Corona crisis pushes global economy into deep recession

The covid-19 virus is having an unprecedented social impact on the entire world, and health care is currently the absolute priority. At the same time, there is no doubt that the virus will have an enormous economic impact. Calculating the full economic impact of the virus is no easy task due to the complexity and constant changes in the spread of the virus and in the policy responses to address and mitigate the crisis. Any analysis therefore has a considerable degree of uncertainty. However, the message from all our macroeconomic analyses is unequivocal: we are in a global recession, even when taking into account significant fiscal and monetary stimulus.

Shock effect

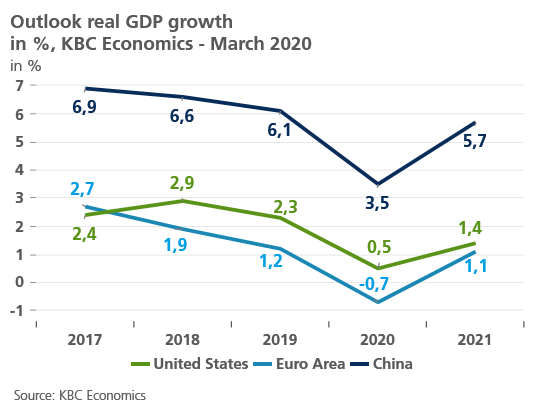

KBC Economics is therefore lowering its economic growth outlook for all countries. The corona crisis will cause a temporary but strong economic downturn during the course of 2020, with a gradual recovery already at the end of 2020 and in 2021 (see Figure). The long-term outlook for the global economy is maintained. To be exact, we expect real economic growth in 2020 to be -0.7% for the euro zone, +0.5% for the US and +3.5% for China. For 2021, we expect growth to be +1.1% in the Eurozone, +1.4% in the US and +5.7% in China.

Europe as a whole affected

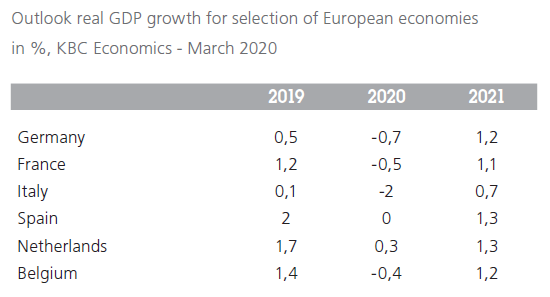

We expect a synchronised decline in economic growth in all European countries, assuming that the virus will continue to spread at a rapid pace everywhere. However, the extent of the downturn per country depends on a number of factors. We take into account the importance of tourism, the integration of countries in European and global production chains, the availability and quality of medical services and the available budgetary space to mitigate the economic impact. In addition, an economy’s recent growth rate before the corona crisis also plays a role. On this basis, we expect a deep recession in Italy (-2.0%) in 2020, but also negative growth in Germany (-0.7%) and France (-0.5%). The downturn in the large European economies will have a negative impact on the smaller European economies (see Table). The logistical challenges posed by the closure of borders and interruptions in transport channels also weigh on the growth prospects. Finally, we see that domestic consumption in all European countries is falling drastically, on the one hand due to quarantine measures and on the other hand due to a drop in consumer confidence. As such, the corona crisis is affecting both the supply and the demand side of the economy.

The corona crisis will also cause some deflationary effects, but the price war on oil markets between Saudi Arabia and Russia will have a greater downward impact on inflation expectations in the euro zone (0.9% in 2020 and 1.2% in 2021). For Europe, the lower oil price mitigates the economic damage caused by the corona crisis. Lower inflation is likely to push the normalisation of monetary policy in the eurozone further into the future. In general, we expect central banks to provide substantial support to contain the recession. Further interest rate cuts by the ECB make little sense at this time, but the measures announced in terms of liquidity provision and additional quantitative easing are crucial.

Highlights and challenges

In spite of the negative message, we also see some positives. The strong and rapid policy responses of central banks and many governments show that lessons have been learned from previous crisis periods. As a result, the recovery will be able to start quickly and decisively. Because of this, we expect a further escalation can be avoided.

Nevertheless, this corona crisis will leave traces. The great willingness in recent years to finance risk cheaply is likely to diminish. In the future, companies and governments will likely have to pay a more realistic risk premium on their debts, which has not been the case in recent years due to unconventional monetary policy. At the same time, many policy initiatives will cause public finances to deteriorate. This will limit the policy room for manoeuvre in the future. Today’s policy challenges to mitigate the effects of the corona crisis are therefore only the start of major policy challenges in the coming years.