Europe in the frontline of the coronavirus’ economic impact

The world is bracing for an adverse economic impact from the coronavirus. Many fear that the economic consequences are currently underestimated, in particular in the event that the virus outbreak becomes a global pandemic. As no one can be sure how long the corona crisis will last, it is useful to know which countries and sectors are most vulnerable. To this end, we simulate the international spillovers of an economic shock originating in the Chinese economy. It appears that several European countries are very vulnerable, in particular Germany as well as several small open economies with strong ties to German industry. The heterogeneous impact on European countries implies that a monetary policy reaction by the ECB may not be very effective.

Simulation exercise

Given the uncertainty surrounding the future developments of the coronavirus outbreak, we assume that the Chinese economy is affected by a negative demand shock. This is a similar kind of shock to the one that occurred after the SARS outbreak in 2003, but its magnitude is assumed to be larger for several reasons. First, the coronavirus appears to spread faster than SARS, therefore infecting a higher number of people. Second, the government’s decision to put dozens of cities on lockdown is unprecedented in terms of the size of the quarantine. Third, the outbreak started in the period surrounding Chinese New Year. Hence, the higher spending on restaurants, travelling, gifts etc. is likely to be permanently lost. For the latter reason, we also assume that Chinese services sectors are more severely hit than Chinese industrial sectors. We model it as a 20% fall in final demand for imports in the services sectors and a 10% fall in final demand for imports in industrial sectors. The magnitude of the shock has been chosen arbitrarily but reflects the likely relative impact of the current situation on services and industrial activities. Hence the outcome of the analysis is more suitable for the ranking of various countries and industries by their sensitivities to the shock rather than for calculating the precise coronavirus impact.

The simulation exercise considers the interactions between countries and sectors, using the World Input-Output Tables (WIOT, 2014). As such, the transmission of shocks to other countries and other sectors is taken into account. The results from the simulation exercise should be interpreted as the cumulative percentage fall in gross value added. The analysis is static and hence neglects potential dynamics or policy reactions.

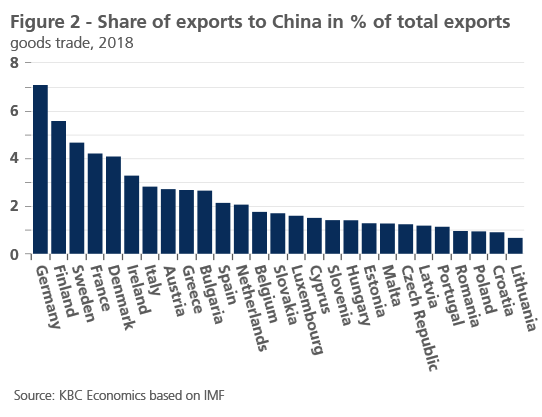

As Figure 1 shows, the main finding is that although the most vulnerable countries in this exercise are obviously the closest trading partners of China (South Korea, Taiwan, Japan), several European countries are vulnerable too. In particular, Germany is very much exposed to a Chinese demand shock as it is the main European exporter to the Chinese market (see Figure 2). Some Central European countries would also be very much affected, in particular the Czech Republic, Hungary and Slovakia. But interestingly, Poland wouldn’t be highly affected. This difference can probably be explained by the varying degrees of integration with the German economy and the relatively strong importance of the automotive industry for the former economies. The Netherlands and Belgium are vulnerable as they are important logistic channels for trade with China thanks to their ports, and because they have close ties to German industry. The Irish economy is also vulnerable given its high degree of openness and exposure to global trade.On the more positive side we notice that France as well as the Southern European economies are hardly affected by a negative shock originating in China. This signals that the coronavirus could potentially have very heterogeneous effects on individual European countries.

Germany again

The fact that Germany and its surrounding and strongly integrated trading partners are very vulnerable to a negative shock in the Chinese economy is very inconvenient news. Germany suffered in particular from a substantial decline in industrial production in 2018 and 2019 due to international headwinds (notably the US-China trade war and Brexit) as well as due to technological and ecological transitions (e.g., in the car industry). This makes the coronavirus a major risk factor for the European economic outlook.

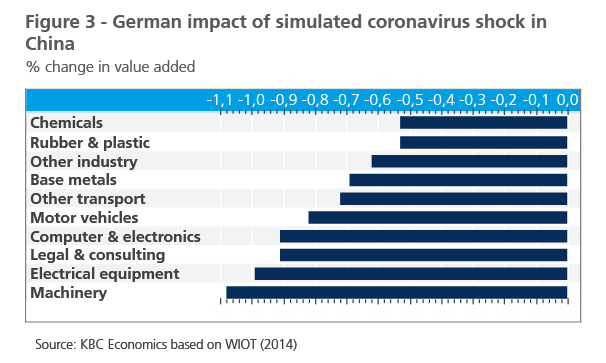

Looking at individual sectors that will be hurt most, one can notice that it is mainly the machinery and automotive industries that are exposed to the coronavirus risk – i.e. the same sectors that were hit by the recent industrial decline. This is not surprising given their strong export orientation to the Chinese market.

No panic, but vigilance.

Despite the vulnerabilities among European economies to the coronavirus shock, as detected by our analysis, it remains to be seen what the actual development of the coronavirus will be. It is important to be aware of these vulnerabilities and to be vigilant. In particular, the policy reaction to such a shock may not be straightforward. Some argue already that the European Central Bank may have to intervene again by cutting interest rates further. However, such a response may not be appropriate, as it is clear that the shock is far from homogeneous across European countries. A common policy reaction to an asymmetric economic shock may cause more harm than good. And as such the coronavirus may become a very complex risk to deal with in the European economy.