Eviva España... but growth champion not immune to Italian scenario

In 2017, Spain was the first southern European euro area country to see its real economy return to pre-financial crisis levels. At the beginning of 2018, growth momentum again proved to be robust. Spain continues to reap the benefits of the recovery policies that were implemented immediately after the crisis. But all that glitters is not gold. The consolidation of public finances and the high level of unemployment remain major challenges. Further economic reforms are needed. Furthermore, the fall of the minority government is a reminder that Spain has a fragmented political landscape. Thanks to better economic fundamentals, Spain remained largely out of focus for international investors during the recent Italian crisis. However, because the country is much more indebted to foreign entities than Italy, it is potentially more vulnerable to the loss of their confidence.

Powerful growth recovery

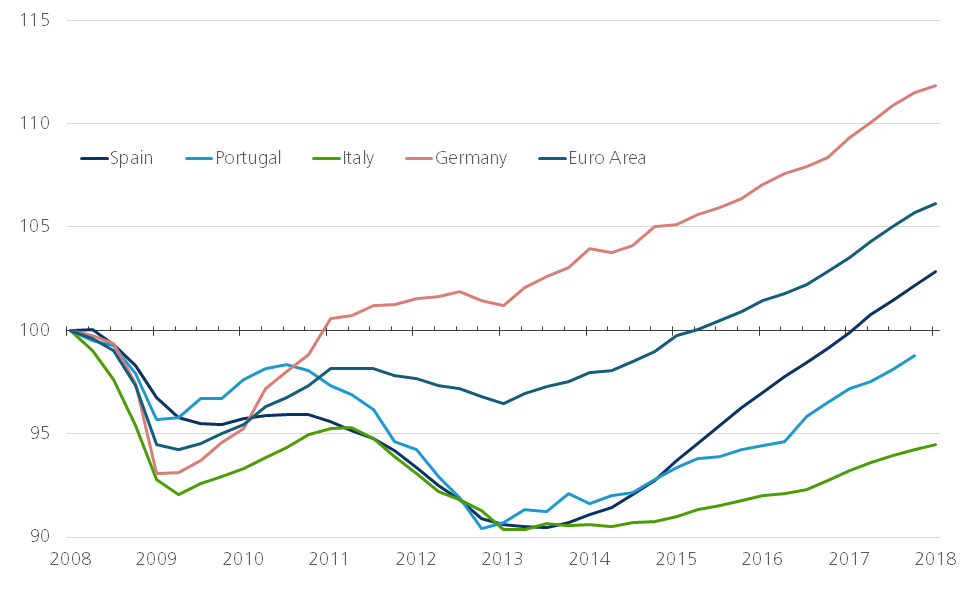

The Spanish economy continues to perform strongly. The impressive growth spurt that started in 2014 brought real GDP back to pre-financial crisis levels in mid-2017 (Figure 1). Spain is the first southern European euro country to succeed in this. The growth differential is particularly marked compared to Italy. At the beginning of 2018, growth momentum in Spain remained robust while that of Germany and France cooled down. Confidence also did not experience the same sharp downturn as in many other euro area countries. Neither the weakening of neighbouring economies nor the Catalan saga succeeded in stifling Spanish growth.

It appears that Spain continues to reap the benefits of the post-crisis recovery policies of 2011-2012. Wage moderation and labour market reforms have made the economy more competitive. Labour costs per product unit, for one, have been reduced to their lowest level since the introduction of the euro. Thanks to the restructuring of the banking sector, there is a return to credit for productive enterprises. Indeed, unlike many other euro area countries, Spain’s qualitative competitiveness improved according to two international rankings. These improvements were accompanied by further structural economic changes. Dynamic services sectors took over the role of growth engines from construction, which had grown excessively before the crisis. At present, imports are also a major contributor to growth. Spain is regaining international market shares and exports are more geographically diversified. In 2017, for the 5th year in a row, the current account balance recorded a surplus despite strong domestic demand.

Figure 1 - Real GDP (Q1 2008 = 100)

Source: KBC Economic Research based on Eurostat

Remaining challenges

But all that glitters is not gold. The strong growth spurt was also made possible by temporary windfalls. Spain has benefited more than its neighbours from low oil prices and the strong monetary stimulus provided by the ECB. These windfalls will soon (start to) turn around. If catch-up demand from the recession dries up and export market growth loses some momentum, this will start to gnaw at Spanish growth.

This will bring the Spanish economic challenges back to the forefront. During the euro crisis, Spain was hit hard because of the property bubble and the high level of private debt. As a result, several Spanish banks ran into trouble. Most of these problems have been resolved, but not all of them. Meanwhile, public debt rose from 35% of GDP in 2007 to 100% in 2014. Strong growth and falling interest rates have since led to a slight reduction in the debt ratio. However, after a period of severe budget cuts, fiscal policy was loosened again in 2015-2016. So, there is still some work to be done to eliminate the ‘excessive deficit’.

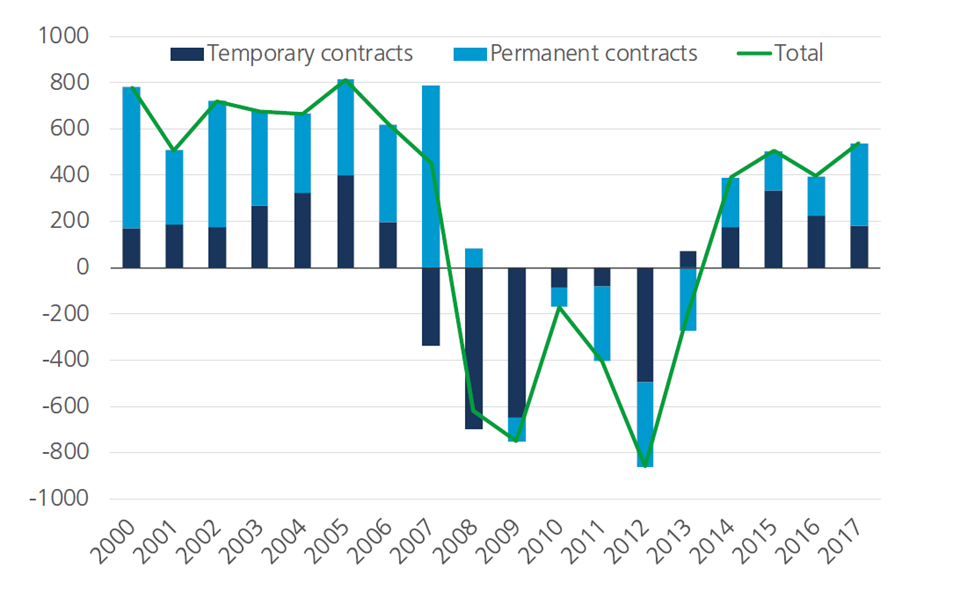

Like many other countries, the main challenge for Spain is to further reform the labour market. Unemployment is falling sharply, but remains the second highest in the EU after Greece: 16.1% of the labour force in March 2018. For young people (<25 years), the unemployment rate is more than twice as high. Despite the considerable increase in employment that resulted from strong economic growth, the proportion of Spaniards of working age actually working is still among the lowest in the EU. Moreover, over a quarter of employees only have a temporary job. That is twice the EU average. Approximately half of the job creation in the past four years consisted of temporary jobs (figure 2).

Figure 2 - Wage-earners in Spain (annual change in thousands)

Source: KBC Economic Research based on National Institute for Statistics (INE)

Temporary employment contracts are, in principle, very useful to facilitate entry into the labour market. The employer and employee can get to know each other better before they enter into a permanent agreement. But the downside of temporary contracts is that they discourage both parties from investing in training. Low training opportunities and career development are typical features of workers with temporary contracts. The frequent use of temporary work thus hinders productivity growth. It also feeds uncertainty. Spain shares this problem with Italy. The inefficiency of the labour market is producing many over- and under-qualified workers. This underlines the need for further reforms, including the development of active labour market policies, that better match employees’ skills with business needs.

Reforms generally require decisive institutions and public support. High unemployment and job insecurity are, however, fertile ground for populist policy proposals that hinder adequate policy. Due in part to higher economic growth, Spain has not yet been affected by this as much as Italy. But also in Spain, the political landscape is becoming more fragmented.

Will we see an Italian scenario unfolding in Spain? Spanish public debt (98% of GDP in 2017) is lower than the Italian public debt (132%). In contrast to the Italian debt ratio, Spain’s has fallen slightly in recent years. This has kept Spain largely off the radar of investors during the recent Italian crisis. The Spanish economy is, however, much more indebted to the rest of the world than the Italian economy. While Italy’s net asset position is broadly in balance, Spain has a deficit of 80% of GDP. As a result, Spain is potentially more vulnerable than Italy to a loss of confidence on the part of international investors.