Reopening of redesigned hospitality sector

Many bars and restaurants are currently hard at work, renovating and making adjustments as the (partial) reopening of large parts of the hospitality sector comes closer. The past year has been tough for the sector, but with the progress made in the vaccination campaigns, there is light at the end of the tunnel. For some businesses, the reopening will come too late and they may have to close shop. For others, the crisis has revealed important new opportunities that will continue to reshape their operations in the future. In order to limit losses and facilitate the restart, we are advocating a maximum extension of active measures, such as opening up squares to bars and restaurants so they can set up terraces, in addition to the passive financial assistance. This will help the hospitality sector get back on track, for some in a redesigned form.

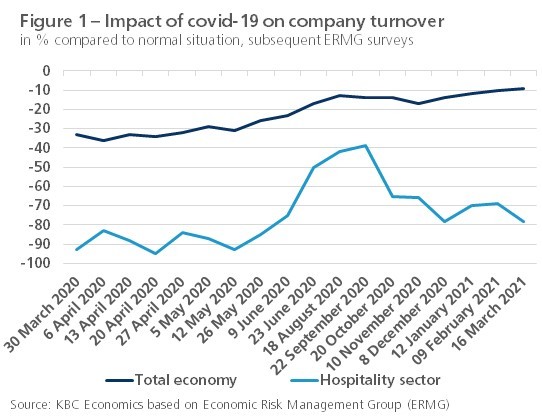

Few sectors in Belgium have been so adversely affected by the lockdown measures as the hospitality industry. We can see this in the turnover data from the ERMG survey. On the one hand, the drop in turnover in the hospitality industry was considerably larger than that in the total economy and this during the entire crisis period (see figure 1). On the other hand, the sector barely managed to increase its turnover figures in the course of 2020. The only exception was the period around the summer months, in which turnover data improved slightly. While most sectors were able to resume their activities in a relatively normal way after the spring of 2020, the hospitality industry was confronted with long closure periods and with capacity restrictions in the months they were allowed to open their doors.

We see a similar picture in the unemployment figures of the RVA. In the accommodation and meals sector, temporary unemployment due to force majeure has been very high in recent months. The absolute peak was reached in April 2020, with more than 95,000 temporarily unemployed. After a brief dip in the summer, the number of temporarily unemployed in the sector rose again. In February (the latest available figure), the number was almost 68,000, or one in seven of the total number of temporarily unemployed in Belgium. By comparison, there were only about 120 temporarily unemployed people in the hospitality sector on average in 2019.

Redesigning and broadening

With the reopening of the terraces on 8 May, there is again some perspective for the hospitality industry, although the relaxation is still conditional and subject to strict conditions. The timing of the full and permanent reopening will depend on the infection figures and how smoothly the vaccination campaign proceeds. Fortunately, it seems like a large part of the population is very eager to visit bars and restaurants again. People's need for social contact makes it likely that the sector will bounce back relatively quickly, with some adjustments here and there. The crisis has made us accustomed to new behavioural patterns which will probably continue to some extent once the virus has been contained. Think of a coffee-to-go, more take-away and home delivery of meals, or fewer lunches due to the increase in teleworking. As long as people are afraid of getting infected with the covid-19-virus, more attention will have to be paid to hygiene and safety. Also good ventilation inside and larger terraces/patios outside will likely be needed to satisfy customer needs.

All this has important consequences for the sector. The required adjustments to the 'new normal', often require significant investments. These will not be feasible for every establishment. They also require more attention to profitability and professional management, all the more so because many hospitality businesses were already struggling with very low profit margins in the pre-crisis period. Competition in the sector is also likely to increase. While an increase in bankruptcies may initially reduce the number of restaurants and bars, this will likely be offset by new initiatives in the longer run. One example is the rise of so-called dark/virtual kitchens. These focus exclusively on the preparation of meals for home delivery and, because furnishings and location are less important than in the traditional hospitality sector, costs remain relatively reasonable.

At the same time, the new trends offer potential for the sector. Broadening services to (new) customers can provide an additional source of income and increase profitability. Partly, this involves vertical expansion, whereby existing services (e.g. preparing meals) are offered more broadly (serving the home consumer through collection or delivery, quick-service restaurants, opening a web shop to sell the consumer's own favourite ingredients or products, etc.). Horizontal broadening, whereby activities or services are developed that go beyond traditional drinking and eating, can also increase turnover. People going to bars or restaurants increasingly expect a unique experience. New concepts (a unique location, a thematic interior, interactive meals, offering accommodation at the same time, etc.) can capitalise on this. The broadening will probably mean that the hospitality industry will merge more with related sectors, such as the retail sector or the events sector.

Such new revenue models do present the hospitality businesses with challenges and success is not guaranteed. Side activities are often very labour- and capital-intensive, they require specific knowledge and competences, and they bring along all kinds of legal obligations. A particular problem in this regard is finding qualified staff. Due to closures and the associated financial uncertainty, there has been an outflow of hospitality personnel to other sectors (butchers, supermarkets,...) in recent months. This poses threats to the relaunch of the sector and can seriously hinder further expansion initiatives. A price increase would help to absorb the higher (investment) costs, but could scare off customers. All the more because prices in the hospitality sector in Belgium are already quite high today. According to Eurostat data, hospitality prices were 22.6% higher (in purchasing power parities) than the EU average in 2019.

Facilitating the reopening

The government currently still provides a large support package for bars and restaurants. This cannot be phased out significantly before the sector is allowed to run at full capacity again. Looking at the future, it is important that the largely passive financial assistance is increasingly redirected towards more active business support, especially as the hospitality industry gradually reopens. Of course, a number of hygiene measures will also remain necessary as long as the pandemic is not contained. But apart from that, it would be good if the government could be flexible for a while with all kinds of specific taxes, regulations and permits. Some active measures were already put in place. The Flemish government recently provided a temporary exemption (until March 2022) from the permit requirement for terraces and many local authorities approved a temporary exemption from the so-called terrace tax. The federal government recently approved, as one of the additional measures, a more flexible use of student jobs. More measures of this kind (allowing bars and restaurants to set up terraces in squares and streets, making vacant buildings available, organising culinary walks together with the hospitality industry, etc.) would certainly help business owners to resume their activities after the difficult covid-19-period.