Euro area inflation: difficult easing ahead

Read the publication below or click here to open the PDF

In 2022, inflation in the euro area (and beyond) rose to its highest level since the 1970s. An easing has begun in recent months, but only due to the fall in energy prices. So-called core inflation remains stubbornly high and even accelerated slightly in February, mainly due to the rise in services inflation. This fuels concerns about further inflation easing. Higher wage growth in particular is expected to fuel services inflation and thus obstruct further inflation easing. Things need not go that far, although the return of inflation to the medium-term target of 2% is expected to be a matter of long-term work. However, the pace of inflation decline will not only be determined by wage developments, but also by corporate margins. In the recent past, these have risen sharply to quite high levels. This would allow them to absorb and neutralise, at least in part, further labour cost pressures. To what extent this will happen will largely depend on the strength of consumption demand. This is held back by the rise in interest rates due to tighter monetary policy. The recent tension in the financial system may put additional downward pressure on demand, but could also curtail central banks' policy space. A consistent macroeconomic policy mix is therefore more important than ever. General fiscal measures that support consumption demand should be phased out, especially as high energy prices and risks diminish. If not, they risk being counterproductive to monetary policy.

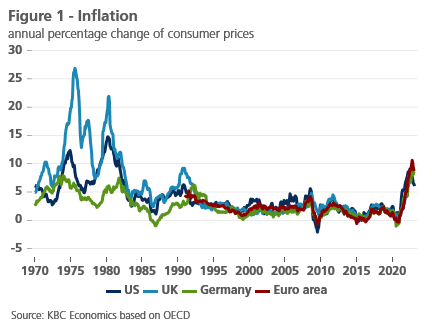

The reopening of the economy after the lockdowns during the corona pandemic and disrupted international supply chains pushed global inflation in 2022 to its highest level since the 1970s. The war in Ukraine with its disruptive impact on food and energy markets created an additional inflationary impulse especially in Europe. In the eurozone, the annual increase in consumer prices - the most common measure of inflation - peaked at 10.6% in October 2022 (Figure 1). In Belgium, it was as high as 13.1% (according to the European harmonised consumer price index).

The fading away of the reopening effects, the normalisation of supply chains, and, especially in Europe, the sharp fall in the price of natural gas have since caused a notable easing of inflation. Nevertheless, euro area inflation in February 2023, at 8.5%, was still more than four times the ECB's medium-term target of 2%.

Very likely, euro area inflation will fall further in March 2023. A sharp decline by (more than) one and a half percentage points to below 7% is certainly a possibility. After all, the sharp rebound in energy prices immediately after the Russian invasion of Ukraine a year ago now falls out of the basis of year-on-year comparison. That so-called base effect will sharply reduce the increase compared to a year ago.

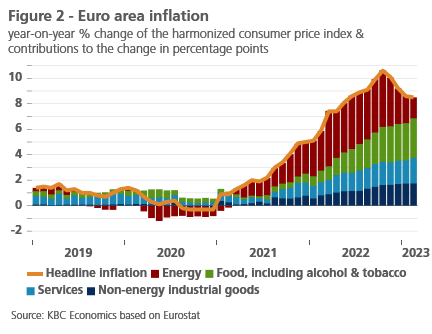

But that decline will not yet be the swallow that heralds the start of spring. For a rapid return of inflation to the 2% target, the rate of price increase of non-energy components in the consumer price index remains far too high. Food price inflation has risen from 0.5% in mid-2021 to 15.0% in February 2023, making the largest contribution to inflation in recent months (Figure 2). The admittedly slower but steady increase in price pressures in services and goods, excluding energy, is at least as worrying. Both constitute so-called core inflation. In February, it rose to 5.6% in the euro area, driven mainly by services inflation.

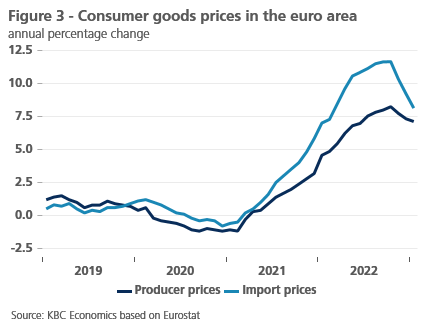

The latter in particular raised eyebrows among many observers. Admittedly, goods inflation (6.8%) is still significantly higher than services inflation (4.8%). But several leading indicators, such as import and producer prices, suggest that a slowdown in goods inflation is in the pipeline (Figure 3). The normalisation of consumption patterns after corona, the unwinding of supply chain bottlenecks, the appreciation of the euro exchange rate and the easing - and even partial reversal - of the energy cost surge are factors that should ensure this. Leading indicators suggest that food price inflation would also begin to fall soon.

Services inflation, on the other hand, is viewed with greater skepticism. After all, the aforementioned inflation-reducing factors could be neutralised there more than in manufacturing by rising wage costs. In general, the wage share in services' costs is higher and it is usually assumed that productivity gains to offset (wage) cost increases are harder to realise in service sectors than in manufacturing. In particular, if wages catch up to recover the loss of purchasing power due to the recent inflation surge, this could keep service inflation high.

Rising wage pressures...

In the euro area, an acceleration in the pace of wage growth is likely in the course of this year against the background of last year's unrecouped purchasing power losses and the tight labour market and the war for talent.1 In the euro area, the unemployment rate was 6.7% in January 2023, barely higher than the historical low of 6.6% in October 2022. The tightness is further reflected in the vacancy rate, the ratio of the number of open positions to the total number of filled and unfilled jobs. This stabilised in the fourth quarter of 2022 at the historically high level of 3.1%, 0.3 percentage points higher than the year before.

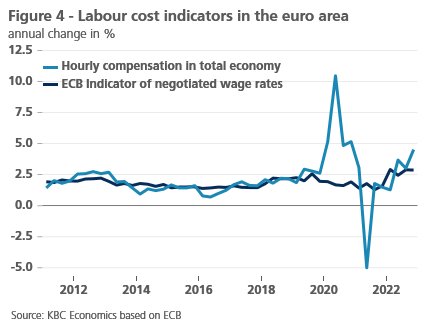

The first signs of an acceleration in wage growth are becoming visible (Figure 4). According to ECB figures, the annual increase in the wage bill per hour worked for the total economy rose to 4.5% in the fourth quarter of 2022. This is significantly higher than the 2.6% increase on average in 2019, the year before the pandemic (which significantly disrupted the annual growth rate). But against the backdrop of last year's sharp inflation surge, this still remains relatively limited. A further increase is therefore likely.

On the other hand, the ECB's indicator of negotiated wage rates points to wage growth of only 2.9% for the fourth quarter of 2022. That figure confirms the assessment that, despite the tight labour market, the catching-up of wages vis-à-vis inflation will only be a gradual process, which is unlikely to lead to a full recovery of purchasing power loss of wages in the euro area.2 In that scenario, wage pressures on inflation could remain somewhat limited. It would delay, but not completely impede, a further inflation easing.

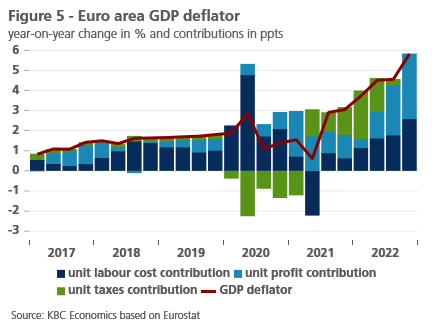

Incidentally, this will depend not only on the strength of wages' catch-up with inflation, but also on the development of companies' profit margins. There are indications that the past surge in inflation may have been accompanied by a widening of those margins. The analysis of the evolution of the GDP deflator illustrates this.

The GDP deflator is a broader measure of prices in the economy than the consumer price index. Its evolution can be decomposed into the impact of labour costs, corporate profits (or, more precisely, gross operating surplus, which roughly corresponds to profits before interest charges, taxes and depreciation) and net indirect taxes (i.e. indirect taxes, such as VAT and excise duties, net of subsidies), each expressed per unit of value added.

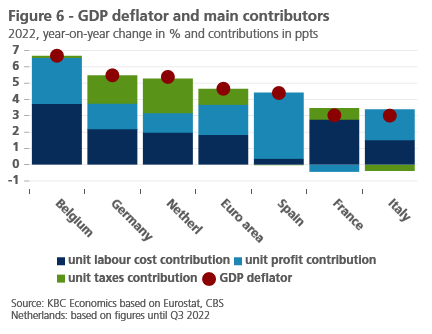

Figure 5 illustrates for the euro area as a whole that, across all sectors, price pressures from labour costs increased during 2022, but that a widening of margins was also an important driver of price increases. Figure 6 illustrates that this was the case in almost all large(r) euro countries (with the exception of France). Also in Belgium, although here wage cost pressure was the main cause of price increases, as well as the largest of all countries shown - a consequence of automatic wage indexation.

The share of firms' gross operating surplus in value added was at its highest level since 2007-2008 at the end of 2022. This means that, if necessary, a further increase in wage costs could also be absorbed, at least partially, by a contraction in margins.

Although it should be added immediately that the overall macroeconomic picture of increasing profit margins can hide large differences between companies and sectors. In its recent annual report, the National Bank of Belgium, for example, points to the large impact of a small number of very large companies on macroeconomic margin rates. In the vast majority of industries, according to the National Bank of Belgium, companies' margins are down in 2022 compared to 2021. In those companies, there is less room to absorb a further increase in labour costs via contraction in profit margins.

Much will also depend on the strength of consumer demand and companies' pricing power. Margin expansion in 2022 went hand in hand with strong demand, especially in the first half of the year. This was initially still the result of pent-up demand after the corona pandemic. In the second half of the year, consumption demand cooled sharply in most countries (but not in Belgium). The energy price shock, which peaked in the summer, is no stranger to this.

But even in the second half of the year, the economy ultimately remained more resilient than expected. Very likely, fiscal measures to support purchasing power after the energy price boom contributed to this. However, an unintended indirect consequence of those support measures is that, by supporting demand, they probably also contribute to the stubbornly high (core) inflation. In this way, fiscal policy works against monetary policy. Since the summer of 2022, the latter has wanted to curb demand and thus curb inflation by raising interest rates. Hence the ECB's - justified - call for a reduction in general and untargeted support measures as energy prices and risks fall.

For itself, the ECB still sees "a lot more ground to cover", as President Lagarde put it during the press conference after the policy meeting on 16 March. After all, monetary policy only has a delayed impact on the economy. If incoming economic data were to show that inflation is not easing sufficiently quickly, the ECB will not refrain from raising interest rates further.

Recent tensions in the financial system may weigh extra on demand. But they could also curtail the central bank's scope to raise interest rates further. In such a scenario, further inflation easing would increasingly depend on fiscal policy. If this is insufficiently restrictive, inflation-easing would really end up on a difficult path. In any case, the consistency of the macroeconomic policy mix is more important than ever.

1 Belgium is an exception in this respect because the automatic wage indexation has already almost fully compensated for the loss of purchasing power.

2 Belgium is an exception in this respect because due to automatic wage indexation, there has been little or no loss of purchasing power.