Belgian economy no longer a harbinger of EMU’s business cycle

There have been signs for some time that the European economy is slowing down. In the past, it was often stated that the Belgian economy is ahead of that of the euro area. This was ascribed to the prominence of semi-finished goods in Belgian production, which undergo further stages of production elsewhere in Europe to be processed as final goods. The business cycle indicator of the National Bank of Belgium (NBB) could then serve as a measure to monitor the slowdown in European growth. Until the early 2000s, the NBB indicator indeed acted as an early signal for cyclical changes in the EMU economy. However, for the past fifteen years, this has no longer been the case, but rather the opposite. One possible explanation is the reduced relative importance of intermediate goods vis-à-vis final consumer goods in Belgian exports.

The business cycle indicator is one of the best-known statistics published monthly by the NBB. The indicator is based on a monthly survey of Belgian businesses with respect to the current and expected state of the economy. The questions relate to several themes (production, order positions, stocks of products, employment outlook, etc.) and cover various sectors (manufacturing industry, business-related services, construction and trade). Besides the detailed results of the survey, there is also a synthetic indicator that incorporates all the information into a single number. This then reflects the general level of business confidence.

In 1999, the Wall Street Journal published an article on the fact that the synthetic NBB indicator is a good predictor of economic development throughout the euro area1. Since then, the importance of the indicator has transcended national boundaries and is regularly taken into account by analysts when assessing the economic environment for the whole of the EMU. The fact that the business cycle curve of the Belgian economy could be a forerunner to that of the euro area would be due to the specific structure of Belgian industry, which has a relatively large focus on semi-finished products. These are intermediate goods produced in Belgium that are then usually used elsewhere in Europe in further stages of the production process to arrive at final goods. A turnaround in economic activity would then be felt first in the early stages of the production chain and should therefore be visible relatively more quickly in the Belgian business cycle curve.

A working paper published by the NBB in November 2000 showed that over the 1993-2000 period, the turning points in the manufacturing industry in Belgium were, on average, three months earlier than in the euro area. Before 1993, the leading character had been either weak or not present at all.2 A Federal Planning Bureau’s survey from 2002 confirmed the finding that the NBB indicator (in particular, that of the manufacturing industry) was, on average, some three months ahead of the real GDP cycle in the EMU in the 1990-2001 period.3 Unfortunately, there has since been no further research into the leading character of the NBB indicator for more recent years.

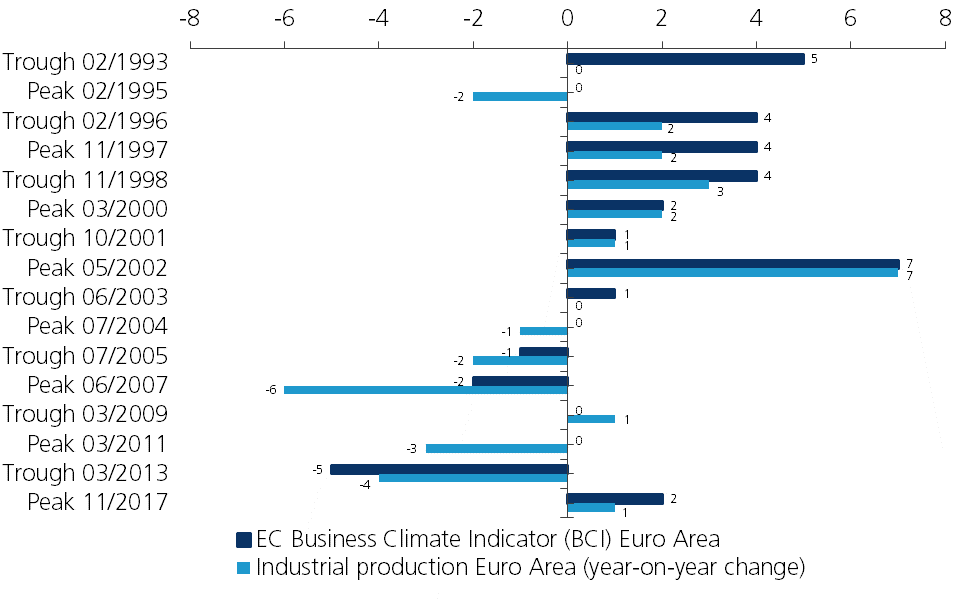

In Figure 1, we test the leading character of the NBB indicator for the euro-area economy by comparing its business cycle turning points at the peaks and troughs with those of the European Commission’s Business Climate Indicator (BCI) for the euro area. Both synthetic indicators are based on surveys where manufacturing companies are asked their opinion on the current and expected situation of the economy. Figure 1 also compares the NBB indicator’s turning points with those of the annual change in industrial production in the euro area. The months on the vertical axis are the (major) cyclical turning points (peaks and troughs) of the NBB indicator (sub-component relating to the manufacturing industry). The horizontal axis shows how many months the NBB indicator’s turning points are leading (+) or lagging (-) those of the BCI indicator and industrial production in the euro area.

Figure 1 - Leading character of the NBB indicator (number of months in which turning points are ahead or behind, manufacturing industry)

Indicator no longer gives early signal

Figure 1 confirms that the turning points of the Belgian economy were significantly ahead of those of the euro area until the recession of the early 2000s. On average, the lead in the 1993-2003 period was more than three months vis-à-vis the BCI indicator and almost two months vis-à-vis industrial production in the EMU. Moreover, the difference between the two implies that the BCI indicator itself was not a good leading indicator of effective industrial activity in the euro area during that period. After 2003, however, it appears that the postulate regarding the NBB indicator’s leading character no longer applied. In 2004-2017, the indicator was, on average, about one month behind the BCI indicator at the turning points and two months behind euro-area industrial production. However, the findings are not completely unambiguous: the NBB indicator again took a slim lead at the latest turning point.

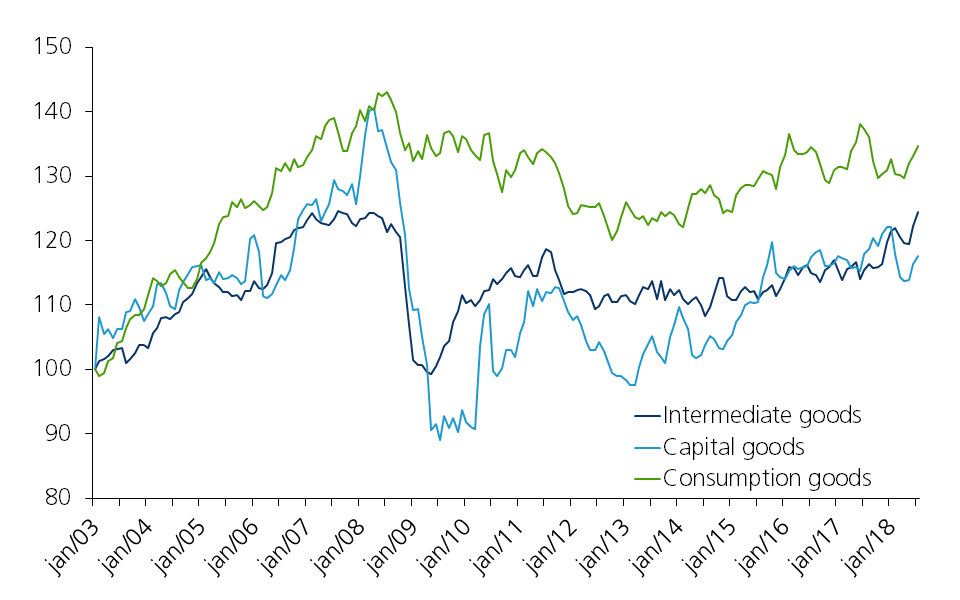

The fact that the NBB indicator no longer gives a clear early signal for cyclical changes in the EMU may be explained by the declining relative importance of the intermediate goods industry in Belgium. Figures for the various industrial sectors in Belgium show that real production and export growth of consumer goods has gained relative importance, to the detriment of intermediate goods and capital goods (Figure 2). Another possible explanation is that Belgium is less and less able to benefit from the dynamics of international trade. Germany, the European industry’s locomotive, has been better than Belgium at keeping up with trends in world trade volume in recent years.

Figure 2 - Belgian exports to the euro area by product category (volume, January 2003 = 100)

1 Wall Street journal (1999), “Euroland discovers a surprise indicator: Belgian confidence”.

2 National Bank of Belgium, “The Belgian industrial confidence indicator: leading indicator of economic activity in the Euro area ?”, Working Paper No. 12, November 2000.

3 Federal Planning Bureau, “The Belgian business cycle as a leading indicator for the euro area”, Euren Spring Report blz. 65-70, June 2002.