Deindustrialisation in Belgium is not irreversible

The deindustrialisation of the Belgian economy is often represented by the image of a shrinking industry. This does not correspond to reality and requires a nuance. In essence, it is a revolution: traditional industries are under pressure, while new technology-intensive activities do not break through sufficiently. More than Belgium, Germany was committed to the development of a technology-driven industry. More generally, Germany’s relative industrial success is also due to sustained wage moderation efforts and reforms aimed at a more flexible use of labour.

Deindustrialisation requires a nuance

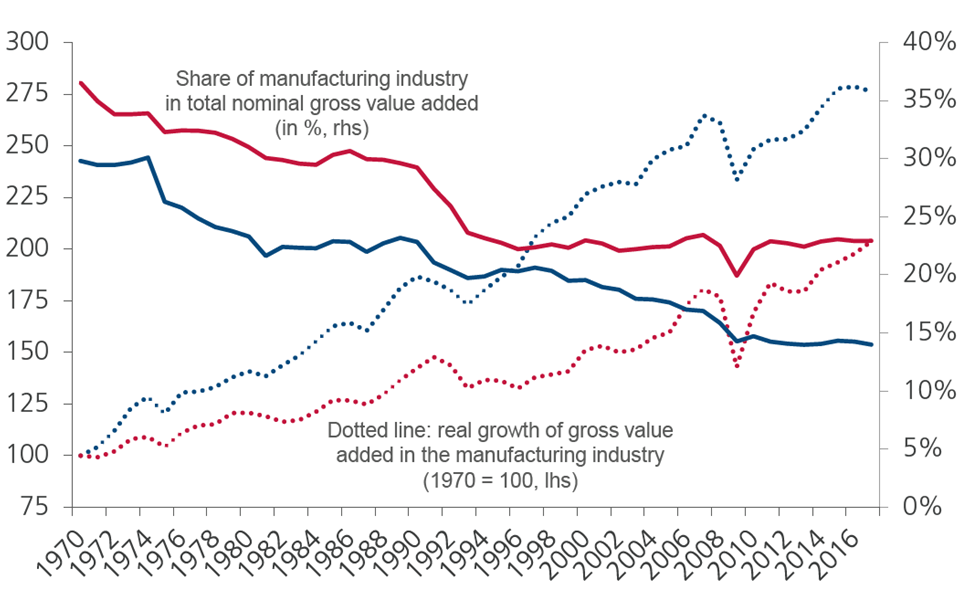

The development of industrial activity in Belgium must be nuanced. In reality, since 1970 only relative deindustrialisation occurred. In other words, the share of the manufacturing industry (excluding construction) in total gross value added decreased in favour of the services sectors. In the period 1970-2017, the decline was 16 percentage points. That’s a little more than in neighbouring Germany. In terms of absolute deindustrialisation, there was absolutely none at all. Employment in the sector declined sharply, but industrial production volumes continued to increase (figure 1). Since 1970, real growth of value added in Belgium’s manufacturing industry averaged 2.3% per year. Belgium even scored better than Germany (1.7%). Since the creation of the EMU in 1999, German industry, however, was in a much better relative position: the growth of Belgian industrial activity has since then fallen sharply to an average of 1.5% per year, well below the German figure (2.3%).

Figure 1 - Development of industrial activity in Belgium vs. Germany

It is often also stated that the relative decline of industrial activity is causing irreversible impoverishment. Again this requires a nuance. Value creation in an economy results from companies producing products for which consumers are prepared to pay a price that makes the companies profitable. A priori, it does not matter whether this production is achieved by industrial activities or by services. It is important, though, that production growth is sustainable. It is not if it goes hand in hand with the creation of imbalances that can disrupt the economy (such as unemployment, a balance of payments deficit or a budget deficit), or if it is at the expense of future generations (e.g. by over-exploiting the environment). It is an illusion to think that a stronger focus on industry will cause less of these imbalances. A particular question is whether densely built-up Flanders can continue to free up sufficient space to develop extensive industrial activities. Also, the argument that countries with strong deindustrialisation lack exports, which would then cause balance of payments problems, is not entirely valid. The difference between industrial products and services has become increasingly blurred in recent years. A result is that services have become more important in terms of exports as well. And, by the way, Belgium still scores well in terms of industrial exports, despite the declining importance of industry.

Technological switch

The declining importance of the manufacturing industry is especially visible in the nominal figures. In terms of volume produced, the share of industry in value added fell much less, with the decline mainly concentrated in more recent decades. The difference between nominal and real development indicates that industrial product prices rose much less than service prices on average. This, in turn, was due to increased international competition. Globalisation makes it increasingly difficult for Belgian companies to compete on price. A shift in the production structure to products that compete on quality still allows the country to exploit a comparative advantage, despite higher labour costs.

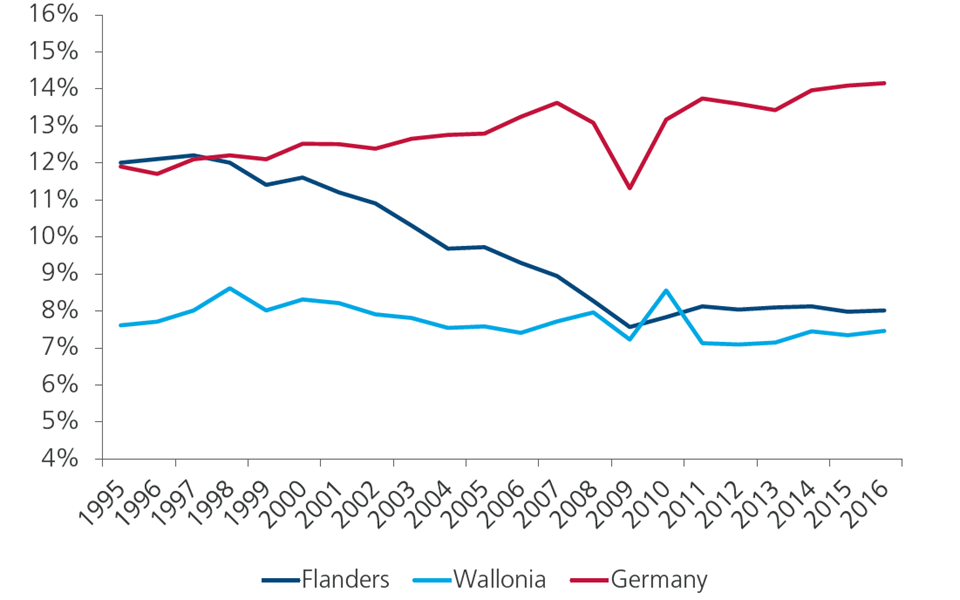

The future of Belgium’s industry therefore lies in niche sectors that make use of high technological and scientific knowledge. Belgium does not appear to score very well in this area, at least compared to Germany. Especially in Flanders, the share of medium- and high-tech industrial sectors in total added value of the economy has declined significantly since the mid-90s (figure 2). In Germany, this share rose slightly. Specialisation in technology-intensive sectors such as electrical engineering, machine engineering and vehicle construction partly explain the German success. This specialisation was accompanied by a prolonged effort in building strong trade relationships with emerging economies. We do have to nuance the figures in figure 2, though, as the classification of sectors by technology intensity cannot always be made flawless. For example, it does not reflect the sometimes strong innovation in Belgium in the more traditional sectors, such as textiles.

Figure 2 - Valued added in medium and high-tech industrial sectors (in % of total gross value added)

It is very important that investments in technological research find their way to the market in the form of an innovative product or production process. This necessary step is still too often hampered in Belgium by structural handicaps such as a lack of entrepreneurship, a high tax burden, an overly rigid labour market and an excess of administrative procedures and regulation. According to Eurostat, the OECD or the World Economic Forum, Belgium is often still dangling from the European tail for these aspects. Sustained moderation of labour costs also remains important, especially in order to be able to compete with neighbouring countries, which must implement the same focus on a qualitative competitive strategy in their industry. In the case of Germany, long-standing efforts on wage moderation and reforms aimed at a more flexible use of labour contribute to explaining the country’s relative industrial success.

The reversibility of deindustrialisation in Belgium remains questionable. Germany does show however that the trend can be reversed. But this requires a consistently maintained public policy aimed at supporting technological innovation, removing remaining structural handicaps and controlling labour costs.