The water level of the Rhine and the German economy

Read publication here or click here to open PDF

During the past month, the water level of the Rhine has been exceptionally low for this time of year. What are the consequences for the German economy should transport on this waterway become impossible? In 2020, only 7.1% of all German goods transport was carried out on inland waterways, compared to 18.3% by rail and 74.6% by road. However, more than 80% of this inland waterway transport was carried out on the Rhine, which is an important supply route for German industry. The replacement of this inland waterway transport is not evident in terms of road capacity and would lead to an increase in congestion on major arteries. In this brief research report, we predict how the water level might evolve in the coming months and what the impact would be on German industry and, by extension, the country's entire economy.

Is the worst over?

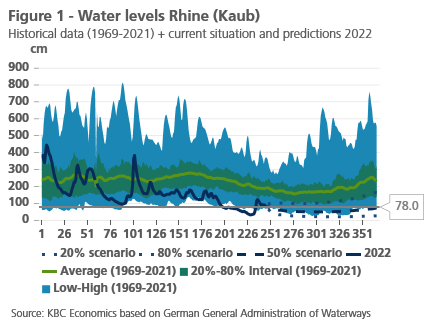

In August, the water in Kaub, an important bottleneck for transport between the Upper and Lower Rhine, dropped to levels not previously seen in that month (Figure 1). After heavy rainfall in the Swiss Alps in mid-August, the water in Kaub did return to more navigable levels. However, looking at the seasonal average of water levels, the lowest levels are usually only reached in October. Using a TBATS model, we draw up three scenarios, namely an average expectation for the water level in Kaub (50% scenario) and a 20% and 80% scenario (Figure 1) where we assume a water level equal to the 20% and 80% percentile respectively. The consequences for the German economy are calculated for each scenario.

Quantifying the drought problem

To quantify drought as a variable, we start from the method described in Ademmer 20201 . In this method, a variable is created by adding up, per month, the number of days where the water level in Kaub is below 78 cm. After all, at or below this height, safe passage for vessels is no longer guaranteed. We thus obtain a variable that allows us to measure the effects of exceptionally low water levels. We adapt the method slightly. At a water level of 78 cm, transport is still possible, but ships must be less heavily loaded. Below a level of 40 cm, profitable transport becomes virtually impossible. Bearing this nuance in mind, we take the actual transport capacity of the Rhine into account when drawing up the drought variable. This method of working allows us to distinguish between the 50% scenario, which in some periods is just under 78 cm, and the 20% scenario, where in the same periods transport becomes almost impossible.

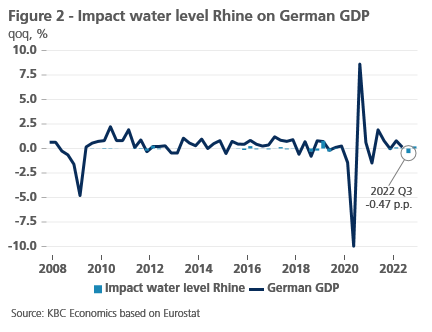

We add the obtained time series as explanatory variable to a mixed-frequency VAR model, which includes Germany's GDP and industrial production. Figure 2 shows the effects on German GDP. Based on the average scenario for 2022 of the Kaub water level, we expect a negative impact on quarterly growth of almost 0.5 percentage points in the third quarter, of which 0.2 percentage points are already recovered in the fourth quarter of this year. In the negative scenario, in which a long period of exceptional drought is expected in the autumn of this year, this effect increases to -0.6 and -0.3 percentage points in the third and fourth quarter respectively. It is more complete to say that the drought responsible for the low level of the Rhine has a negative impact on the German economy, as measured. These droughts may affect the economy via more channels than just a lower transport capacity of the Rhine.

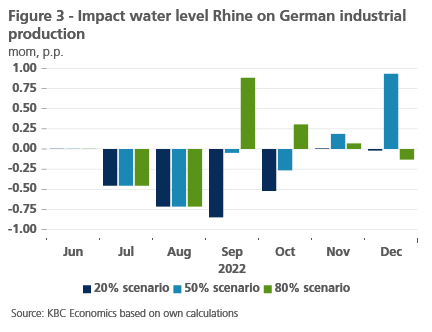

A similar exercise is done for industrial production in Germany, which suggests a negative impact of -0.7% in August from the low water level. Figure 3 shows the impact on month-on-month growth for the different scenarios of the water level in Kaub. In the 80% scenario, we can already speak of a recovery in industrial production in September, due to rising water levels. In the 50% scenario, we will have to wait until December. In the 20% scenario, we expect additional negative growth in the coming months and recovery will only occur in 2023.

Is inland waterway transport mainly influenced by water conditions or rather by economic growth?

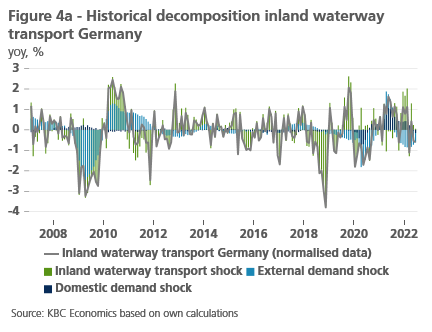

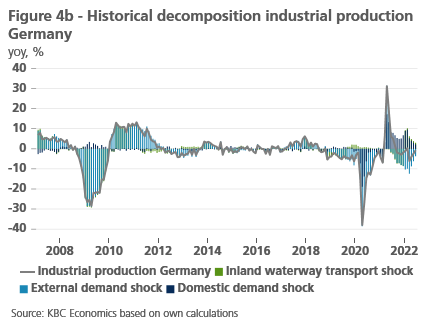

To confirm the above results, we try to measure the effects of low water levels through fluctuations in German inland waterway transport, more than 80% of which is carried out on the Rhine. We distinguish three important periods in this time series; we observe a strong decrease in inland waterway transport during the global financial crisis, in autumn 2018 and as a consequence of the coronavirus pandemic. In order to distinguish the consequences of a drop in domestic or foreign demand from a drop in transport due to low water levels, before measuring the impact on the German economy, we identify a domestic and external demand shock as described in Killian 20212 . The drop in 2008 was mainly due to a negative external demand shock, while during the corona pandemic there was a combination of negative domestic and external demand shocks (Figure 4a). The domestic demand shock is shown in dark blue, the external one in light blue. Shocks associated with water levels or more generally with frictions in inland water transport are shown in green. The last fifteen years saw periods of drought in 2009, early and late 2011, late 2015, early 2017 and the most extreme in 2018. The calculated inland water transport shocks therefore seem to be a good approximation of the drought problem. Next, we measure the effect of the same shocks on German industrial production.

In Figure 4b we again notice the already described interplay of domestic and external demand shocks. The strongest inland water transport shock, measured in 2018, indeed has measurable effects on German industrial production, similar to those measured in the model that uses water levels themselves as a variable.

Data for inland waterway transport is not yet available for the summer months of 2022, but a decrease can already be expected based on a strong inland waterway transport shock, on top of a possible domestic or external demand shock due to a prolonged energy crisis.

Conclusion

Despite the rise in the water level of the Rhine during the second half of August, there is a risk of further problems during autumn. Despite the limited share of inland waterway transport in total goods transport in Germany, its impact on German industry is certainly not negligible. Persistent drought and associated problems with inland waterway transport will subsequently have a negative impact on German industrial production, which is already suffering greatly from an ongoing energy crisis.

1Ademmer, Martin, Nils Jannsen, and Saskia Mösle. Extreme weather events and economic activity: The case of low water levels on the Rhine river. No. 2155. Kiel Working Paper, 2020.

2Kilian, Lutz, Nikos K. Nomikos, and Xiaoqing Zhou. "Container trade and the US recovery." Center for Financial Studies Working Paper 659 (2021).