Does Brexit reflect a trade failure? (publication anglaise)

Résumé

Le Brexit est souvent présenté comme une réaction de déception, l'intégration européenne n'ayant pas apporté l'amélioration du bien-être escomptée au Royaume-Uni. Or, par rapport à des pays comparables de l'UE, le Royaume-Uni n'a pas connu de détérioration relative de son niveau de vie susceptible d'expliquer le choix du Brexit. L’analyse des flux commerciaux bilatéraux permet d’affirmer que le marché intérieur européen n'a pas radicalement déplacé les relations commerciales britanniques vers d'autres pays de l'UE. Ce constat s'applique toutefois également aux autres États membres de l'UE et il reflète l'importance croissante des économies émergentes en tant que partenaires commerciaux au cours des dernières décennies. Néanmoins, l'économie britannique, quoique peut-être un peu moins que les autres économies de l'UE, a généralement bénéficié de l'intégration européenne par le biais de son commerce international. L'appartenance à l'UE en tant que puissant bloc commercial lui a en effet permis de bénéficier de la capacité de l'UE à conclure des accords commerciaux substantiels. Il est en outre prouvé que les accords commerciaux formels, tels que l'adhésion de la Grande-Bretagne à l'UE, favorisent le renforcement des liens économiques et les avantages économiques qui en découlent. Nous pensons par conséquent que l'évolution du commerce au sein du marché intérieur européen ne peut être invoquée pour expliquer ou justifier le résultat du référendum sur le Brexit en 2016

- Introduction

- The EU's impact on UK trade

- Regional trade agreements & the EU’s impact on trade

- Conclusion

Cette publication n'est disponible qu'en anglais.

Lisez-les ci-dessous ou ou ouvrez le PDF ici.

Recent years have seen a strong backlash against globalisation that has taken many forms. One important aspect has been a questioning of the principle that closer economic integration across nations would result in significant benefits for all parties. Much of the commentary in this regard has been by way of assertion rather than analysis. For example, Brexit has frequently been presented as a reaction to the perceived failure of European integration to deliver expected improvements in prosperity for the UK. This note looks at a number of measures and methods to ask whether there is economic evidence of such a failure.

The looming departure of the UK from the EU is important for many reasons, not least because it signals a willingness to abandon a long established path towards closer European ties and in its place to opt for radical, untested and likely damaging alternatives. Is this because European integration didn’t deliver the benefits it promised? Does the economic evidence suggest the UK struggled rather than strengthened inside the EU?

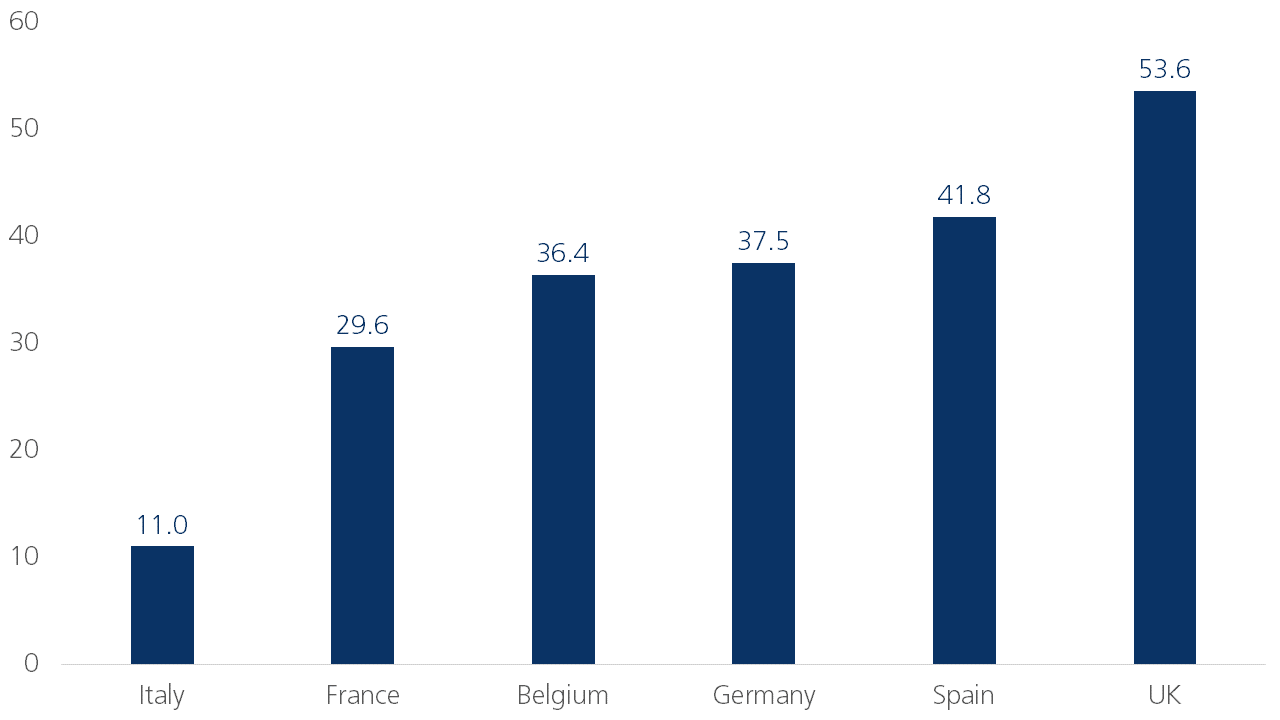

On the basis of the most commonly used metric, GDP per capita, the UK economy has done relatively well. Since the European single market began in 1992, growth of GDP per capita in the UK has been faster than in comparable EU economies (figure 1). Moreover, in terms of income levels, UK GDP per capita in 2017 was higher than in France and above the EU15 average. Although real GDP per capita in the UK was still lower than in frontrunner Germany, the gap between these two economies narrowed. On the other hand, the gap between the French and especially between the Italian real GDP per capita widened in favour of the UK economy. Hence, on this important measure, the UK‘s experience appears to be one of prosperity rather than pain.

One of the key channels through which the economic benefits of EU integration might be expected to come is increased trade between EU members. A strong and structured trading relationship is generally seen as the economic glue that brings countries closer through shared gains in activity and incomes. We next look at how the patterns of UK trade with its EU partners and with other countries have changed through the past couple of decades. We then consider how these developments compare to the sort of outcomes suggested by economic theory and a range of studies examining the factors that drive international trade.

Figure 1 - Real GDP per capita (in USD, 2010 PPPs, % growth 1992-2017)

The EU’s impact on UK trade

At a very basic level, it might be expected that the process of EU integration would be reflected in comparatively strong growth in trade between the UK and other EU countries. As we will see, the reality is a little more complex.

In principle, it could be argued that we should look at UK trade patterns before and after the UK joined the EU in 1973 rather than from 1992. However, there are strong arguments against such an approach. First of all, data limitations make such comparisons difficult. More fundamentally, economic structures have changed dramatically in the past fifty years, draining most of the meaning from such comparisons. Finally, much of the disquiet in the UK about EU membership is focussed on the closer integration that followed the creation of the EU Single Market in 1992. Hence, we use 1992 as our base date. However, as we note below, other studies suggest this choice of start date may understate the importance of EU trade to the UK.

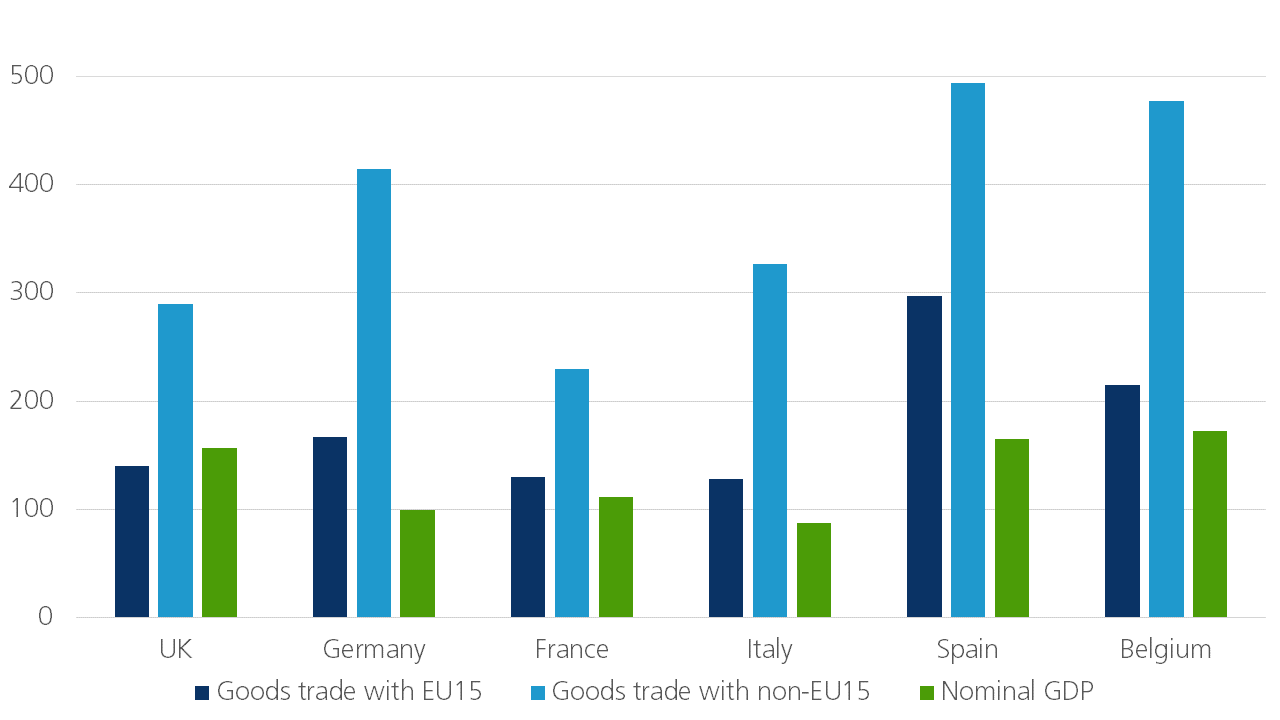

Total UK trade in goods (defined as the sum of imports and exports of goods) grew by more than 200% in the period between 1992 - the start of the Single Market - until 2017. However, as figure 2 below illustrates, there was a difference in the evolution of trade with EU15 members and trade with other countries. UK goods trade with EU15 members grew by 140% during the period while trade with other countries almost quadrupled (+290%). Could this suggest EU integration fell short of expectations?

Figure 2 - Goods trade and GDP (% growth 1992-2017, imports + exports in EUR)

Well, first of all, it is important to note that the UK experience in terms of the pattern of trade growth was not unique. As the figure shows, it was also the case for Germany, France, Italy and Spain that the growth of goods trade with the EU15 was weaker than the growth in trade with other countries. Although the general trade dynamics were comparable across major European economies, there were some differences in degree. For example, in Germany and Italy, trade with non-EU15 countries grew even faster relative to trade with the EU15 than was the case for France and the UK. So, the experience of the UK in terms of trade growth is far from unusual.

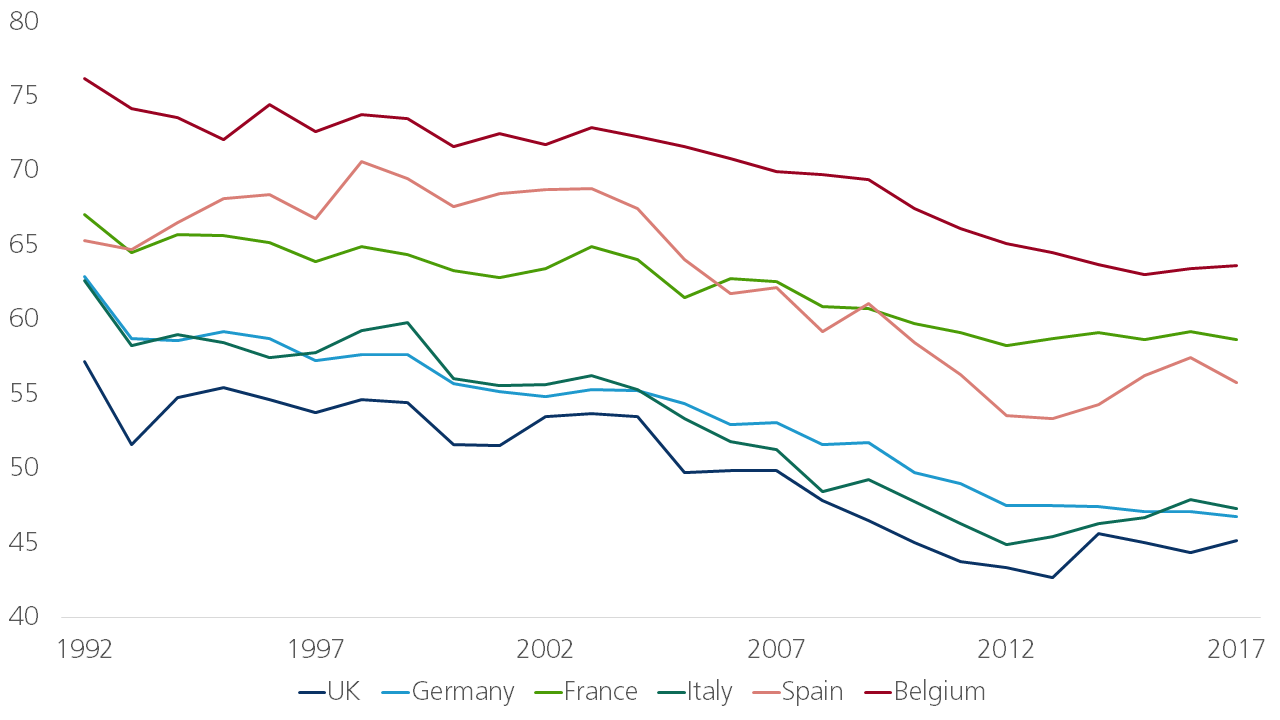

An examination of the pace of growth gives only a limited picture of the importance of trade between countries. It is also necessary to compare the level of goods trade across economies. Goods trade with the EU15 as a share of total goods trade has been declining in the past decades for the UK as well as for the other large EU economies (figure 3). However, even for the UK this ratio is still substantial even if it has been somewhat lower than for other countries. Significantly, compared to all EU Member States, the UK is ranked the lowest in terms of trade with the EU as a share of its GDP, implying that UK trade integration into the Single Market for goods is the lowest across the EU.

Figure 3 - Goods trade of advanced economies by trading partner (% growth 1992-2017, imports + exports)

On the face of it, these results might suggest that EU integration has fallen short of its promise but there are good reasons to argue the contrary. One important consideration is the changing structure of advanced economies that has seen both production and trade of goods diminish in importance relative to an expanding services sector. At the same time, the integration of China and many other economies into a notably more globalised world of multi-stage multi-location supply chains has seen global trading patterns alter radically.

After China’s accession to the World Trade Organisation in 2001, the country became more important as a trading partner for all European countries. China’s share in total UK goods trade rose from 1% in 1992 to almost 7.5% in 2017. It was the UK’s sixth most important export destination and third most important import partner in that year.

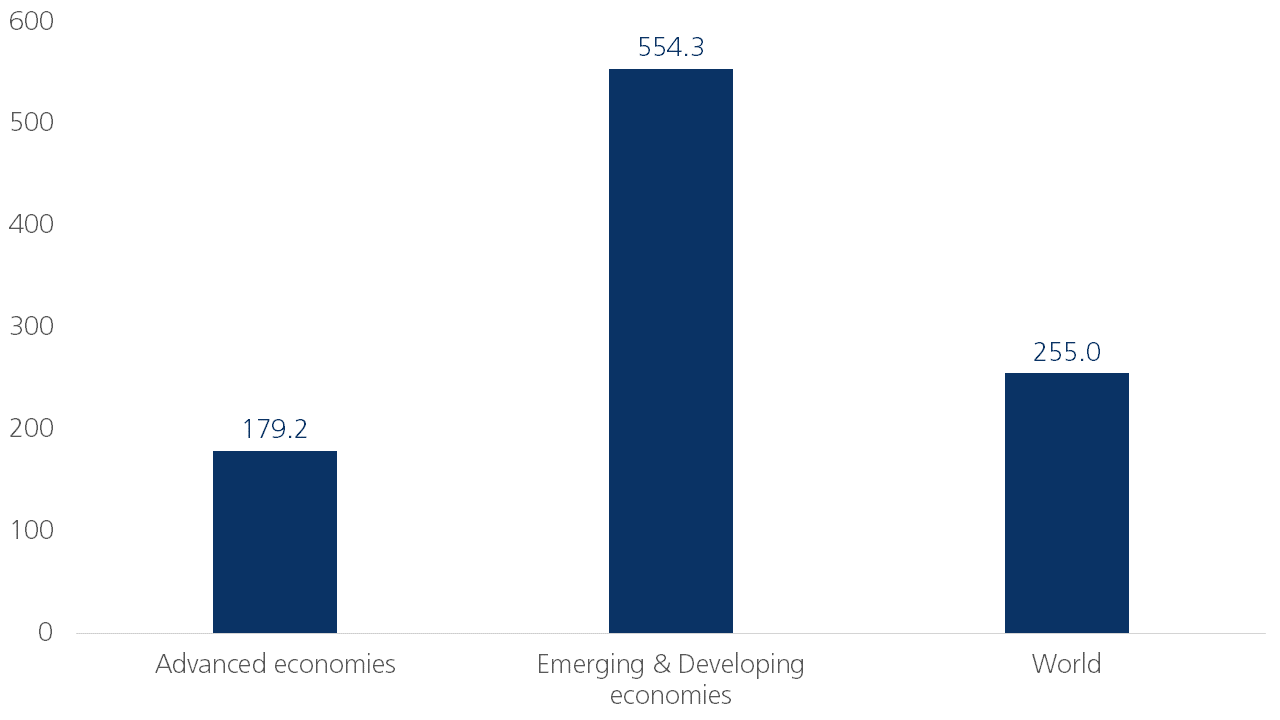

In fact, not only China but also other emerging markets have become more important as a trading partner for advanced economies. While goods trade of advanced economies with other advanced economies grew by 180% between 1992 and 2017 - an outturn broadly comparable to the UK’s 140% growth in trade with the EU15 - this was dwarfed by growth of more than 550% for advanced economies’ trade with emerging and developing markets (figure 4). As a result, the share of emerging economies in total goods trade of advanced economies grew from 18% to 37% in the same period. Such benefits were not felt evenly across all countries. For example Germany was able to benefit substantially from the emerging markets’ rise due to their large demand for machinery and cars.

Figure 4 - Goods trade with the EU15 as a % of total goods trade with the world (imports + exports)

The outsized growth of trade with developing economies not only reflects the opening up of political and economic systems in many of these countries to embrace stronger relations with the western world. It also owes much to a wave of globalisation that hugely emphasised the development of global supply chains that intensified linkages across countries. These developments dwarfed the impact of closer EU ties in terms of the measured growth in goods trade. However, as the difficulties the UK is now having in its efforts to advance post-Brexit trade deals suggest membership of the EU by virtue of its global importance in terms of size and purchasing power facilitated trade deals that underpinned rapid trade growth of the UK (and other EU members) with countries outside the trading bloc.

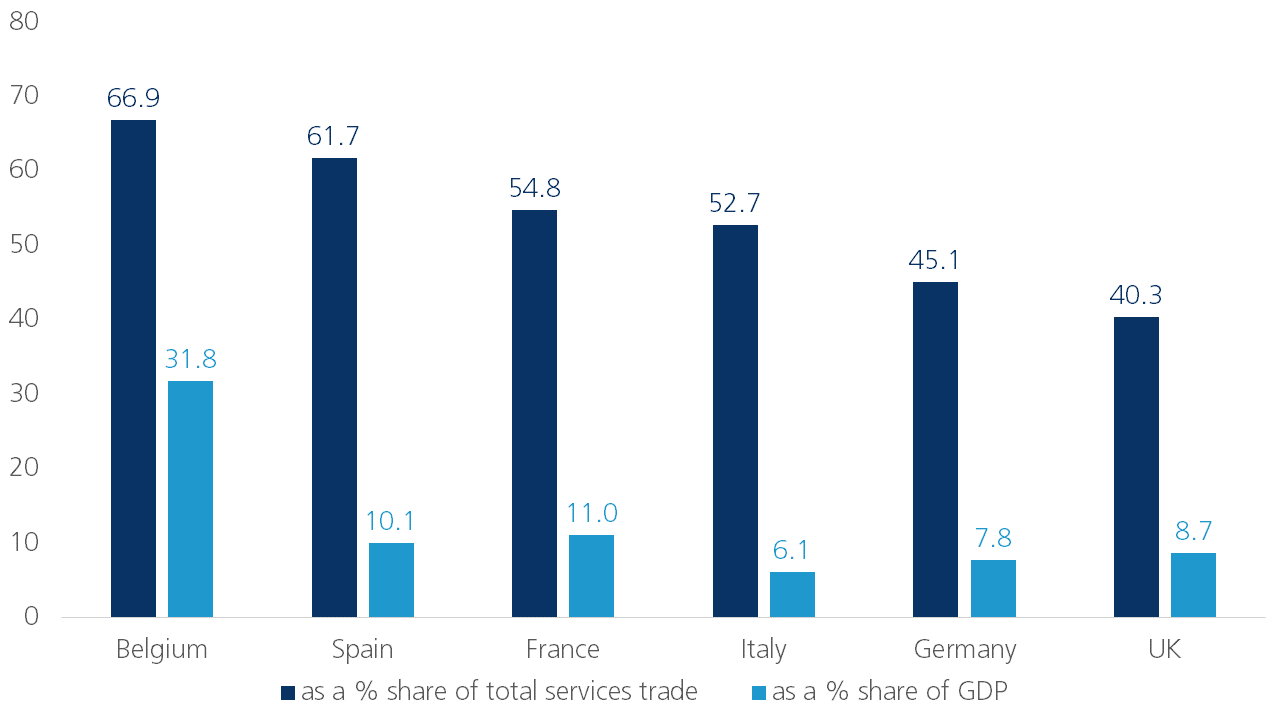

As noted previously, in common with other advanced economies, activity has increasingly focussed away from the production of goods to very diverse activities within the services sector. Taken as a share of GDP, imports and in particular exports of services have shown a steady upward trend. Here too, data on bilateral trade flows suggest UK trade integration in the Single Market for services is low in comparison to other EU countries. 40% of all UK services trade is with the rest of the EU15 (figure 5). By way of comparison, Germany’s services trade to EU15 countries stands at 45% of its total services trade, for Spain this is even 61%.

Figure 5 - Services trade with EU15 (exports + imports, 2017)

As the graph shows, services trade beyond the EU tends to be positively related to economic size, with larger economies more global in their services trade. The US, Switzerland, Japan and Australia are the most important non-EU trading partners for services of the UK. However, services trade has become more important for the UK economy over the years. As a result, UK services trade with the EU has become notably more important in terms of UK economic activity. Indeed as the light blue bar in figure 5 illustrates, services trade with the EU15 is a larger share of economic activity in the UK than it is for Germany or Italy. The UK owes the rapid growth of its services sector to the swift de-industrialisation of the economy and its role as a global financial centre.

The analysis of bilateral trade flows for goods and services suggests that, although intra-EU trade growth wasn’t particularly weak for the UK, UK trade integration into the EU Single Market was and still is somewhat lower than for other countries. There are many and varied reasons why this might be the case (which we discuss more formally below). At a very basic level, the fact that the UK is an island implies the existence of a natural impediment to trade not felt by countries sharing land borders. In addition, the UK’s history as a major global trading nation is reflected in longstanding and diverse links with other countries well beyond its immediate shores.

Nevertheless, the rather low trade integration into the EU Single Market doesn’t imply that UK trade didn’t benefit from membership of the EU. On the contrary, via its EU membership and the EU’s power to negotiate trade deals, the UK’s access to other markets has increased. In that sense, being a member of the EU has given the UK, as well as all its other Member States, a global base. Indeed, given its small and declining GDP share in the global economy and its waning position as a “superpower” (which was one element in the UK joining the European Community in 1973), it might be argued that its capacity to grow trade beyond the EU might have been notably more limited had it remained outside the EU. Also, in terms of investment treaties and international rules for government procurement, the UK has probably benefited from the greater power and influence in decision-making its membership of the EU has conferred.

Regional trade agreements & the EU’s impact on trade

Until recently, there was little dissent from the view that European integration and related trade gains would deliver better economic outcomes. The European Commission describes the European Single Market as “the EU as one territory without any internal borders or other regulatory obstacles to the free movement of goods and services”. In theory, these circumstances should stimulate trade flows and competition between the Member States. A range of studies have examined the question of how in practice regional trade agreements such as membership of the European Union act to increase trade and thereby boost economic welfare.

The key element that differentiates these studies from the work we have done above is their use of models which take into consideration other factors that may impact trade flows. This includes economic size as measured by GDP, the distance between countries, whether they share a common language or colonisation history, geographical factors such as a shared border, and if the countries are landlocked or islands, once these other factors are controlled for, it is easier to assess the impact of regional trade agreements and other similar forms of economic integration.

Estimates made by various studies of the impact of trade agreements on trade flows have varied dramatically over the last twenty years of research. However, while such studies differ in terms of the scale of effects, they agree on the direction. Membership of some formal economic grouping is seen boosting trade flows. By extension, the stimulus from additional trade is seen enhancing overall levels of activity and employment thereby underpinning the view that economic integration delivers material benefits to the countries involved.

Most of the literature on international trade agreements finds a clear and progressive increase in trade flows from circumstances in which there are no formal links between countries through various forms of trade agreements to a close relationship such as a customs union or other forms of deeper economic integration. Work by Baier and Bergstrand suggests trade flows between countries could double compared to no trading arrangements and might be about 25% higher than in formal but looser relations.

If we consider research focussed specifically on the European Economic Area, the OECD finds that being a member of the European Economic Area increases trade by approximately 60% at the lower bound. A range of other papers examining EU membership’s impact on intra-EU trade suggests gains running from 51% (Eicher et al 2012) to 104% (Carrere (2006)), while a paper by Glick (2016), which distinguishes between older and newer EU members, found that joining the EU increased trade by almost 70% for older members and almost 300% for newer members. In the run-up to the Brexit referendum in the UK in 2016, analysis by the Treasury suggested that EU membership increases trade between EU members by 68% to 85% relative to a baseline position of WTO membership.

It should also be noted that previous studies have shown substantial evidence that EU trade creation effects (intra-EU trade as a % of total trade) are stronger right after, and even before, a country joins the EU. EU-benefits based on trade integration effects may hence be concentrated in specific periods in time. Looking at trade evolutions many years after the UK entered the EU, as done in this paper, may hence not always be interpreted as (lack of) evidence for EU integration benefits.

Conclusion

Judged by reference to developments in living standards (as measured by growth in GDP per capita), the UK has not experienced any marked deterioration relative to comparable countries that might rationalise a decision to abandon its membership of the EU.

Did the UK grow closer to or further away from its EU neighbours? On the basis of bilateral trade flows, it might be argued - as some Brexiteers have done - that the Single Market didn’t radically re-orient the direction of the UK economy towards other EU countries, but this was also true of other member states and reflects the particular importance of emerging economies to trade developments through the past two and a half decades.

Overall, the UK economy, albeit maybe to a somewhat lesser degree than the other EU economies, still benefited from EU integration through trade. By being a part of the EU as a powerful trading bloc, the UK could benefit from the EU’s abilities of getting concessions in trade negotiations and reaching extensive trade deals. Moreover, there is almost universal agreement in the evidence of numerous studies that formal trade arrangements such as the UK’s membership of the EU promote significantly closer economic ties and associated economic gains. Consequently, we don’t feel trade developments under the Single Market can be used to explain or justify why a majority of the UK population voted to leave the EU in 2016.

While this analysis found that while bilateral trade with other EU members may be less important for the UK than for many other EU states, the level of trade is still indicative of a British economy significantly integrated into the EU. This means that the withdrawal of the UK from the EU will have profound implications for future UK trade relations, not only with the EU, but also with other trading partners. In an upcoming study we will look at the likely implications of Brexit for the UK economy and for the EU.

References

Baier, Bergstrand, Feng (2014), “Economic integration agreements and the margins of international trade”, Journal of International Economics, 93, p.339-350.

OECD Working paper (2015), “Implicit regulatory barriers in the EU Single Market: New empirical evidence from gravity models”, Working Paper (2014)77.

Carrere, Céline (2006), “Revisiting the effects of regional trade agreements on trade flows with proper specification of the gravity model”, European Economic Review, vol.50(2), p.223-247.

Glick (2016), “Currency Unions and Regional Trade Agreements: EMU and EU Effects on Trade”, Federal Reserve Bank of San Francisco Working Paper 2016-27.

Eicher et al (2012), “Trade creation and diversion revisited: Accounting for model uncertainty and natural trading partner”, Journal of Applied Econometrics, 2012, vol. 27(2), p.296-321.

HM Treasury (2016), “HM Treasury analysis: the long-term economic impact of EU membership and the alternatives”.