Fed ready to pull the trigger

- Fed will act to sustain the expansion

- Close, but unchanged, call in 2019; rate cut in 2020 according to dot plot

- An ounce of prevention is worth a pound of cure

- July rate cut 100% discounted

- US yield curve bull steepens, dollar softens and equities gain

It was only three months ago when the Fed changed its forward guidance on policy rates from “further gradual increases” to “patient” in light of global and financial developments. While still suggesting a slight tightening bias in the March dot plot, Fed chair Powell clearly stated that the next rate move could be in either direction. That newly installed Fed guidance didn’t last long. The suddenly escalating trade developments and increased concerns about the global growth outlook already triggered a new change to the Fed’s reaction function. The FOMC promises to closely monitor the implications of incoming information for the economic outlook and will act as appropriate to sustain the expansion, with a strong labour market and inflation near its symmetric 2% objective. The Fed used similar language in previous cutting cycles. Powell added that “the case for somewhat more accomadative policy has strengthened”. In a first dissenting vote since being installed as Fed Chair in January 2018, St.-Louis Fed Bullard preferred not to wait, but act with a 25 bps rate cut from 2.25%-2.5% to 2%-2.25%.

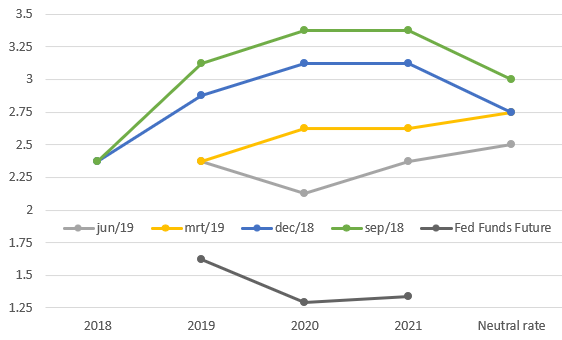

The new June dot plot shows that a large minority of Fed governors uses a further darkening eco outlook as its base scenario. Seven out of seventeen members expect the policy rate to be 1.75%-2% by the end of the year, implying two 25 bps rate cut or one 50 bps rate cut. The 2019 median expectation remained unchanged from March yesterday, but just by one vote. The average forecast for this year, did shift around 35 bps lower, from 2.49% to 2.17% adding evidence the Fed’s changed bias. Fourteen out of seventeen June “dots” remain unchanged for 2020, but the median (2%-2.25%) does incorporate one 25 bps rate cut. In 2021, both median (2.25%-2.5%) and average June forecasts (2.32% from 2.16%) are back higher. The median levels for 2020 and 2021 are respectevily 50 bps and 25 bps lower than in March. The way most Fed governors predicted Fed Funds future levels suggests that they play with the idea of cutting rates ones or twice as an insurance to keep the economic expansion going. “An ounce of prevention is worth a pound of cure”, Fed Chair Powell later added in the Q&A session. The scenario of a profound cutting cycle to counter a hard landing is not in play. The median estimate of the long term neutral Fed rate declined from 2.75% to 2.5%.

In its new Summary of Economic Projections, the Fed by and large kept its growth and inflation forecasts unchanged, of course against the background of a slightly lower Fed policy rate path. New median estimates suggest 2.1% growth this year (unchanged), followed by 2% in 2020 (vs 1.9%) and 1.8% (unchanged) in 2021. The unemployment rate should remain below 4% in the 2019-2021 period, and even at slightly lower levels than forecast in March. More importantly, the median estimate for the natural rate of unemployment (NAIRU) declined a notch from 4.3% to 4.2%. The Fed thus thinks that the economy can employ more people without having to risk higher inflation. The Fed’s policy statement showed some small modifications, incorporating the recent soft patch of eco data. The US labour market remains strong, with economic activity rising at a “moderate” instead of “solid” rate. Household spending appears to have picked up from earlier in the year, but business fixed investment has been soft.

Headline PCE inflation forecast dropped from 1.8%, 2% and 2% (2019-2021) in March to 1.5%, 1.9% and 2%. Core PCE forecasts changed to 1.8%, 1.9% and 2% from stable at 2% for the forecasting horizon. The Fed statement notes that market-based measures of inflation compensation have declined. The 5y5y forward US inflations swap for example fell below 2% for the first time since 2016. The lack of strong upward inflationary pressure allows the Fed to try to navigate a soft landing with moderating growth and contained inflation.

How the dots changed. Rate cut(s) are coming

Bull steepening and softer dollar

Rate markets have been frontrunning on Fed rate cuts this year and feel comforted by the Fed’s message. The US yield curve bull steepened yesterday with yields ending 12.8 bps (2-yr) to 1.3 bps (30-yr lower). The move is extended this morning in Asia with the US 10-yr yield dropping below 2% for the first time since November 2016. A sustained break below the 2.01%-2.06% support levels, suggests significantly more downside. A July rate cut is now fully discounted with markets currently just pondering whether it will be a 25 bps (72% probability) or 50 bps (28% probability) move. The Fed Funds future forward curve estimates 75 bps rate cuts this year and 25 bps in 2020 with the policy rate afterwards stabilizing at 1.25%-1.50% in 2021. The discrepancy between markets and the Fed thus remains large. We don’t expect the gap to be closed from a market point of view, unless we withness a dramatic improvement in eco data which would be sufficient to fend off a near term rate cut.

The US dollar declined because of the loss of interest rate support. EUR/USD returned north of 1.12 and currently trades around 1.1260. EUR/USD 1.1348 is first resistance USD/JPY fell below 108 to trade at the softest level since the early January flash crash. The trade-weighted dollar dipped below 97. Fed Chair Powell blocked all questions related to a weaker dollar policy, as referred to by US President Trump recently. US stock markets profited marginally, gaining 0.15% to 0.4% and remaining within striking distance of all-time highs. The next high profile event from a market point of view is next week’s G20-Summit including a high level meeting between US President Trump and Chinese President Xi Jinping. Lack of progress will amplify rate cut bets.