Polish wonder continues and may inspire Europe

The Polish economy outperformed in recent years, although many questioned the country’s political developments. It appears that recent economic policy decisions had a positive impact on the Polish economy, in combination with EU funding. The economic outlook for Poland remains very positive, although in the longer run recent policies may contain risks for international competitiveness and fiscal sustainability. Although the Polish example is an important inspiration to other EU member states, one should also consider the longer-term risks.

Politics versus economics

When the Law and Justice (PiS) party surprisingly won an absolute majority of seats in the 2015 Polish parliamentary election and began implementing its Christian-social programme, it was a shock to many. Those caught by surprise included leading credit rating agency S&P, which was so frightened that it quickly downgraded Poland’s rating in early 2016. In recent years, the Polish government has occasionally clashed with the European institutions. However, economically speaking, the Polish economy did exceptionally well, supported by the implementation of a number of rather unconventional economic policies. Now Law and Justice has once again won an absolute majority in the key lower parliamentary chamber (Sejm). This time, however, nobody is going to downgrade Poland’s credit ratings. The Polish zloty has even strengthened in response to the election result. So, despite international worries and doubts about some political developments in Poland, nobody questions the positive economic outlook.

A sceptic might say that the market is glad that nationally oriented PiS’s victory was less overwhelming than expected in the end, so the new government’s room for manoeuvre will be limited. Not only did the ruling party fail to secure a constitutional majority (2/3 of seats) but it also lost the upper chamber (the Senate) and it failed to win the three-fifths majority in Sejm needed to potentially override the president’s veto. While President Duda is from PiS, there will be a presidential election in May 2020 and the next head of state may take a less favourable approach to PiS’s legislation. Moreover, such a scenario may develop even if Mr Duda stays in office. Since the Polish president may only be re-elected once, Mr Duda, following his potential second successful run for the presidency, might act much more independently in his office and keep the PiS government within constitutional boundaries.

Good track record

However, an optimistic view of another four years of PiS in government is based on the positive experience of the past four years, which was a fantastic time for the Polish economy from a macroeconomic perspective. Thanks to average annual GDP growth of 4.5%, real convergence has kept strong momentum, and GDP expressed in euros has increased by 24% in the past electoral term. Moreover, strong growth under PiS’s government has gone hand in hand with a dramatic decrease in the unemployment rate, which is now at its all-time low (3.4%). As a result, Poland is also suffering from scarcity in the labour market, just like the other economies in the region. Bear in mind that all this has happened with steadily low inflation and an almost balanced current account.

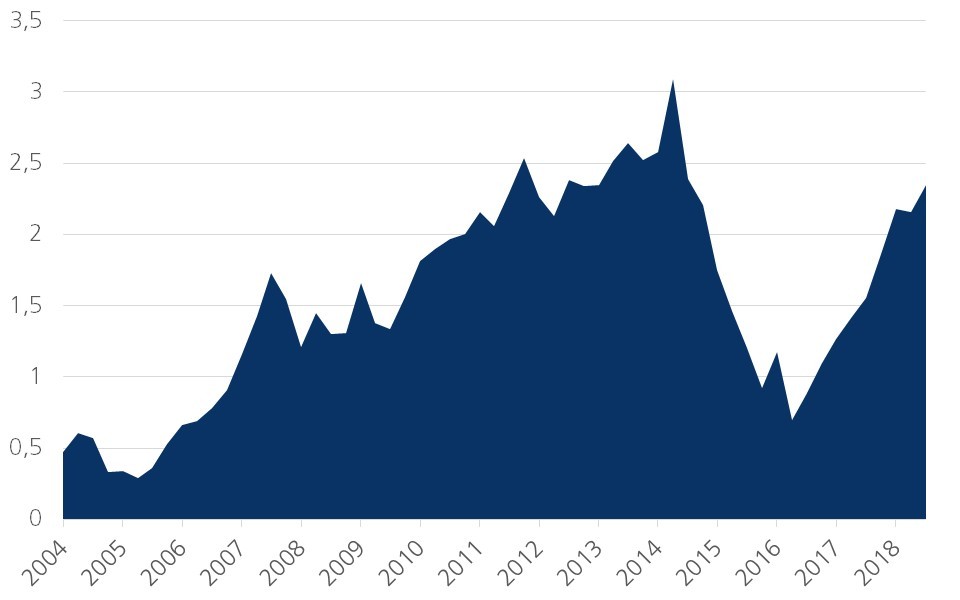

Naturally, it is not only domestic economic policies that are responsible for the positive economic developments. In particular, a huge inflow of EU transfers – most importantly from structural funds – has been an integral part of the Polish economic miracle of the past four years. In spite of its often tense relations with the European Commission (because of a controversial legislative reform), the PiS government has behaved pragmatically as far as drawdowns of EU funds are concerned and has been able to get EU subsidies amounting to 2–2.5% of GDP a year (figure 1). This trend will probably continue. This allowed Poland to invest massively in infrastructure – especially in motorway construction – which further boosted the potential of Poland’s economy. Here again the preservation of the political status quo is an advantage as the existing administration can make use of prior know-how concerning the preparation of specifications for project tenders, which should keep the level of subsidy utilisation high and further stimulate economic growth.

Figure 1 - Transfers to Poland from EU structural funds (4-quarter rolling average, % of GDP)

The overwhelming election victory and the continuing rule of PiS, which can again govern without any coalition partners, mean that the current trend with regard to fiscal policy will not change. Although the PiS government managed to gradually reduce the deficit and government debt (relative to GDP), putting aside the fast pace of growth, fiscal policy is actually relaxed. Moreover, because of approved and already implemented welfare (social) benefits, pressure on the public budget will further intensify despite the business cycle. The PiS government has not only increased social benefits for young families, but importantly has started paying a 13th month pension for retirees. In our view it is the relative generosity towards pensioners (the PiS also decreased the retirement age in the last electoral term) that can generate pressure on public finances in a long-term horizon. Especially if we consider that Poland, like its neighbouring countries, faces a negative demographic trend. If this trend does not reverse (e.g. thanks to migration), the medium-term pressure on the budget may continue to intensify.

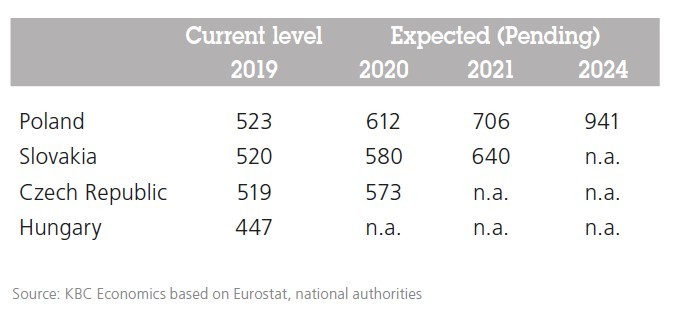

The overwhelming victory of PiS also means that another controversial measure, which is the radical minimum wage increase in the years to come, will be implemented. One of the key campaign promises of PiS was to increase the minimum wage from the present PLN 2,250 (EUR 525) to PLN 4000 (EUR 933) in 2024 (see table 1). In terms of the minimum wage level, this step will put Poland far ahead of its regional PEERs. This may not be a problem at the peak of the business cycle but, if the labour market cools, the relatively high minimum wage may constitute a problem from a structural point of view.

Table 1 - Minimum wage at national level (EUR, monthly)

Inspiring Europe?

Hence, we expect continuity in Poland’s economic policy over the next four-year period under the rule of PiS. Meanwhile, the Polish economy will again be supported by very low official interest rates set by the National Bank of Poland and relatively high transfers from the EU funds. This altogether should deliver macroeconomic stability and strong growth, which will probably be faster compared not only to that of the Eurozone, but also compared to that of its Eastern-European neighbours, notably the Czech Republic and Slovakia.

The Polish experience may also inspire others in Europe. Targeted fiscal spending, in particular for young families, may generate positive growth effects. In the current debate on intensifying fiscal stimulus throughout Europe, this is an important insight, in particular for EU member states with negative demographic trends. However, the longer-term effects of some recent Polish policy decisions, in particular on international competitiveness and fiscal sustainability, remain to be seen.