German industry (and coalition) not out of the woods yet

The German economy surprised positively in the third quarter of 2019 with real economic growth of 0.1% (qoq). Growth bounced back from -0.2% (qoq) in the second quarter, avoiding a recession, technically speaking. However, this recovery is likely to be temporary and the German economic outlook remains subject to various adverse forces that hurt German industry in particular. Additional fiscal stimulus is likely to be too small to be a gamechanger.

The consumer is king

The German industrial recession started more than a year ago. Industrial output has shrunk by nearly 10% since then and is currently at levels of output recorded in early 2015. Interestingly, so far, the industrial recession has not grown into a full-scale recession. In the past, all declines in German manufacturing that lasted for at least three quarters ultimately brought a recession to the rest of the economy. But not today.

German consumers can be thanked for the resilience of the German economy. Consumer optimism and willingness to spend stem from the record long boom on the German labour market. German employment has been growing since early 2010 - nearly a decade without a stop. That has put upward pressure on wages, which in real terms have been growing at stable, high levels exceeding 1.5 % over the past 5 years (rather low inflation dynamics have also played role).

With higher wages and a strong labour market, the German consumer is in much better shape than at any time since the reunification. And that is why the real spending of German households remains resilient and sharply contrasts with falling industrial output (see figure 1). That is also why there is still solid demand for residential investment among German households, which supports construction activity. So far, this has been enough to avoid an overall recession.

A murky path ahead

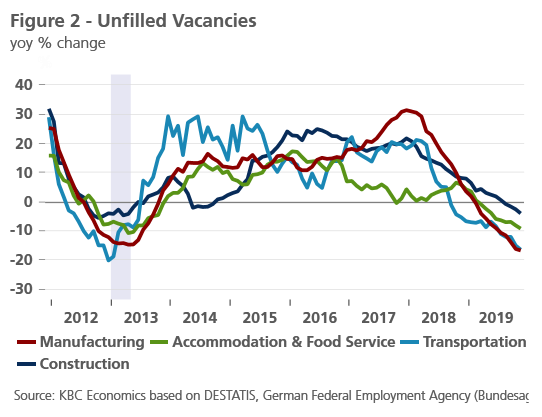

Nevertheless, looking ahead, one must be cautious, as there might be more negative spillovers if the industrial recession deepens further. Already, German employers are more cautious in hiring new workers. Although the number of unemployed remains near record lows, the number of free vacancies has started to decline since the beginning of 2019. And recently, the decline in vacancies has accelerated, spreading from manufacturing to other sectors such as construction and real estate services (see figure 2). So far, this minor shift in sentiment on the labour market has affected neither Germany’s positive wage dynamics nor household spending. But that may change in case of persistent industrial weakness.

Hence, the most important question is ultimately how much further the German industrial sector might fall going forward. Although the latest GDP data were slightly better, we are not out of the woods yet. The industrial production and export data were boosted in the third quarter by temporarily higher UK demand - as many UK firms have been preparing for a possibly chaotic no-deal Brexit. Hence, although we believe the German industrial sector will slowly recover at the beginning of 2020 (assuming no new geopolitical shocks), the bottom is yet to be found at the end of 2019.

Politicians under pressure

Weak figures for the fourth quarter could increase pressure on German politicians to introduce new fiscal stimulus or to at least ease some of Germany’s strict fiscal limits. Up till now, the ruling GROKO coalition (CDU/CSU and SPD) has stuck to a fiscally conservative stance; the budget proposal for 2020 continues to assume a federal budget surplus and only 1.5% growth in public expenditures. Nevertheless, in light of the weakening economy, low borrowing costs and additional investment challenges (such as climate change), this fiscal conservatism has come under fire recently. Surprisingly, the highly influential BDI industry lobby group (close to conservatives) also recently called for a fiscal U-turn. Meanwhile, the deeply divided SPD has voted for more left-leaning leadership that will challenge the current coalition agreement on the “black zero” policy. If the German data deteriorate further in the fourth quarter, the pressure will only grow.

Ultimately, we believe some of the measures put on the table by the SPD (such as a higher minimum wage) may be implemented to keep the GROKO coalition alive. Those measures may also lead to a mild relaxation of strict fiscal rules, breaking the “black zero” policy but maintaining the constitutional “debt brake” rule. Nevertheless, any major fiscal stimulus is probably still out of the debate as the SPD does not have enough power to push something of that sort through the coalition, and it stands to lose the most in case of early elections. That said, we expect the GROKO coalition to continue in 2020 (through Germany’s EU presidency), but its position is set to weaken further on internal clashes and on the slow nature of the recovery in the industrial sector.