Economics Perspectives September 2018

US economy boosted by fiscal stimulus

Euro area growth above potential…

… but core inflation remains subdued

Slower German bond yield normalisation

Italian risk without contagion so far…

...but general risk premia on upward trend

Emerging market turmoil there to stay

Read the publication below or click here to open the PDF

- The global economy continued its strong performance. However, growth became geographically less synchronized, while turbulence hit several emerging markets. Moreover, several risk factor disturb the overall optimistic picture.

- In particular the US economy remains in good shape. Net job creation increased further to 204000 in August and the unemployment rate remained at 3.9%, well below the level that the Fed considers to be sustainable in the longer term (4.5%). In line with this, average earnings growth accelerated to 2.9% year-on year. The Fed will likely continue its current rate hiking cycle until it reaches a within the range of 3.25%-3.50% at the end of 2019. This level will be higher than the 2.9% that the Fed currently considers to be its longer-term neutral policy rate.

- Our near-term growth scenario for the euro area remains relatively favourable too, though less buoyant. In both the US and euro area economies, economic growth is currently well above its potential rate, and will gradually slow towards that potential rate. Real GDP growth in Central Europa is expected to remain markedly higher than for the euro area as a whole. This implies that the converging trend of the region has again shifted into a higher gear.

- At 2% in August, euro area headline inflation in the euro appears fully aligned with the ECB medium term target. However, underlying core inflation still only amounts to 1.0%. The large difference between both inflation measures is predominantly due to year-on-year changes in energy prices (+9.2% in August).

- The ECB confirmed its earlier forward guidance and reduced the amount of its net monthly asset purchases to 15 billion EUR, with the intention to end it at the end of 2018. Current policy rates are expected to remain unchanged until at least ‘through the Summer of 2019’.

- German bond yields will probably normalise more gradually than we have expected so far. Excess liquidity remains present, political and economic risks create ‘safe haven’ effects and persistent German budget surpluses are keeping a lid on bond yields.

- A major political risk affecting the European economy remains Brexit. Our scenario is a ‘softish but not smooth’ outcome. This involves a sufficiently vaguely-worded exit agreement, after which the future trade relationship between both economies can then be worked out. Other major sources of uncertainty for the economy are the upcoming Italian budget, financial market volatility, rising protectionism and vulnerabilities in Emerging markets.

- Focus article - Emerging market vulnerabilities and weaknesses

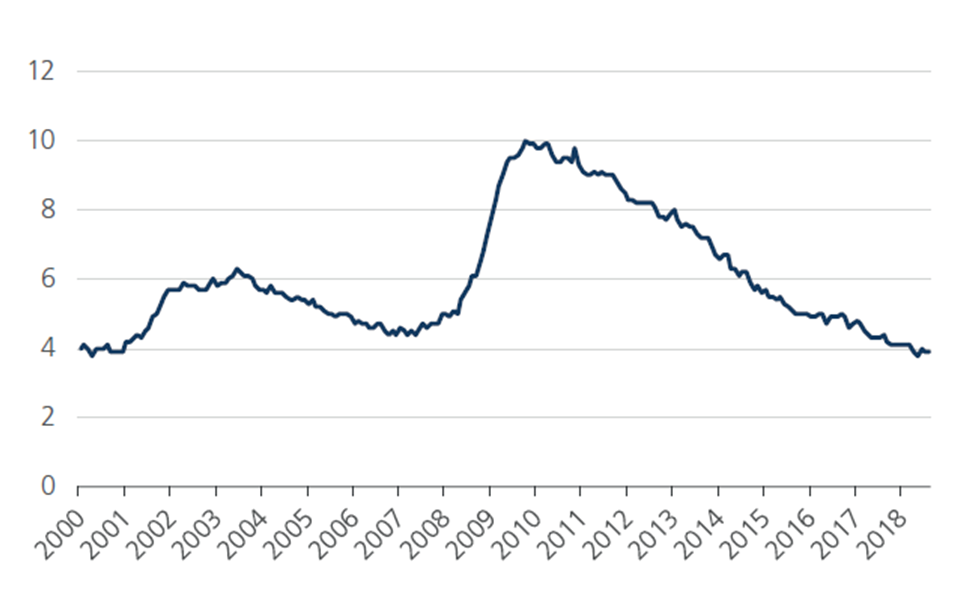

The US economy remains in good shape. Confidence indicators in the manufacturing sector in particular improved and resumed their upward trend. The booming momentum was also reflected by the sustained strength of the labour market performance in August. Although the job market is already tight, net job creation increased further to 204,000 from 170,000 in July. As a result, the unemployment rate remained unchanged at 3.9%, well below the level that the Fed considers to be sustainable in the longer term (4.5%). Excluding the May 2018 figure (3.8%), the unemployment rate is at its lowest level since December 2000 (Figure 1). The combination of these strong data and the ongoing impulse stemming from expansionary fiscal policy led us to revise upward our US growth forecast for 2019 to 2.5%.

Figure 1 - US unemployment rate well below pre-crisis level (in % of labour force)

In line with the booming labour market, average earnings growth accelerated to 2.9% year-on year compared to 2.7% in July. This suggests that the much-debated empirical relationship between labour market tightness and wage growth remains intact. Higher wage growth and unit labour costs should further support headline inflation. Together with somewhat higher oil prices and the typical late-cyclical inflation uptick, our US inflation forecast for 2019 is now somewhat higher (2.6%) compared to last month.

Against this background of strong growth momentum and some pointers towards building inflationary pressure, we expect the Fed to take a more aggressive policy stance, notwithstanding recent criticism by President Trump. In our view, the Fed will likely continue its current rate hiking cycle until the policy rate reaches a peak within the range of 3.25%-3.50% at the end of 2019. This level will be higher than the 2.9% that the Fed currently considers to be its longer-term neutral policy rate. Although this more hawkish Fed policy will push US 10y bond yields slightly higher as well, the US yield curve will nevertheless become flat by the end of 2019. This is consistent with our view that the US economy is in a late-cyclical state.

For both the US and the euro area economy, we expect a gradually slowing trend in economic growth to become established in the years ahead. However, in the US, this is temporarily offset by an expansionary fiscal policy boost, supporting growth in 2018. In the euro area, on the other hand, there is no such temporary policy boost. As a result, we currently observe a somewhat diverging growth dynamic between the two economies. This was for example reflected in the much stronger US growth momentum in the second quarter of 2018 (1.0% quarter-on quarter not annualised in the US, compared to only 0.4% in the euro area).

Apart from the diverging fiscal policy stance, reasons for this comparatively weak European growth also include increasing labour shortages in some areas, uncertainty about Brexit, increased trade tensions and the sensitivity to the Emerging Market turmoil, which is decreasing foreign demand. On top of direct trade channels, these uncertainties also indirectly weigh on sentiment and investment decisions and hence on economic growth. In his press statement on 13 September, ECB President Draghi also explicitly mentioned financial market volatility as an increasingly prominent risk factor.

Nevertheless, despite being cautious about some risks facing the Euro area, our growth outlook for the next couple of years is reasonably positive. For both the US and euro area economies, economic growth is currently well above its potential rate, which is estimated at about 2.1% for the US and 1.5% for the euro area by the Fed and the European Commission respectively. This assessment is supported by the rapid and substantial fall of the unemployment rate in both economies. Moreover, real GDP growth in Central Europe is expected to remain markedly higher than for the euro area as whole. This implies that the converging trend of the region has again shifted into a higher gear.

After a minor drop in August to 2.0%, headline inflation in the euro area appears broadly aligned with the ECB’s medium-term target. However, underlying core inflation declined marginally and now stands at only 1.0%, well below the ECB’s target of ‘below but close to 2%’. The large difference between both inflation measures is predominantly due to large year-on-year changes in energy prices (+9.2% in August). Inflation in the service sector remained subdued at only 1.3%, while prices of non-energy industrial goods went up by only 0.3% compared to the same month a year ago.

We expect energy prices to remain somewhat elevated in the near future. Compared to last month’s forecast, oil prices are now expected to remain at a slightly higher level, ending 2018 at about 75 USD per barrel of Brent. This is mainly due to a stronger-than-expected impact of supply-side factors such as US sanctions on Iran and a supply shortfall from Venezuela. Moreover, oil prices have been volatile in recent weeks, reaching a temporary bottom of 70 USD/barrel in mid-August before rising again to its current level of about 80 USD per barrel of Brent (Figure 2). This level and volatility has in part been caused by elevated global political and economic uncertainty. Since we expect that the energy component will remain an important driving force of headline inflation in the near term, we also raised our 2019 inflation forecast for the euro area.

Figure 2 - Volatile oil price on the rise again (USD per barrel of Brent)

On 13 September, the ECB confirmed its earlier forward guidance and, as it had signalled in June, reduced the amount of its net monthly asset purchases to 15 billion EUR from 30 billion EUR previously. It also reiterated its forward guidance that, unless economic conditions deteriorate, the Asset Purchase Programme will be ended by the end of 2018. Current policy rates are expected to remain unchanged until at least ‘through the Summer of 2019’, and in any case as long as it is necessary. In other words, the ECB’s policy stance is set to remain highly accommodative and we continue to expect only one policy rate hike in 2019.

Two things will likely happen as a result. First, the policy divergence between the ECB and the Fed will in the coming months be supportive of the US Dollar exchange rate. In the coming months, we therefore expect the Euro to weaken towards a lower level at the end of 2018 (1.15 USD per EUR) than anticipated last month. In the second half of 2019, the relative dynamics of monetary policies will likely change, starting off a gradual appreciating trend of the Euro against the Dollar.

Second, the accommodative ECB policy will likely cause the German bond yields to normalise more gradually than we previously expected. German 10 year government bonds are now expected to yield 0.60% at the end of 2018. This seems strangely out of line with macro-economic fundamentals of the euro area such as expected growth and core inflation. However, there are some powerful factors at play that may continue to contain German bond yields, which serve as a benchmark for the euro area as a whole. Even after the expected end of the ECB’s Asset Purchase Programme this year, excess liquidity will remain substantial and continue to exert downward pressure on yields. Moreover, the high level of political and economic risk will create ‘safe haven’ effects and direct capital flows towards perceived risk free assets such as German Bunds. Risks both inside and outside Europe play a role. Within Europe the Brexit negotiations are supposed to lead to an agreement by the end of 2018 which may not proceed in a smooth way. Also the political situation in Italy remains a risk factor. At a global level, continuing trade conflicts and emerging market turmoil make investors look for safer alternatives.

On a more general note, a scarcity of German Bunds is likely playing a major role. Otherwise, it would be difficult to explain the relatively stronger impact of flight to quality capital flows on German Bunds than on US Treasuries, which have a longer and well-tested history as a safe haven. In the European context, demand for risk free assets is not only boosted by financial regulation, but at the same time the supply of these risk free German Bunds is restricted by persistent German budget surpluses. According to the latest forecasts of the European Commission, the German general government surplus in 2018 will amount to 1.2% of GDP and is expected to further rise to 1.4% of GDP in 2019. An unbroken sequence of budget surpluses since 2014 implies an absolute fall in gross public debt and hence a decrease in the supply of Bunds.

Meanwhile, the yield spread of other euro area sovereigns versus Germany has remained broadly stable in recent weeks, with the notable exception of the Italian spread. Market fears that the new Italian government may propose a draft budget law in October that would not be compatible with EU stability rules, sharply increased Italian spreads to 290 basis points at the end of August. ECB president Draghi specifically referred to the economic damage that may have been caused by this policy uncertainty. However, after some reassuring comments, the spread again sharply fell to below 240 basis points (Figure 3). According to Italian press reports, Italian Minister of Finance and Economy Tria had threatened to resign if the financial implications of the government programme would lead to an unsustainable government budget for 2019.

Figure 3 - Italian spread sensitive to fiscal uncertainty (10y government bond yield spread to Germany, in basis points)

The absence of contagion to the spread of other vulnerable euro area member states sends the reassuring message that markets are considering the matter as a contained Italian issue, with limited risk for the euro area as a whole. Based on past experience, that market assessment may, however, quickly change again once the actual budget law is presented in October.

Despite the relative calm with respect to general intra-EMU sovereign spreads, credit spreads in general have been rising recently and will likely continue to do so. This is for example the case for the risk premia on European corporate bonds and for insurance premia (CDSs) on bonds issued by investment grade quality European and US corporates. In principle, this tentative normalisation of risk premia is a healthy evolution. Together with other institutions, the Bank for International Settlements has warned for many years that many risk premia are artificially compressed by the abundant liquidity provision by central banks and no longer accurately reflect the true credit risk. As such, an orderly upward correction of risk premia should promote longer term financial stability. It should therefore be welcomed. At the same time, however, the increasing risk premia also reflect the actual presence of real risks in the global economy, ranging from trade conflicts, emerging market turmoil to geopolitical events. For this reason, they should remain closely monitored.

A major political risk affecting the European economy remains Brexit. As time passes by without substantive progress on a few notable sticking points, the risk of a Brexit without an exit deal increases, although this is not our base scenario. Our expectation remains that there will be an exit agreement with a sufficiently vague wording that both the UK and the EU can live with. During the following transition period between the Brexit date and the end of 2020, the future trade relationship between both economies can then be worked out.

As ECB President Draghi mentioned during his latest press conference on 13 September, the main sources of uncertainty for the economy are, apart from financial market volatility, the rise of protectionism and vulnerabilities in emerging markets.

Trade conflicts have indeed become an inherent feature of the global economy of late. The US-China trade war escalated further with new US tariffs on Chinese imports and Chinese retaliation measures in response. Another recent development was the provisional bilateral agreement between the US and Mexico as part of the overall renegotiation of NAFTA. This bilateral agreement essentially requires a higher share of local content of Mexican exports to the US. Moreover, a higher share of these exports would be required to be produced by workers earning a higher minimum wage. The question remains whether Canada will agree to this deal. Some sensitive issues remain to be discussed, such as the potential arbitration procedures and tariffs on some agricultural products. On the one hand, it is not obvious that the US Congress would agree with a trade deal that excludes Canada. On the other hand, the US administration is increasing pressure on Canada by threatening to increase import tariffs on Canadian cars. These developments are bad news for free trade and ultimately for global economic prospects. Either NAFTA including Canada will come to end and lead to damage to the Canadian economy, or, in case of an agreement, President Trump’s confrontational negotiation tactics will have proven to be effective. This could inspire him to apply them in other trade conflicts as well, notably the one with the EU, which is currently at a stage of ‘ceasefire’.

The ongoing turbulence on emerging markets also continues to contribute to global risk and uncertainty. Although emerging markets as a whole are not a homogenous group of economies, most of them are affected by the impact of the Fed policy tightening cycle on net global capital flows. In particular emerging markets with weak economic fundamentals and unsustainably expansionary macroeconomic policies (leading to unhealthy current account deficits and high inflation) are suffering markedly. Recent prominent examples for this are Argentina and Turkey. The Argentine central bank was forced to raise its policy rate to 60% in order to support the exchange rate of the Peso and fight inflation. Based on the same reasoning, the Turkish central bank raised its policy rate on 14 September from 17.75% to 24%, against the explicit wish of the government. But even for emerging markets with relatively healthy macroeconomic fundamentals, the near-term financial environment will remain challenging for as long as the Fed tightening cycle continues.

The preliminary estimate of Belgium’s real GDP growth in Q2 2018 was revised slightly higher from 0.3% to 0.4% (quarter-on-quarter). It was the first time since Q1 2017 that Belgian growth was not below the euro area reading, which also came out at 0.4% in Q2. Compared with neighbouring countries, Belgium continued to perform worse than Germany (+0.5%) and the Netherlands (+0.7%), but better than France (+0.2%). All components of domestic demand (excluding inventories) made a positive contribution to the change in Belgian GDP. Households raised their consumption (+0.1%) and housing investment (+0.3%). Public expenditure was up too, in terms of both consumption (+0.4%) and investment (+1.6%). Businesses stepped up their investment by 1.0%. GDP growth was also underpinned by net exports, as exports rose by more (+0.7%) than imports (+0.4%).

The slightly accelerating and somewhat better-than-expected Q2 GDP growth is at odds with the dynamics of business cycle indicators. Both consumer and business confidence fell back in spring and remained weak during the summer months. All in all, the Belgian economy grew only moderately in the first half of the year and, in our scenario, that continues to be the case in the second half. Therefore, we expect real GDP growth for 2018 as a whole to be somewhat lower than initially forecast (1.5% instead of 1.6%). Also for 2019 we revised our growth forecast slightly downward from 1.5% to 1.4%. The manufacturing sector in particular is vulnerable to worsening global sentiment indicators. In Q2, value added in manufacturing already fell for the second quarter in a row. The weaker export order book assessment and the downward correction in the capacity utilisation rate point at a continued downward path of manufacturing activity in the current and coming quarters (figure 4).

Figure 4 - Export orders and capacity utilisation point at a weaker activity in the manufacturing sector

The Belgian employment figure for Q2 surprised to the upside as well. Domestic employment expanded by 0.5% (i.e. almost 22,000 jobs) from the previous quarter. Employment growth accelerated compared to the previous three quarters, indicating that Belgian GDP growth continued to be quite labour intensive. The number of unfilled vacancies in Flanders climbed to historical highs. This illustrates that the labour market has become very tight, with the number of unemployed people per unfilled vacancy now at a level lower than before the financial crisis (figure 5).

Figure 5 - The Flemish labour market has become very tight

However, other labour market indicators indicate that a turning point is imminent. Businesses’ employment expectations have been falling for a while now, and, more recently, also the unemployment rate worsened. The harmonised unemployment rate for Belgium rose to 6.2% in July, from 6.0% in June. Admittedly, the Belgian unemployment series has been quite volatile in the past, subject to many revisions, and hence its recent development must be interpreted with care. Nevertheless, it could be a first indication that the decline in the unemployment rate is gradually bottoming out.