Italy needs to become a bit more German

The Italian Government is stubbornly holding onto a draft budget that flouts the European budgetary framework. Even without this framework, the proposed budget would not be feasible, as Italy cannot afford a fiscal stimulus of consumption, but needs a thrifty policy along the lines of the German model instead. In addition, the country must focus on structural economic reforms and investments. This requires building trust. However, by seeking confrontation, the government is undermining that, and threatens to achieve the opposite of what it wants: a poorer Italy.

In the parliamentary elections of 4 March 2018, the two main populist parties in Italy swayed half of the voters in their favour with a programme of tax cuts and public spending. Both parties came together to form a government, which is now preparing its first budget. In doing so, it must take account of the European budgetary framework, which has widened considerably since the 2011 debt crisis. For example, member states must now submit their draft budgets to the European Commission (EC) in advance, which then checks whether the budgetary rules are being observed. If not, the EC can ask for revisions, which is what it did for the Italian draft budget.

Controversial policy...

The Eurosceptic government is ignoring these rules of the game. To implement populist election promises, it is providing tax cuts for families, the self-employed and small businesses. Inactive or unemployed adults receive a basic income. The earlier increase in the retirement age is being reduced. In order to narrow the budget gap to some extent, public service expenditure will be scrutinised and large companies will have to pay more taxes. A tax amnesty and privatisations should also make a contribution.

A number of proposals make sense. Public investments, for example, in the road network, are being increased and administrative and regulatory simplifications are on the agenda. The basic income would be linked to compulsory training for reintegration into the labour market.

But the negation of the sky-high public debt is a problem. In order to keep this under control, the Italian stability programme of this past April foresaw a halving of the budget deficit to 0.6% of GDP in 2019, with a balance being achieved in 2020, followed by a small surplus in 2021. In this way, the debt-to-GDP ratio - the second highest in the EU after Greece - would have fallen from over 131% of GDP in 2017 to less than 122% in 2021. The government is now ignoring that commitment. It aims to increase the budget deficit to 2.4% of GDP in 2019. According to EC estimates, this could even be 2.9%. The government expects a decline from 2020 onwards, but the EC expects it to rise further to 3.1% of GDP. According to the EC, the debt ratio would at most stabilise, while the government still expects a slight decline.

These contrasting estimates reflect differences in the assessment of economic growth. The government claims that its expansionary budget will stimulate economic growth, thereby believing in an optimistic scenario where the deficit and debt ratios are lower. However, this optimistic vision is not gaining support. According to the European budgetary framework, macro-economic parameters for drafting the budget must be developed by an independent institution. In Italy, however, validation of the government’s forecasts was refused because ‘they are outside the range of figures acceptable on the basis of current information’. The EC’s recent growth projections are also well below the government’s assumptions. The proposed policy is therefore controversial on more than one count.

... undermines trust

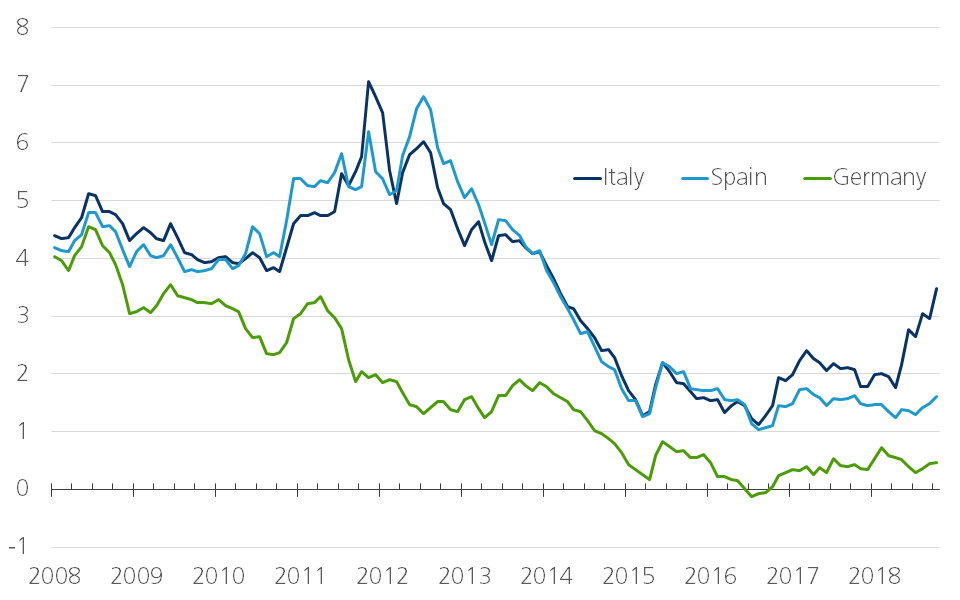

The government is right to diagnose the need to strengthen the growth of the Italian economy. Real GDP is still below pre-financial crisis levels and the unemployment rate is among the highest in the euro area. But its remedy threatens to completely miss the mark. The growth problem is decades old, the result of a lack of competitiveness and structural economic renewal. This will not be solved by a policy that mainly stimulates demand. It requires a strengthening of the supply side of the economy. Previous governments had been committed to this, but were severely punished politically in the elections. The current government now risks being punished economically. The proposed policy undermines confidence both on the financial markets and amongst entrepreneurs. Yields on ten-year government bonds rose to 3.5% (Figure 1).

Figure 1 - 10-year government bond yield (percentage)

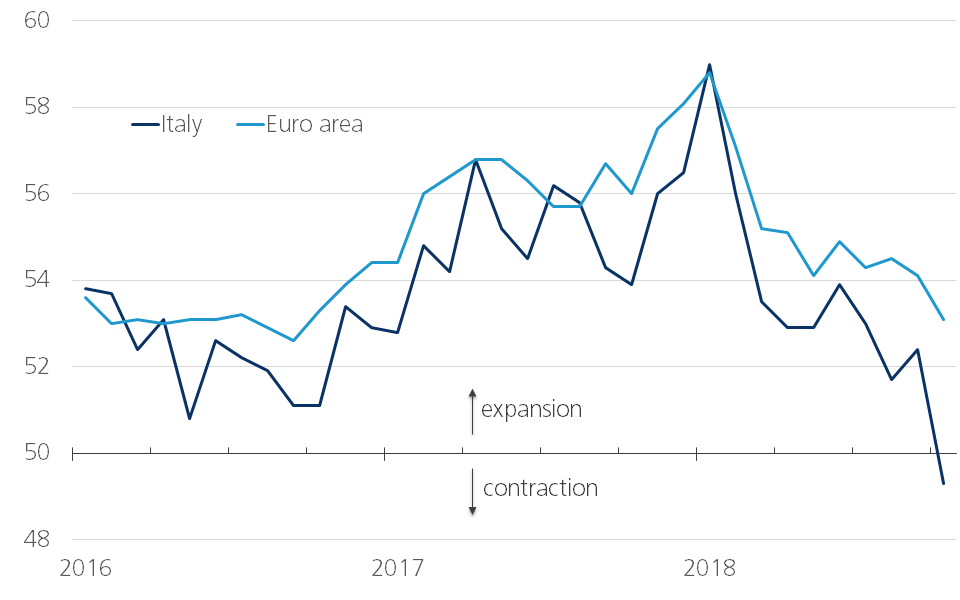

This is not yet as dramatic as it was during the 2011-2012 crisis, but is on the edge of the danger zone where the public debt interest-rate snowball will accelerate. The high levels of debt and weak economic growth make Italy very vulnerable to this. Meanwhile, economic growth stalled in the third quarter and business confidence has been deteriorating much more than elsewhere in the euro area (Figure 2). There is no indication that the government’s growth optimism will pan out and it raises questions about the feasibility of the proposed policy.

Figure 2 - Business confidence (Markit Composite PMI Output Index; 50 = neutral level)

Europe’s budgetary rules have many shortcomings (Economic Opinion, 20 September 2018). But even without these rules, the Italian budget would still be a problem. Italy has little budgetary scope today for policies that stimulate consumption demand, but should focus on strengthening the supply side of the economy. This requires a confidence-building policy. Budgetary orthodoxy based on the German model would contribute in this case to a confidence-building environment in which much-needed investment could flourish. Abandoning long-term budgetary commitments and seeking confrontation detract from this, and the government is more likely to achieve the opposite of what it wants: a poorer Italy. So, Italy should become a bit more German... It would also help if Germany could become a bit more Italian by loosening its budgetary reins a little more than is currently the case (Economic Opinion, 24 October 2018).