OPEC+ meeting: vague agreement to boost output

On Friday and Saturday, a closely watched OPEC+ meeting took place in Vienna. Although the expected output increase has been delivered, the vaguely worded final communiqué – emphasizing the return to full compliance with original production cuts – suggests disagreements within the cartel. While the Iranian interpretation of the agreement anticipates a limited increase of output within the individual quotas, Saudi Arabia and Russia interpret the agreement more flexibly, targeting the group-level quota. Therefore, the overall increase in production is likely to be higher than initially expected, up to 1 million barrels per day, which will ease the market tension and lead to lower oil prices by the end of 2018.

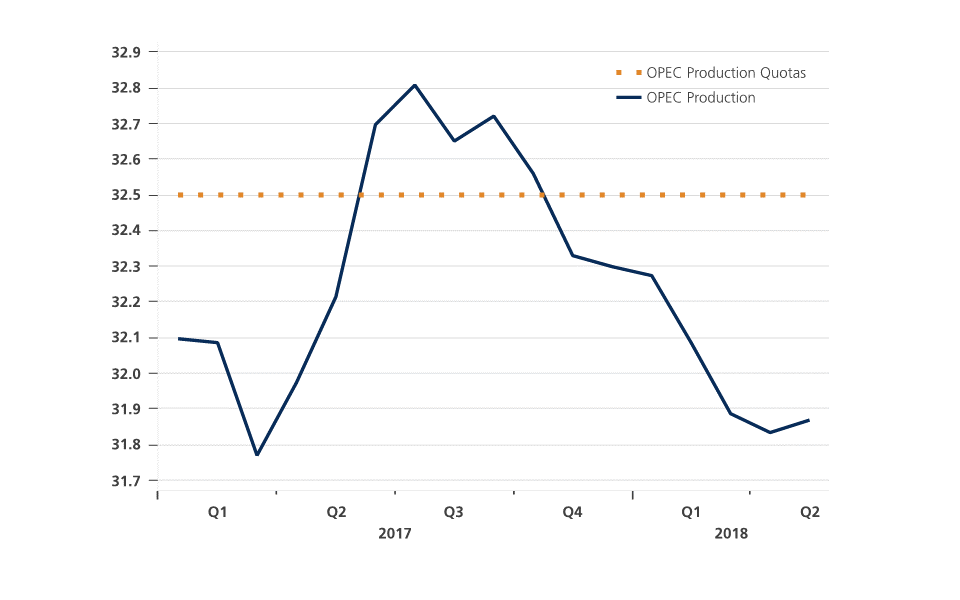

Back in November 2016, when an unexpected alliance of Saudi Arabia and Russia was formed to eliminate the global oil glut, only a handful of analysts saw the odds in favour of such cooperation. Not only had OPEC historically a poor track record of complying with its own production cuts, but also the previous episodes of OPEC-Russia collaboration ended infamously. More than a year and a half later, however, a group of 24 countries, so-called OPEC+, arrived in Vienna – against all expectations – with a mission accomplished. The countries have managed – albeit largely supported by economic collapse in Venezuela – to maintain significant over-compliance with the production cuts of 1.8 million barrels per day (147% in May), reducing the global oil stocks back to the five-year average (Figure 1). As a result, market balance has slipped to a deficit and, in particular, the oil price has surged by 60% since the agreement was in place to the current 75 US dollar per barrel.

Figure 1 - OPEC has maintained significant over-compliance with productions cuts (in millions of barrels per day)

Source: KBC Group Economic Research based on OPEC

Nonetheless, as the International Energy Agency warns, it would be extraordinary if such a large jump did not affect demand growth. In addition, the oil market has been struggling with the aforementioned production collapse in Venezuela, where the output fell by 600,000 barrels per day on year-on-year basis, and increasing uncertainty about the Iranian oil supplies in the light of US sanctions. It then comes as no surprise that Russia, under pressure from domestic oil majors, and Saudi Arabia, pressured by US president Trump, prefer to opt for opening the taps.

However, this is not the case for Iran and Venezuela which – from different reasons – do not have the capacity to boost output. Negotiations in Vienna therefore had to reconcile these inherently contradictory interests, making them some of the most political in years. Moreover, the internal conflict between the Saudi-Russia and Iran-Venezuela alliances has been underpinned by recent interventions by US President Trump who on the one hand takes a hard line on the latter group, on the other hand vocally opposes the ‘artificially’ high oil prices. That was the reason why US President was strongly criticised during the meeting for his alleged interference in the cartel’s policy. The truth is that Donald Trump was able to put surprisingly effective pressure on Saudi Arabia as his prospects for the US midterm elections seem rather unfavourable in the context of rising fuel prices.

One agreement, multiple interpretations

At least on paper, these conflicting interests have been reconciled in Vienna. The final communiqué is so vaguely worded that it allows diverse interpretations of the agreement. In fact, the vaguely worded agreement (with no specific figure) was the only possible agreement given the clashing interests. The key takeaway is a return to 100% compliance with the previously agreed production cuts, i.e. eliminating the persistent over-compliance. This would mean the return of about 700,000 barrels per day to the global oil market. Iran, however, sees an even smaller amount of (real) output coming onto the market as it interprets the deal within the framework of previously agreed country-specific output allocations. This would prevent from compensating for production losses in other member states, e.g. Venezuela and potentially Iran itself.

On the other hand, the interpretation Saudi Arabia presented a day later suggests a different conclusion. Saudi Energy Minister Khalid Al-Falih emphasized that Saudi’s guiding principle is to ‘respect what the market needs’ and that they will do ‘whatever is necessary to keep the market in balance’. In other words, Saudi Arabia, together with Russia, will not be bound by individual targets but, the overall group-level quota. As a result of going away from allocation on a pro-rata basis, Saudis expect a total output increase of 1 million barrels per day, equal to more than 1 percent of global supplies, from July.

The Saudi-Russia alliance to dominate, oil prices to trend down

Who is in this case the biggest winner in the last week’s meeting and what will be the impact on the oil market? On Friday, given the relative modest output boost prospects it looked like Iran, but on Saturday, after having been given more details, it is clear that Saudi Arabia and Russia got what they wanted. The two largest oil exporters in the world are simply in a predominant position that enables them to determine the future path of the cartel’s policy. After all, they are among the few producers maintaining significant spare production capacity. In the end, the Saudis will not only satisfy the US president, and the Russians will lift their market share at the expense of other producers, but they will provide the oil market with the well-timed cushion of additional supply (Figure 2). Ultimately, 1 million barrels per day of extra crude should put the market into comfortable surplus, leading to lower oil prices by the end of 2018.

Figure 2 - OPEC+ output boost will ease market tension in H2 2018 (in millions of barrels per day)

Source: KBC Group Economic Research based on International Energy Agency