Trade agreement with the EU is essential for the UK

After a problematic set of negotiations, the European Union (EU) and the United Kingdom (UK) succeeded in getting the first phase of the Brexit negotiations off the ground. Achieving an agreement on the Brexit bill, the Irish border issue and EU citizens’ rights was an essential precondition for the EU to start negotiations on its future trade relationship with the UK. A deal on trade is crucial to secure a mutually beneficial level of economic integration between the EU and the UK in the future. As a result of the depreciation of the Pound Sterling since the Brexit referendum, British trade is already strongly influenced by the entire Brexit process. At first sight, it might seem that British exporters can clearly benefit from the weaker Pound. But the recent dynamics in British trade are far less rosy than is often thought. We are currently seeing a foretaste of the major structural challenges that Britain’s economy and trade face after it actually leaves the EU. A sound free trade agreement with the EU can ease but not eradicate the Brexit pain for the British economy.

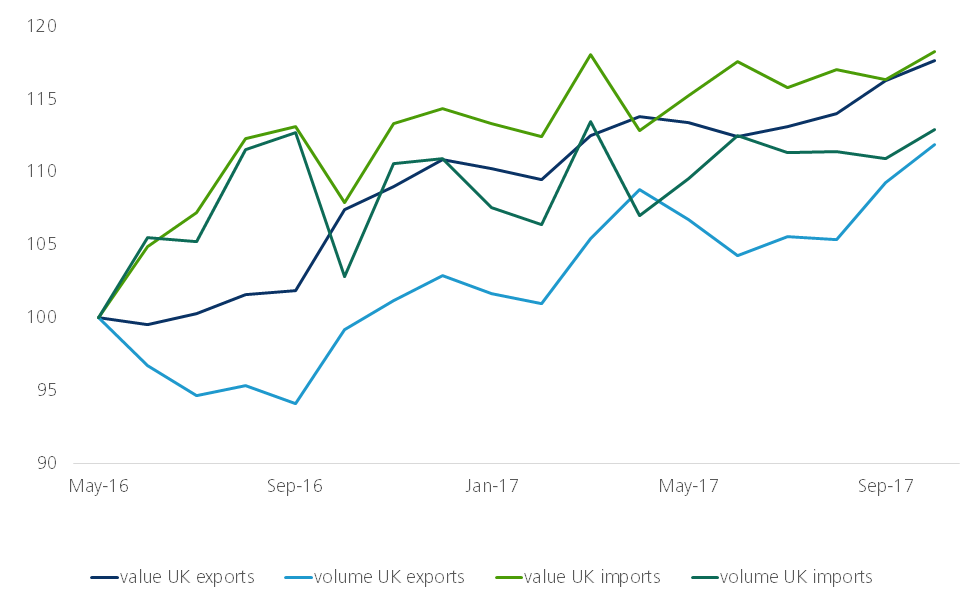

The Pound Sterling depreciated gradually after the referendum in June 2016. The economic theory states that a weaker currency stimulates exports and slows down imports. However, reality does not always follow this theory. Recent developments in the British economy are a good example of this. We compare British trade figures for May 2016 - before the Brexit referendum - to figures for October 2017 (adjusted for seasonal effects). Exports from the United Kingdom increased by 17.6 % in value terms during this period. So far, the theory is right. During the same period, the value of British imports did not fall, but increased by 19.2 %. This may be hinting at a potentially major problem for the British economy.

The depreciation of the Pound Sterling made imported products and services relatively more expensive for British consumers. In principle, it is then expected that more expensive foreign products and services will be replaced by cheaper domestic products. Of course, such a switching is not instantaneous and it presumes these products are readily available. Because of a longstanding de-industrialisation trend in the British economy, this may not be the case. Despite higher import prices, UK imports increased, in particular of goods (21.8 %) and to a lesser extent of services (9 %). Moreover, the marked weakening of Sterling through the past two years has had a very limited impact on the (negative) British trade balance.

Value vs. volume

At first sight, the export performance of British companies seems to have been positively influenced by the weaker Pound. However, this may not really be the case to any significant degree. It is important to examine the change in the value of UK trade in terms of movements in prices and volumes. UK export values (17.6 %) actually increased at a faster pace than UK export volumes (11.9 %). The strong pick-up in export prices and limited volume gains at a time when world trade conditions were improving may hint that UK exporters are taking the benefit of weaker Sterling in higher prices rather than trying to build market share. This could be a cautious response to increased uncertainty associated with Brexit but it may also reflect capacity constraints that mean UK producers are unable to markedly increase their production. The existence of such constraints is also suggested by the resilience of imports, with solid growth in the volume of imports providing little evidence of any marked expenditure switching to domestic UK products.

Imports increased solidly, not only in value but also in volume terms (+17.2 %). The combination of increased imports and higher import prices has significantly eroded the purchasing power of British consumers. Further adverse macroeconomic impacts are being felt. British inflation is rising rapidly, prompting the Bank of England to adjust its monetary policy, with the first rise in base rates in nearly ten and a half years being implemented in November. Brexiteers also argue that the exit from the EU will allow their country to focus more on non-European markets. They are strongly counting on historical ties that date from the increasingly distant age of the British world empire. To the extent that trade with countries outside the EU expands aggressively, it could compensate for less integration with the EU. Unfortunately, recent developments in British trade show a different evolution. In the period following the Brexit referendum, UK exports to the EU grew by 10,4 %. UK exports to non-EU markets decreased by 3 % over the same period.

Figure 1 - Evolution UK trade

Source: KBC Economic Research based on ONS (2017)

Challenges

These observations point to the threat posed by Brexit to the UK economy in the context of Britain’s current competitiveness problems. For the time being, the British economy is unable to produce a realistic alternative to imported products. The current composition of domestic industrial production is clearly insufficient to meet domestic demand. The re-industrialisation of the UK is on the British political agenda for the post-Brexit era. but the reality is that a longstanding process of de-industrialisation accelerated by the growing importance of service sector activity in the UK and globally as well as the particular impact of international financial services sector activity in the City of London which has boosted domestic costs will be very difficult to reverse.

The volatility in Sterling around a weakening trend through the past couple of years increases the urgency to rebalance domestic production and demand to avoid damaging instability in households’ spending power. The uncertainty surrounding the whole Brexit process will add to this urgency. Moreover, it is necessary to increase the strength of British exporters as thus far they were clearly unable to make sufficient use of the stimulating GDP depreciation to increase their export turnover and market share. In addition to the composition of industrial production, UK exporters are also facing a major challenge to build up sufficient market share in non-EU markets. Reduced access to the European single market makes such geographical reorientation important. The recent trend indicates that this is not an obvious task. This, too, will probably require a strongly stimulating trade policy on the part of the British government.

More fundamentally, these evolutions and challenges once again point to the lack of economic logic of Brexit. Strong integration with the EU, leading to a relatively stable EUR/GBP exchange rate and an open, intensive trade relationship, would save the UK economy a lot of misery. Everyone must respect the democratic choice of British voters, but at least we can strive for far-reaching trade integration in the post-Brexit era. A sound trade agreement between the EU and the UK would be extremely positive for the EU, but essential for the British economy.