Belgian real estate sector not immune to corona but there are bright spots

Covid-19 has hit the Belgian real estate sector unusually hard in

recent months. The blow was all the more severe because construction

and real estate activities have performed very well in recent years.

The shock was initially related to supply problems, in particular

temporary closures, staff shortages, social distancing and supply

chain problems. For households, covid-19 has also caused an income

shock, rising unemployment and increased uncertainty. Therefore,

weaker demand for real estate will gradually take over from previous

physical supply constraints as a factor limiting activity in the

real estate sector. Nevertheless, we should not be too negative for

the sector. Indeed, there are also bright spots, including the still

very low interest rates, the expected catch-up demand for smaller

construction works and the resumption of government investment in

public infrastructure.

The Belgian real estate sector has been in very good shape over the past two decades. This was reflected both in ‘construction’ (NACE Section F) and in ‘real estate activities’ (NACE Section L). In addition to house building, the first subsector includes commercial construction (e.g. industrial and office building) and civil construction (e.g. roads and bridges). The second comprises a broad range of real estate services, including the sale, rental and management of real estate. Over the period 2000-2018, real annual growth in the two real estate sectors averaged 2.5% and 2.8% respectively. That is more than the average 1.7% growth for the entire economy during that period. In recent years, the relatively strong growth of both real estate sectors has continued.

Severe hit

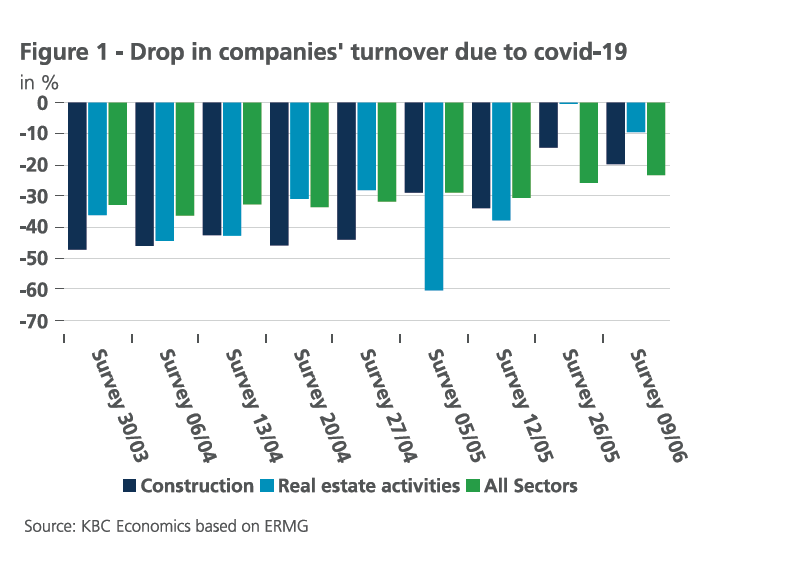

Covid-19 has also disrupted the operation of companies in the real estate sector on an unprecedented scale. From the successive surveys conducted by the Economic Risk Management Group (ERMG), it follows that the loss in companies’ turnover in both the construction sector and real estate activities has been large in the first phase of the pandemic in comparison to the total economy (figure 1). A substantial part of real estate activities was hit directly, as they were cancelled or suspended due to the closures imposed by the government. For example, real estate offices as non-essential companies had to keep their doors closed. Since mid-May, companies in the sector are entitled to resume their activities.

Construction companies did not belong to the sectors where closure was mandatory. Nevertheless, almost half of them choose to shut down their activities completely at the peak of the crisis, the main reason being difficulties in applying social distancing rules. Supply problems have been particularly acute in construction. At the end of April, when the health crisis was at its peak, 45% of construction companies surveyed by the ERMG reported social distancing as a reason for the decline in revenue, by far the highest figure among all economic sectors. Staff shortages and supply chain problems were also seen as a large problem compared to most other sectors. Conversely, the share of construction companies that mentioned a lack of demand as a reason for the revenue decline was among the lowest among all sectors in the economy.

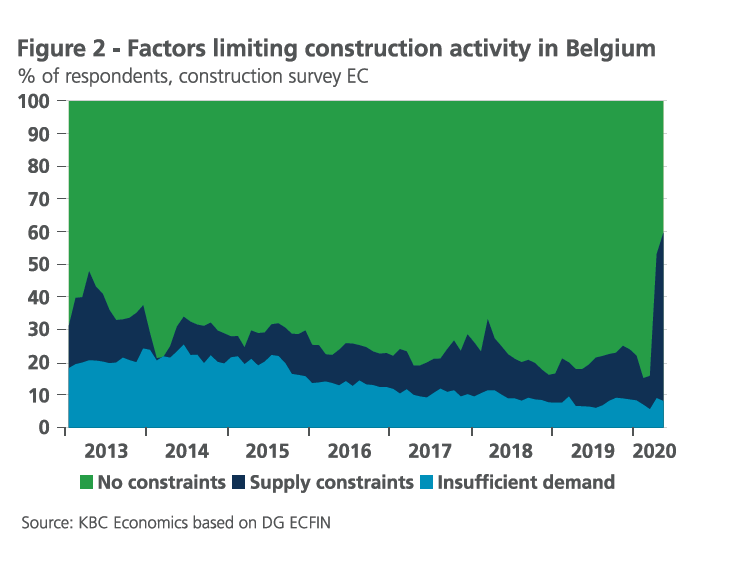

The question on the reasons for the revenue decline was no longer included in more recent ERMG surveys. A similar survey conducted by the European Commission shows that supply constraints in construction were still important in May, however (figure 2). 52% of the respondents indicated that they were confronted with this. The share of respondents in the EC survey indicating insufficient demand as a barrier to activity has increased slightly in recent months but remained rather low at 8% in May.

From supply problems to weak demand

In recent weeks, companies in the real estate sector pointed to a marked recovery in their turnover thanks to deconfinement measures put in place. Construction and real estate activities have exceeded the national average for the first time in the 26 May ERMG survey (figure 1). They now feature among the sectors least affected by covid-19 over the last couple of weeks (if the build-up of past losses is disregarded). Nevertheless, the situation deteriorated again in the most recent survey (9 June), in contrast to that for the total economy.

In our opinion, insufficient demand will gradually start to take over from physical constraints as a factor limiting activity in the real estate sector. The hit on household income, the higher unemployment rate and the increased level of uncertainty will indeed weigh on households’ ability and willingness to build, renovate or buy a house. Residential investment and sales activity on the secondary housing market will likely suffer from the weaker demand. The NBB business indicator already pointed at a strong deterioration of demand expectations and order book appraisals in the building industry.

Bright spots

In our baseline scenario, we expect that developments in the real estate sector in 2020 will be accompanied by a contraction in household investment in residential buildings (-7.7%) and a correction in house prices (-3.0%). However, we should not be too negative for the sector. After all, there are also bright spots. Interest rates remain very low, which still supports the affordability of real estate. Moreover, in the coming months there will probably be a catch-up demand from households for smaller construction works that could not be done in the past months (e.g. installation of a new kitchen). Furthermore, the resumption of government investment in public infrastructure (e.g. roads) will also support the construction sector in the coming period. For certain sub-activities, therefore, recovery can already be faster and more robust. Finally, we see covid-19 in the base scenario as a temporary shock. As soon as the uncertainty surrounding the virus has sufficiently subsided, real estate activity as a whole will certainly return to stronger growth.