Asymmetric shocks would trigger a triple dip crisis in Europe

European growth is currently disappointing amidst global doom and gloom. Still, a recovery in the European economy is expected, despite a number of risk factors with a high probability and high impact, notably Brexit and the trade war. These risks, if they materialize, are likely to cause an asymmetric shock to the European economies triggering the third dip in the past decade. However, despite their disruptive nature, they are unlikely to fundamentally derail the European economy from its long-term growth path.

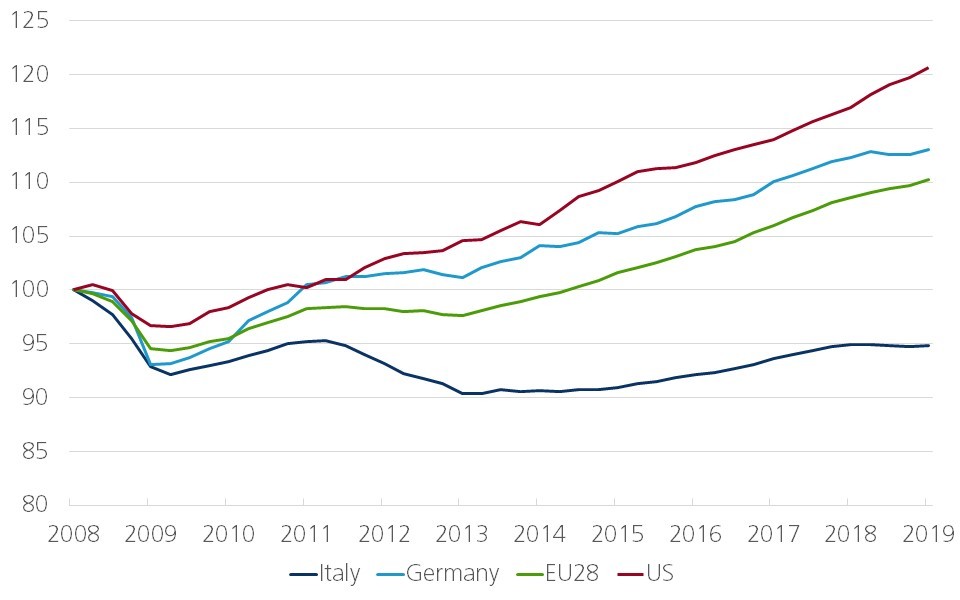

Economic sentiment remains weak throughout the global economy, with a clear deterioration in sentiment in the US recently due to increasing concerns about the trade war escalation and weaker job creation. European business sentiment, in particular in the manufacturing sector, is not yet convincingly bottoming out. At best it is stabilizing, which is already good news in the light of the more gloomy economic outlook for the US and Chinese economies. There is growing consensus among international institutions and economic forecasters that the European economy will gradually recover from its current temporary slowdown. After all, the European business cycle has not been so impressive during the past decade. In particular compared to the US economy, the EU economy experienced only a very limited growth upheaval in the decade after the global financial crisis (see Figure 1).

Figure 1 - Real GDP growth (index Q1 2008 = 100)

One of the reasons why the EU economy is lagging behind in an international comparison is the double dip crisis the EU experienced during the previous decade. The global financial crisis was followed by a European debt crisis which caused a second hit to the European economy in the space of just a couple of years. Obviously, not all EU member states were hit, and those that were, were not affected to the same extent during these two crisis moments. It is, however, clear that recovering from two crises in a row is much harder than recovering from just one. Moreover, economic recovery in Europe was hampered in the short run by limited fiscal stimulus, partly due to a strong focus on austerity. Though the latter may be economically beneficial in the longer run, it undoubtedly limited the scope for fast recovery in Europe.

The current slowdown in the European economy is completely different from the two business cycle dips. It is the result of particular economic developments in some EU countries, notably Germany and Italy. The German slowdown has so far been mainly related to domestic industrial issues, in particular in the automotive and chemical industries, as well as to slower consumption growth. The Italian growth slowdown is much more structural as it was triggered by weaker international competitiveness and a lack of trust in the domestic economy, and the failure to implement the correct policy responses to those issues.

Some may wish to call the current slowdown a triple dip. However, both the extent of the slowdown and its country-specific nature make it hard to do so. In order to speak about a substantial drop in the European business cycle, one needs a more European-wide phenomenon. The financial crisis and debt crisis did not affect all EU member states, but a substantial number of them were involved. In order to have a triple dip crisis in the EU, we need a shock that has a wider geographic spread, but not necessarily a symmetric shock hitting the entire EU economy in the same way. Asymmetric shocks tend to have more distorting effects on the EU as we lack the necessary policy instruments to offset them. Such asymmetric shocks are typically aggravated by the unfinished European institutional framework. They are particularly painful within the euro area because euro area countries lack the exchange rate instrument, or alternatively the policy tools like international fiscal solidarity or factor mobility, to compensate for them.

Screening the world for potential asymmetric shocks that could hurt Europe in the near future, two obvious candidates stand out: a no-deal, hard Brexit and a direct trade confrontation between the EU and the US. Both issues have recently been prominently high on any risk agenda. The probability that one or both risk factors materialize has increased substantially. Moreover, the moment of truth is approaching, although ultimately the timing is hard to predict. The domestic political context in the UK makes a softer Brexit more difficult than ever. As the UK leaving the EU without a deal is the default option on October 31, the timing of this potential shock is coming close. On the trade front, President Trump has threatened on various occasions to increase tariffs on European products, from German cars to French wine. A decision on US import tariffs on European cars is expected within the following months, as the US president has a detailed evaluation report from the US Department of Commerce at his disposal. There is no doubt that the information contained in this report can be used to justify higher US tariffs on EU cars, at least if there is a political/presidential willingness to do so. It is equally certain that the EU will retaliate with higher tariffs on US imports, probably triggering a new round of trade measures by the US, and so on.

Both a hard Brexit and a US-EU trade war would be asymmetric shocks to the EU economy. Not all countries will be affected in the same way and to the same extent. From various analyses we know that small open economies in Europe will be much harder hit by Brexit than larger countries like France, Italy or Spain. Similarly, US tariffs on European cars will mainly affect the main car and car parts manufacturing economies in Europe, while a further escalation in the US-EU trade war could go in many directions. Hence the risk that we’re heading for a substantial and asymmetric shock to the EU economy is high. If it happens, it will cause a severe and immediate hit to the European economy, resulting in a triple dip since 2008.

A triple dip would, however, not imply the end of the current European business cycle. The European economy is still in a stage of long-term recovery without reaching full capacity. Hence another severe drop in economic activity might be followed by another recovery, similar to what we have observed after the previous two dips. After all, business investment keeps on growing and consumption growth is providing sustainable support to economic growth. Undoubtedly, both would be negatively affected by the shock, but are also likely to recover as the main uncertainty factors, that have the European economy hostage at this moment, will have disappeared.

Hence the risks for the European economy are extremely high at this moment. We’re actually living in a binary world: either the European economy will be severely hit, or the European economy will flourish after Brexit is orderly handled by a deal between the UK and the EU, while a US-EU bilateral trade deal will boost transatlantic trade. Let’s hope for the latter, but watch out for the former.