Belgian local authorities face major financial challenges

Belgians go to the polls on Sunday 14 October to decide who will run the municipalities and provinces for the next six years. Local authority finances have been brought under control in recent years, following a prolonged period of hefty budget deficits. While undoubtedly a good thing, the improvement nevertheless disguises several major budget challenges facing local councils. These relate to the ageing population and to other social and ecological trends. It is important that local authorities can continue to invest sufficiently, which will require efforts in the decade ahead to further raise the efficiency of their operations.

Healthy finances restored...

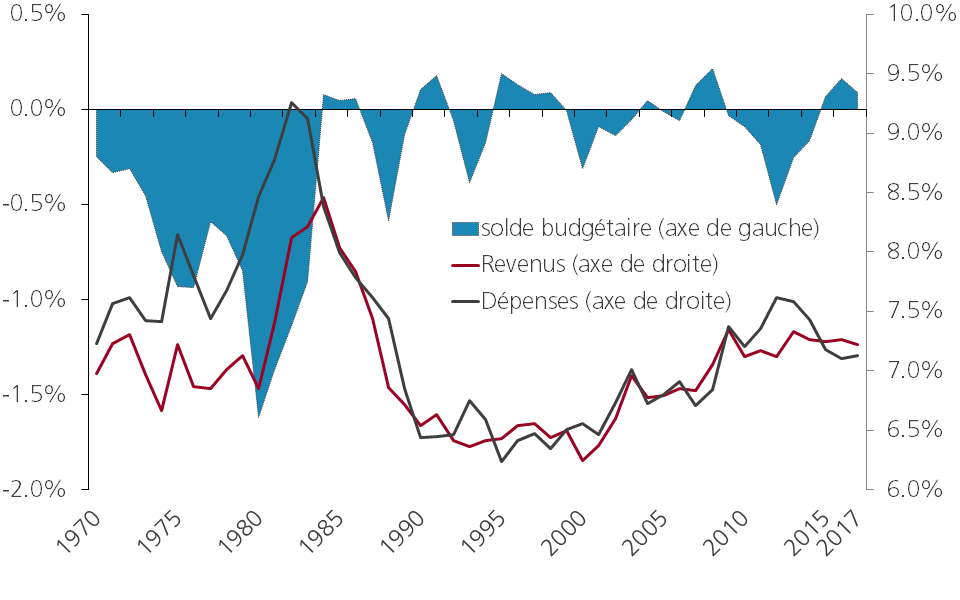

The budgetary status of Belgian local government (10 provinces and 589 municipalities and Public Social Welfare Centres) has moved back into surplus since 2015, after six years of deficit sparked by the financial and economic crisis (see figure). The crisis chiefly affected local authorities through reduced supplementary income tax receipts – their primary revenue source – and increased demand for welfare spending. Local authorities also lost substantial amounts in dividends following the collapse of the municipal holding company (Holding Communal) in the wake of the Dexia case and the liberalisation of the energy market. Budget deficits in 2009–14 also reflected a substantial increase in staffing levels at local authorities.

Figure 1 - The budgetary status of local authorities in Belgium (in % of Belgian GDP)

The situation was turned around in 2016 to a budget surplus of 0.16% of GDP, declining to 0.09% of GDP or around 0.4 billion euros in 2017. The recent improvement was partly attributable to the more favourable economic climate, which caused revenues to rise again. A more significant contributor to the improved financial situation, however, was the sharp reduction in spending (see figure), facilitated by the principle that municipalities have to submit balanced budgets – a strict framework introduced in 1982 to put an end to the substantial deficits at that time. In concrete terms, local authorities got a better grip on their staffing levels while becoming more modest in their investment plans. In the run-up to the previous municipal and provincial elections in 2010–12, at the height of the crisis, annual local authority investment was still averaging 0.87% of GDP. By 2016–17, the average was just 0.67%.

...but substantial challeges

The relative health of local government finances disguises several major financial challenges. First of all, local councils must have sufficient scope for additional investments in the future. These traditionally account for roughly a third of all government investment in Belgium, but are relatively low at present. Local authorities play a leading role when it comes to sustainable and social development through their waste management operations, enhanced road safety, flood prevention, the quality of the living environment, affordable housing and so forth. The increasing importance of all these factors requires investment in areas such as new cycle paths, the relaying of town centre roads and squares, sustainable public buildings, more integrated public transport and the building of social housing. Calls by Europe to purify waste water by 2027 will also require specific and substantial local investment.

Secondly, a broad range of services provided by local authorities places them in the front line when it comes to dealing with the consequences of demographic ageing. They will have to expand their public service offering to meet the specific needs of a larger group of elderly people in areas like housing, social services and care, along with modified formulas for mobility, public spaces and leisure opportunities. Local authorities also have to contend with pension issues as they are obliged to fund pensions themselves for their statutory civil servants. Demographic ageing might also have negative repercussions for the tax base from which municipal taxes are drawn. In addition to an ageing population, local governments’ tax base will also be affected by the ‘tax shift’, which is intended to lower the costs levied on labour.

Efficiency gains as an answer

It is essential that local authorities function efficiently if they are to meet the financial challenges facing them. Various recent studies by the likes of the OECD, the SBOV (Flemish Policy Research Centre) and the National Bank of Belgium show that scope for efficiency gains definitely remains at local government level, with reform of the provinces and mergers between municipalities among the most frequently cited options. More effective use of digital applications and procedural simplification are other possibilities that are often raised.

Local authorities have already taken steps in the right direction in recent years, but for the time being, these are still too modest. A great deal is expected in Flanders from the new ‘Local Government Decree’ of December 2017, which in addition to the simplification, deregulation and digitisation of local administration, aims to intensify collaboration between municipalities and Public Social Welfare Centres on the one hand and different municipalities on the other. There is a thicket of non-transparent collaborative arrangements at present, which have grown up on an ad hoc basis to the detriment of ‘joined-up administration’. More thought must also be given in this regard to the adoption of best practices. Considerable differences often remain between comparable municipalities (i.e. taking account of scale and function) in terms of staffing and operating costs per resident.

There is also scope, lastly, for local authority savings, through the scaling back of personnel, for instance. Local authority staffing levels and the number of local office-holders (‘political personnel’) are both fairly high in Belgium (about 430 per 100 000 inhabitants, compared to fewer than 100 per 100 000 inhabitants in the Netherlands). Personnel reductions will arise not only through the aforementioned efficiency gains, but can also be achieved by no longer ‘trying to do everything yourselves’. Local authorities can outsource more functions, such as waste processing or child care, to the private sector or else collaborate with it more widely. In addition to savings, local authorities can take advantage of revenue-generating opportunities. Municipalities control a substantial proportion of the waste sector, for instance, while domestic waste is increasingly viewed as a raw material that could be put to better use through so-called ‘urban mining’.

Voters will decide the election results on Sunday. Whoever ends up running the municipalities and provinces for the next six years, the financial and social challenges they will face are by no means small ones.