s economic situation, the more that state leans toward Biden. However, given that the current state of the US economy is in flux, with signs that the post-lockdown rebound is fading, recent economic developments only add to election uncertainty.

Voting in a Covid economy

The Covid-19 pandemic and subsequent economic malaise has no doubt played a crucial role in shaping the run up to the US elections. Not only is the pandemic expected to change the format by which voters cast their ballot (with mail-in and early voting expected to be much higher than previous elections), it is likely also shaping voters’ views on the candidates. Indeed, US presidents have long been judged on the health of the economy during their administration, and of the three US presidents that failed to win a second term since 1933, two faced rising unemployment at the time of their elections.

The US unemployment rate is currently at 7.9%, which is much lower than the peak of 14.7% reached in April, but still far higher than the 3.5% seen at the end of 2019 or even the 4.9% rate recorded in October 2016, just before Trump was elected. Meanwhile, GDP growth is expected to have rebounded strongly in the third quarter of the year, following a steep decline of 9.02% year-over-year in the second quarter. However, there are also indications that the pace of the economic recovery is already losing steam, with the rate of monthly job gains slowing and with the expiration of several short-term stimulus measures which had been implemented to help the economy weather the Covid-induced lockdowns of the spring. Thus, while the economic disruptions of the pandemic have likely helped Biden grow his lead against Trump, it is not clear how the most recent economic developments could ultimately affect voting outcomes. Furthermore, given the structure of the US election system, it is likely more important to consider economic developments in a number of key swing states rather than the nation as a whole.

The states that decide the presidency

National polling numbers in the US do not always give a clear indicator of who will win the presidential election. This is due to the US’s electoral college system, where each nominee gains electoral votes based on which State they win, and 270 electoral votes are needed to win the presidency (rather than the popular vote). This means that battleground states, and particularly battleground states with a high number of electoral votes, are key to trying to predict who might win the election. Though there is no precise formula to determine which states are key battlegrounds for an election, it usually depends on polling and the historical tendency of a state to swing between voting Republican and voting Democratic. Three weeks out from the US election, we look at the economic indicators of fourteen states that are either considered perennial “swing states” or that show a narrow race between Biden and Trump. Together they account for 203 electoral votes, with Texas (38 votes), Florida (29 votes), Pennsylvania (20 votes) and Ohio (18 votes) delivering the biggest electoral prizes for the winner.

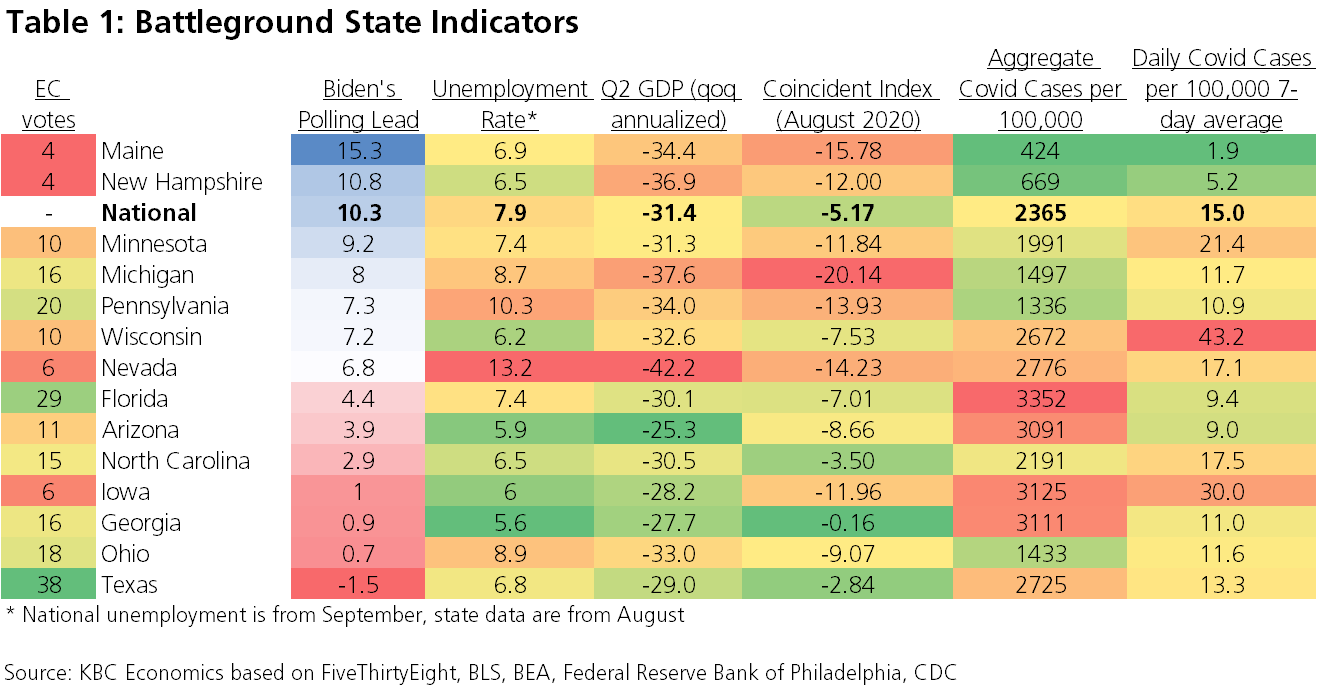

Table 1 arranges these fourteen states according to the magnitude of Biden’s polling lead as of 11 October 2020 according to FiveThirtyEight (which takes an average of separately conducted polls). What is immediately clear is that Biden is ahead in most of these states, with the exception of Texas. However, given the margin of error for these polls (about 3.5 points per candidate for an 800-person poll, or 7 points on the difference between the candidates), Michigan through Texas are all clearly in play for either candidate.

In addition to the number of electoral votes allotted to each state, Table 1 also presents a number of important economic indicators and Covid-19 statistics, color coded according to their magnitude. If we consider just the economic indicators, which include the state unemployment rate as of August 2020, the Q2 real GDP growth rate, and the August Coincident Index (a leading index for economic activity), it is clear that in the swing states with better economic data, Trump lags behind Biden by a smaller margin. Intuitively this makes sense. Those states with worse economic outcomes will be more interested in seeing a change in leadership.

This clear deviation also suggests that the direction of the recovery could have an important impact on the election outcome. If voters in these swing states sense that the recovery is on track, Trump may be able to narrow the gap to Biden in these states in the final weeks leading up to the election. On the other hand, if the recovery is slowing, particularly in these swing states, Biden may solidify his lead.

The pandemic itself is, of course, also an important factor that may be influencing voters. A recent poll by Reuters suggests that 59% of Americans disapprove of the president’s handling of the pandemic, while 37% approve. However, interestingly, when we look at specific battleground states, those that have seen a more severe impact of the pandemic (as measured by aggregate Covid-19 cases per 100,000) tend to have a smaller margin between Biden and Trump. Hence, it isn’t clear that the poor trajectory of the pandemic in the US will cost Trump the election.

It’s not over until it’s over

The US elections may seem to be right on our doorstep, but past elections will tell us that polling margins can still change over the next three weeks. Furthermore, Biden’s lead in key battleground states is narrower than his national polling lead, and these states remain up for grabs. As usual, economic developments appear to be a key determinant this election. However, the current economic landscape is rife with uncertainty, especially given political wrangling and mixed messaging related to new fiscal stimulus, adding even more clouds to an already murky election outlook.