Coronavirus strongly affects Belgian economy due to international chain reaction and weakening confidence

With the sharp rise in the number of infections in Europe, the coronavirus crisis has taken a new turn in recent days. A precise estimation of its economic impact remains very difficult due to the great uncertainty about the further spread of the virus. But now that the virus is beginning to have more and more visible effects on financial markets and the real economy, it is becoming clear that the economic impact will be much greater than initially estimated, as was also indicated by the OECD this week. The impact is no longer limited to a shock from the Chinese economy. Rather, it implies an international chain reaction due to the geographical spread of the virus. This hits the Belgian economy particularly hard because of its strong exposure to international risks combined with its already weak consumer confidence. That is why we have lowered our growth forecast for the Belgian economy from 1.0% to 0.8% for 2020. At the same time, we expect the coronavirus to have only a temporary impact in the first half of the year. Hence, we see Belgian economic growth recovering from the second half of the year and reaching 1.2% again in 2021.

The crisis caused by the coronavirus outbreak in China was initially seen mainly as a negative supply shock resulting from the disruption of global supply chains. Such a shock from China mainly affects industrial sectors that are strongly interlinked internationally. The coronavirus crisis is now also manifesting itself more and more as a negative demand shock. Now that the virus is spreading rapidly within Europe, it will undoubtedly have a major impact on consumer confidence and will therefore also affect consumption expenditure, which has been a major source of growth in recent years. The first effects of this (fewer international flights and cancellations of all kinds of events, among other things) are now visible.

Within the euro zone, the economic impact will be felt mainly in Italy and Germany. These are two economies that were already performing relatively weakly before the outbreak of the virus and, moreover, depend heavily on industry and are therefore sensitive to supply disruptions. In the case of Italy, the crisis hits the economically and touristically most important northern regions. We therefore expect the Italian economy to shrink by as much as 0.7% in 2020. In Germany, the virus will slow down the recovery of the still weak industrial sector. Moreover, it will weaken the consumption of goods and services, which has been the stronghold of the German economy until now. We now expect only 0.4% GDP growth in Germany in 2020, instead of the 0.7% expected in our previous scenario. For the other eurozone countries, the estimated impact is slightly smaller, but not negligible. For the eurozone as a whole, we have lowered our growth forecast for 2020 from 1.0% to 0.7%. In addition, we are convinced that monetary and fiscal policy will not be able to launch sufficient growth-supportive measures.

Consequences for Belgium

Belgium is vulnerable, both on the supply and the demand side. As a small open economy, the country obviously cannot escape the consequences of the coronavirus. The Belgian economy is highly integrated in global supply chains which are disrupted by the virus outbreak. More specifically, Belgium’s strong ties with Germany pose major risks in this respect.

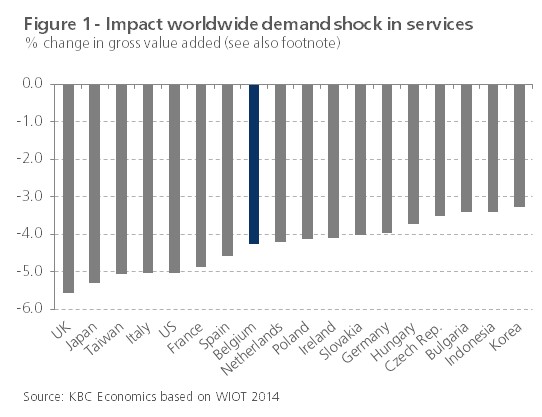

Moreover, Belgium has the second largest port in Europe and many international companies, including logistics groups, are active there. If economic activity slows down elsewhere, this will quickly seep through to the Belgian economy. KBC’s own simulations based on the World Input-Output Database (WIOT) show that Belgium is one of the European countries where a global demand shock for service activities, as it is currently occurring, has the heaviest impact (figure 1).1 Belgium’s main trading partners also appear to be very vulnerable, reinforcing the negative impact on the Belgian economy. Germany appears to be less vulnerable to a negative demand shock in services, but at the same time, the country is much more vulnerable to a decline in industrial activities. The latter also applies to Belgium, making our country doubly vulnerable. In concrete terms, we expect Belgian exports of goods and services to take a significant hit in the first half of the year.

At the same time, the outbreak of the virus will undoubtedly weigh on the sentiment of Belgians. In February, consumer confidence strengthened, but this survey took place at a time when the infections had not yet spread widely in Europe. Moreover, the level of Belgian consumer confidence has been rather low from a European perspective for some time now. The many ominous media reports are likely to lead to more cautious consumer behaviour. Especially places where usually a lot of people gather, such as shopping malls, restaurants or museums, will be shunned more. In addition to exports, consumption expenditure in the first and second quarters will therefore be less dynamic.

Serious but not dramatic

Quantifying precisely the impact of the virus outbreak on the Belgian economy remains difficult. After all, the final effect will strongly depend on the extent to which the virus will continue to spread. For the time being, consistent with our scenario for the euro zone, we assume that the impact will be serious, but not dramatic. Specifically, we anticipate a negative impact on growth in the first and second quarters: in both quarters real GDP growth will be no more than 0.1% quarter-on-quarter. As the virus outbreak should be a temporary shock, the impact will disappear from the summer onwards.

This brings our outlook for Belgian economic growth for the total year 2020 to 0.8%. That is 0.2 percentage points lower than what we thought until recently and also well below the growth forecasts of other forecasters. By way of comparison: the consensus forecast and the OECD’s latest forecast in its country report for Belgium are 1.1%. The most recent growth forecasts of the NBB and the Federal Planning Bureau are even higher, at 1.2% and 1.4% respectively. However, these were made at a time when the virus had not yet hit Europe (so hard). We anticipate possible adjustments in our colleagues’ forecasts.

1The shock in the figure is defined as a fall in global demand for services (in sectors H51, G45, G46, G47, L68, M73) by 20% and a fall in Chinese demand for the goods and services from other sectors by 10%.