Diversity in European income trends...but education pays off everywhere

Net income is increasing in the EU, but income growth differs across EU countries. Moreover, throughout the EU, higher education levels are leading to higher incomes and higher income growth. This is resulting in substantial income dispersion in several EU countries depending on people’s educational background. These findings hold in particular for Central and Eastern European countries. As a result net income in those countries is once again converging to the EU average. The road is, however, still long and the increased income dispersion between low-skilled and high-skilled workers may lead to calls for redistribution policies. The latter may slow down the income convergence process for high-skilled people in Central Europe.

In recent months newspaper headlines have announced spectacular wage increases in Central Europe. These do not come as a surprise to economists. First, Central and Eastern European economies are currently outperforming most Western European countries. Second, the region is still in a catching up mode, which implies convergence of prices as well as income levels and wages, to the EU average. Third, high wage growth is, at least partly, the result of relatively high productivity growth.

Higher wages lead to higher net incomes. Rather than just looking at average incomes, it is interesting to distinguish between workers’ educational attainment. In a recent KBC Economic Opinion (5 September 2017), I argued that high-skilled labour shortages are an imminent threat to European growth. There is a clear difference in net income growth among educational categories too. The median net income of low-skilled employees has increased by 8.5% since 2007 against an increase of about 12% for medium-skilled and high-skilled workers. Hence the higher income growth for skilled people reflects the growing high-skilled labour shortages in the labour market.

Comparing net income trends across EU economies, one will notice many, often opposing, trends. First, Figure 1 shows that the median net income of high-skilled workers has increased in many EU countries, although it has also decreased in some, between 2007-2008 and 2015-2016 (bi-annual averages). The largest income growth can be found in Bulgaria (90%), Estonia (63%) and Slovakia (50%). Conversely, net incomes for high-skilled workers declined in Greece (-37%), Portugal (-21%), Ireland (-16%), Cyprus (-15%) and Italy (-6%). Hence there are substantial differences across the EU, and even within the Central and Eastern European region. For example, high-skilled net income hardly increased in Slovenia and Romania, and went up only moderately in Hungary (14%) and Czech Republic (25%).

Figure 1 - Percentage change in high-skilled workers’ median net income in EU countries (2015-2016 vs. 2007-2008)

Source: KBC Economic Research based on Eurostat

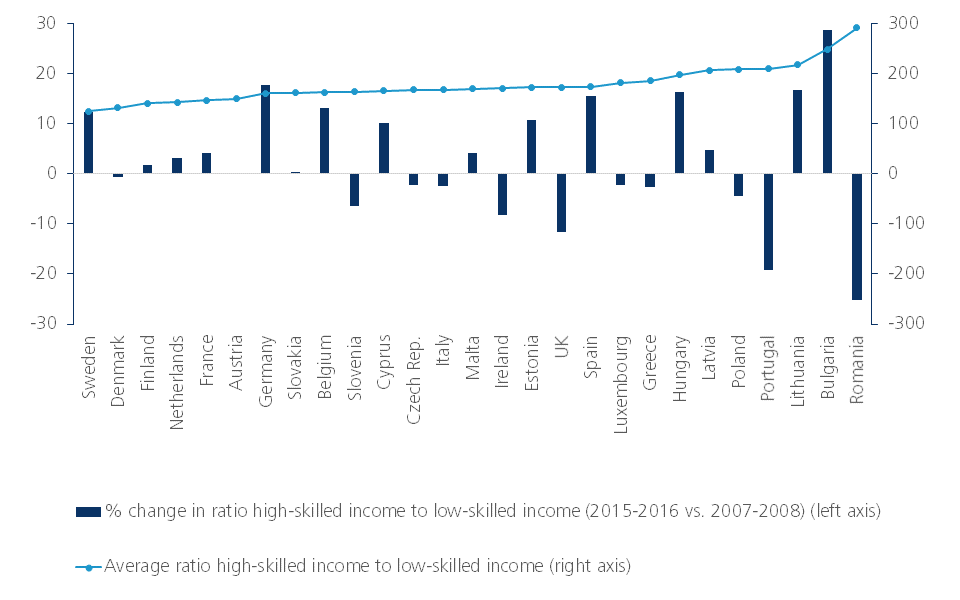

Second, the median net income ratio of high-skilled versus low-skilled workers has developed in many directions within the EU. Figure 2 compares this ratio for the years 2015-2016 against the years 2007-2008 (bars in the figure), while EU countries are ranked according to their ratio of high-skilled income versus low-skilled income (average in period 2007-2016; lines in the figure). Note that, on average, high-skilled workers earn more than low-skilled workers in all EU countries. Hence the height of the bars in Figure 2 reflect the extent to which the incomes of high-skilled people went up relative to low-skilled people over this period. Surprisingly, countries with a similar difference in high-skilled versus low-skilled wages have not necessarily experienced the same trend. For example, in Bulgaria high-skilled workers saw their incomes soaring compared to low-skilled workers, whereas in Romania the enormous differences in income between high-skilled and low-skilled workers declined substantially. Hence the opposing trends despite the fact that there is a substantial income gap between high-skilled and low-skilled people in Bulgaria and Romania. There are opposing trends in Spain and Portugal, too. In Central Europe we notice that Hungary and Estonia face a widening income gap, whereas in the Czech Republic and Poland the income gap is shrinking. Finally, in Western Europe, German and Belgian high-skilled incomes rose relatively sharply, but only moderately in France and the Netherlands. Therefore, these observations imply that divergent income dynamics are at play within the EU member states. If the income gap between highly-educated and lowly-educated people clearly widens, this may have social and economic consequences and may trigger a debate on redistribution at some point.

Figure 2 - Percentage change in the ratio of high-skilled income to low -skilled income

Source: KBC Economic Research based on Eurostat

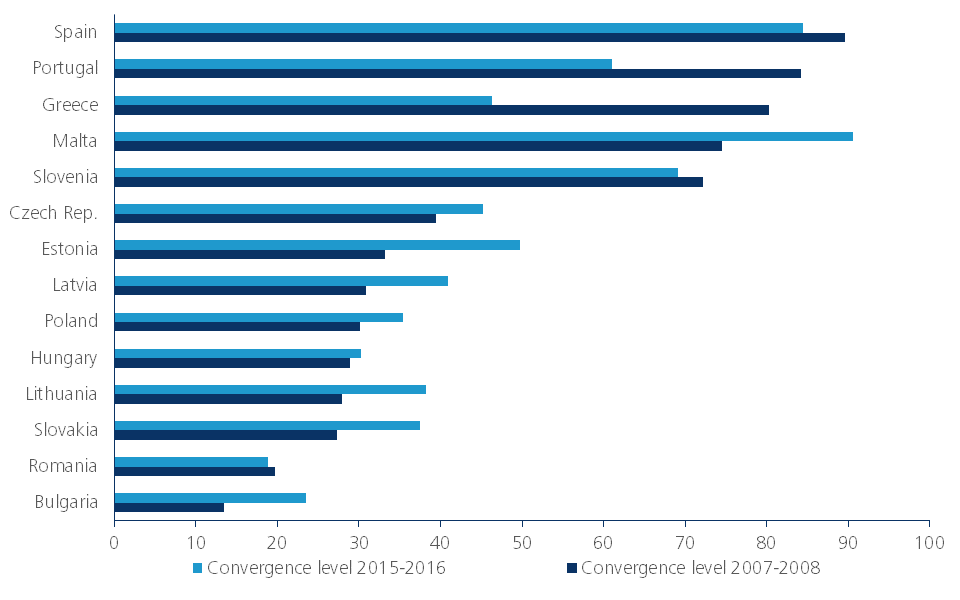

Even before the 2017 wage increases in Central Europe, incomes had again started to converge in the EU, in particular as net incomes have been on the rise in Central Europe for several years. This holds in particular for high-skilled workers’ income. As a result, net incomes converged towards the EU average (Figure 3). It is actually the restart of a long-term process that was interrupted by the financial crisis. Note, however, that net income convergence is not following a constant path within the EU.

Figure 3 - Convergence in high-skilled net incomes to the EU average (EU27 average = 100)

Source: KBC Economic Research based on Eurostat

Southern Europe has stopped converging to the EU average net income. So clearly, high-skilled workers in countries severely hit by the crisis were hurt more by the financial crisis than their counterpart in other EU countries. In times of crisis, education may not shelter your income, but it may help avoid the full brunt of the impact. Moreover, income growth in economies with the highest average net incomes for high-skilled employees in 2007-2008 was strong, leading to further divergence from the EU average. Hence income convergence is far from fully realised in the EU.