Inflation rose more sharply in April due to food, we expect a more modest decline in the summer

Inflation rose by 0.7% month-on-month in April, which was more than the CNB (0.3%) and the market (0.2%) expected. We also expected a lower number (0.4%). Year-on-year price growth thus accelerated to 2.9%, which is 0.4 percentage point above the central bank's latest forecast in May.

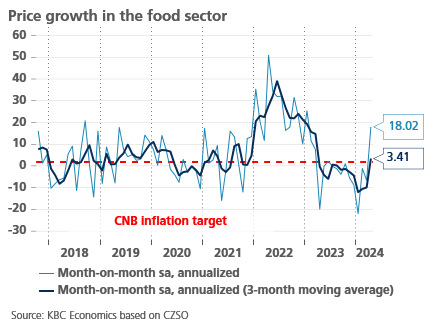

From our point of view, the surprise was mainly because of much faster growth in food prices (1.7% month-on-month), which was driven mainly by prices of meat, dairy products and vegetables. Food, which has become quite significantly cheaper in recent months, began to rise again in April. In addition, we are starting to compare with the months in 2023 when food had already started to become cheaper and its positive impact on year-on-year inflation is starting to visibly weaken – while in March they fell by 5.8% year-on-year and in April it was only by 2.7%. In the coming months, food prices are likely to continue to rise slightly and their positive effect on inflation will fade.

On the other hand, it turns out that inflation momentum is weakening for some services (hospitality), as well as for non-energy goods (e.g., textiles and footwear). However, this does not apply to all components of core inflation – on the contrary, prices in culture or rents have accelerated. Even so, core inflation is likely to lag behind headline inflation in terms of dynamics this time.

Looking ahead, we now expect inflation to be close to the current level in the coming months and then to fall to close to 2.0% in the summer months, due to a further reduction in energy prices and a favourable comparison base. By contrast, the end of the year will be marked by a further fading of the positive effect of food prices and we may then approach 3.0% inflation.

From the central bank's point of view, the surprise is primarily about "food", but even so, the higher number will have a psychological effect on the Bank Board. We now assume that the CNB will cut interest rates by “only” 25 bps to 4.0% at the end of this year and to 3.5% at the end of 2025.

At the same time, they will also be willing to tolerate stronger gains in the Czech koruna. The May forecast predicts the EUR/CZK exchange rate in the second quarter to be at levels around 25.20.