Emerging markets quarterly digest: Q1 2021

Read the publication below or click here to open the PDF.

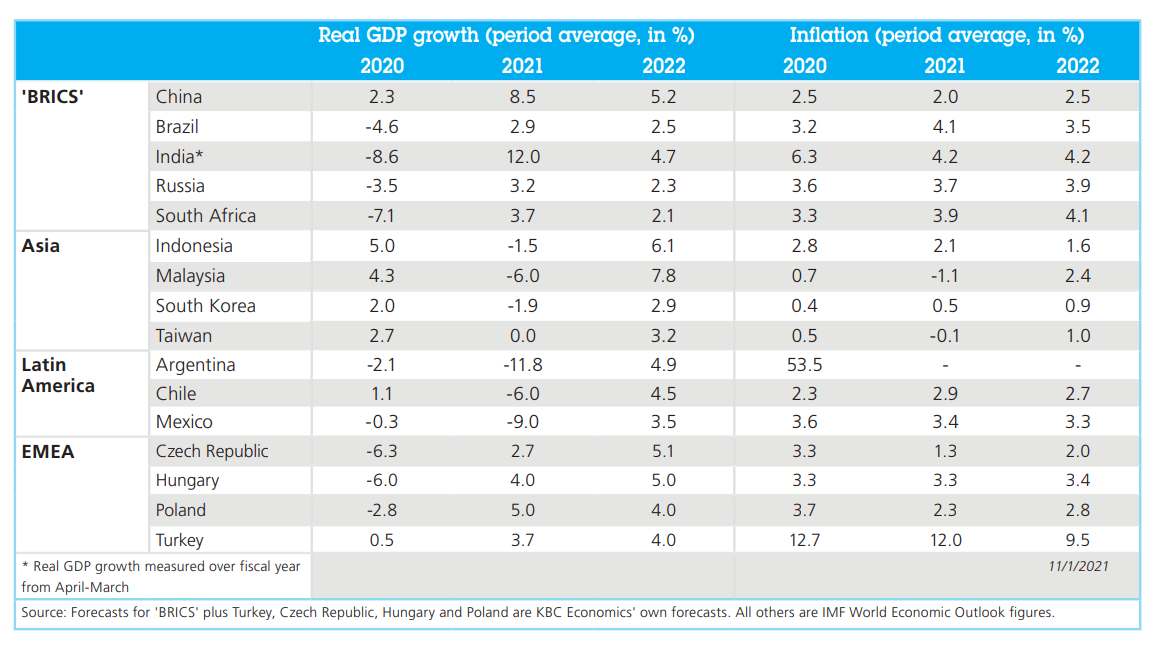

New year, same risks

With 2020 behind us and vaccine campaigns underway in a number of countries, the global economic outlook appears brighter than it has been in several months. At the same time however, a vast amount of uncertainty has carried over into the new year, also for emerging markets. Many emerging markets are well positioned to benefit from the recovery, especially those that managed to contain the economic damage imposed by the pandemic and likely have less scaring. We do expect strong growth rebounds in emerging markets that experienced steep GDP contractions in 2020, but risks may be higher, particularly where the pandemic is far from under control.

Furthermore, while we expect easy financial conditions to persist among advanced economies in 2021, market participants will be on the lookout for any hint regarding the future timing of policy normalization. Hence, while emerging markets should continue to benefit from loose policy and search for yield behavior, external vulnerabilities and macroeconomic imbalances could eventually become a point of concern for certain economies. A further widening of such imbalances (particularly government deficits and build-up of debt) could lead to higher risks down the road. As such, 2021 is set to be a much better year for emerging market economies overall, but some will face a steeper climb and higher risks than others.

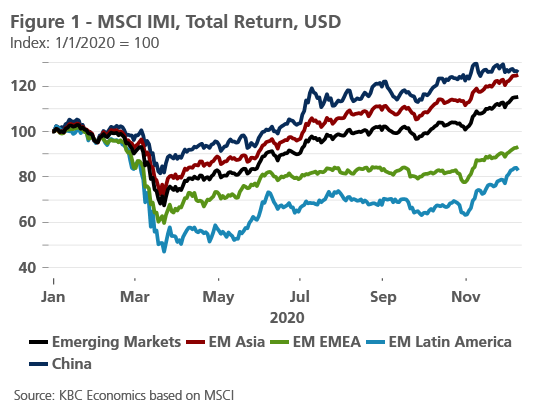

Vaccines arrive, but not for all

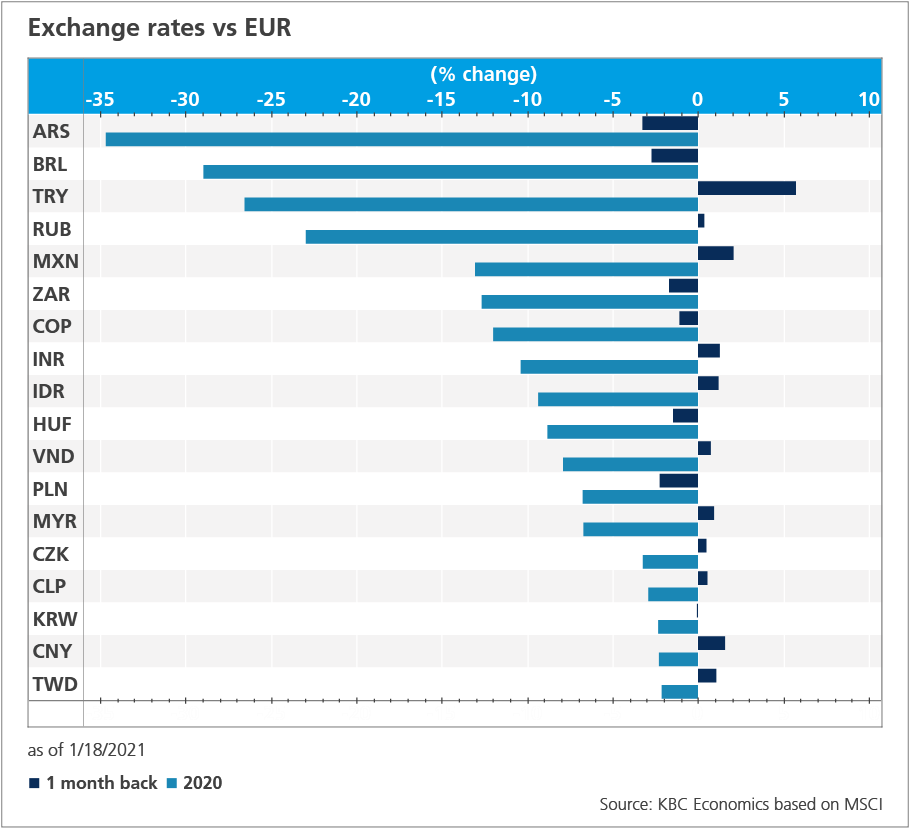

Pandemic developments, which now include the pace of vaccination campaigns, will play a key role in the speed and strength of the global recovery. Announcements related to vaccine safety, efficacy and robustness since November have clearly supported optimism in financial markets, including in emerging markets (figure 1). This optimism reflects an anticipation of the boost that mass vaccination will eventually give to the global economic recovery.

It is important to note, however, that vaccine distribution will not be equal across countries, with experts suggesting that some people in lower income countries will have to wait until 2024 for vaccines (source: Duke Global Health Institute). While advanced economies account for the bulk of claims on early vaccine doses, many large middle-income economies have also secured their own access to vaccines (including Brazil, India, Indonesia, Mexico, Chile and Argentina among others). Thus, some emerging markets may not be too far behind advanced economies in terms of the vaccine rollout. It is the lower income countries that will likely have to wait some time before providing vaccines to a significant portion of their populations.

In addition to the moral implications of an unequal vaccine rollout, there are also health and economic risks that can arise from such a situation. Experts have been warning that a pandemic doesn’t respect national boundaries, and this is highlighted by the emergence of new, faster spreading strains of the coronavirus in the UK and South Africa. Hence, with further mutations of the virus still possible, any delay in bringing the pandemic under control in all parts of the world raises risks for the global recovery. Such risks aside, emerging market economies in general should see some benefit from the preliminary vaccine efforts, even if they are limited at first to wealthier countries. As these economies normalise and demand returns, export-reliant economies will benefit from a rebound in global consumption. Travel and tourism may also start to recover, though this will likely take some time. And already, the rebound in commodity prices that reflects this expected economic normalisation is a welcome development for commodity exporters.

Don’t forget the debt and deficits

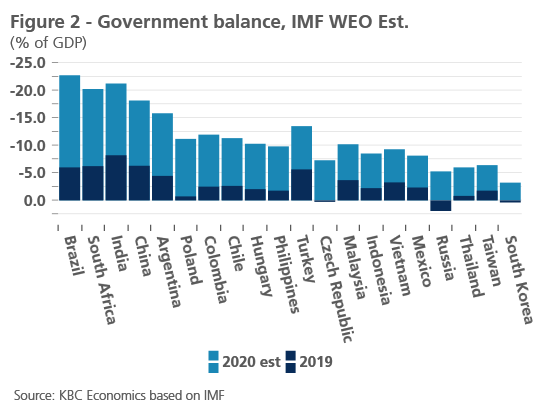

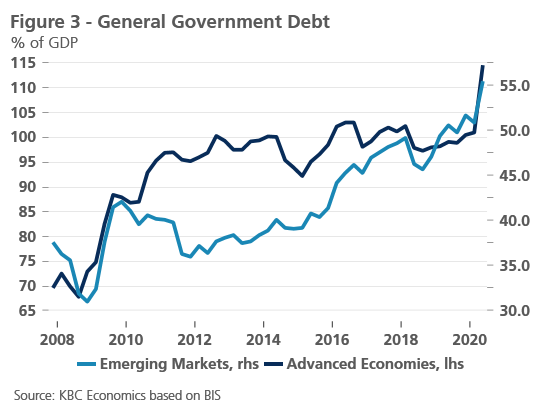

Before the positive announcements on vaccine developments, emerging market assets were also supported last year by the unprecedented and synchronized policy response to the crisis, particularly from advanced economy central banks. Easy financial conditions, together with ‘search for yield’ behavior, helped emerging markets underwrite the higher spending needed to combat the crisis. Indeed, government deficits as a percent of GDP skyrocketed in 2020 (reflecting also the sharp declines in GDP) while inducing little reaction from markets (figure 2). As a result of both increased spending and a sharp decline in GDP in many countries, global debt burdens have spiked as well (figure 3).

Ultra-accommodative monetary policies in advanced economies are expected to remain in place through 2021, which should continue to benefit emerging markets. However, this leaves open the possibility that emerging market imbalances (and particularly fiscal deficits and debt build-up) continue to grow. With market participants already scanning central bank communication for any hint as to the timing of eventual policy normalization, emerging economies without a feasible post-pandemic fiscal consolidation plan may run into trouble with both markets and rating agencies.

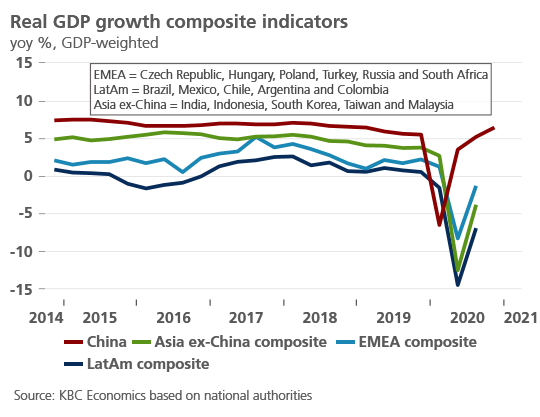

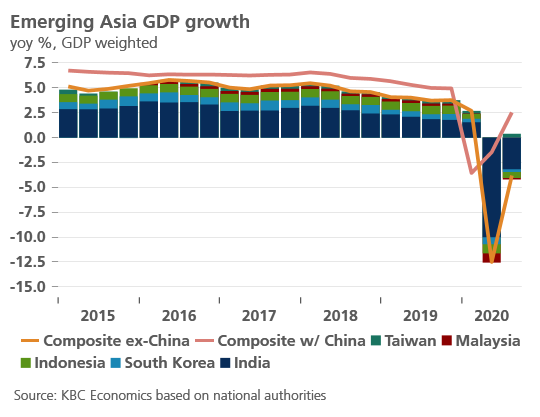

Emerging Asia

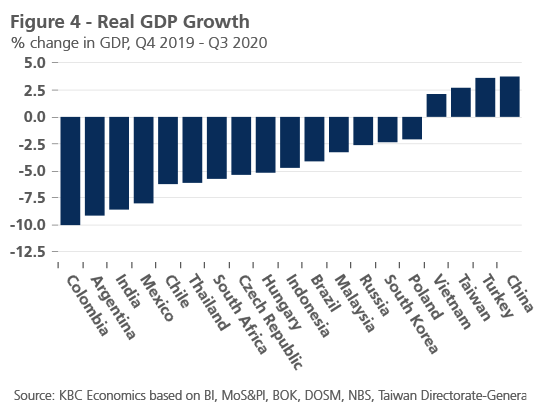

A number of economies in emerging Asia are likely to eventually leave the pandemic behind with less long-lasting economic damage and with fewer structural vulnerabilities compared to peers. China, Taiwan and Vietnam stand out in this respect, with all three economies seeing positive growth between Q4 2019 and Q3 2020 (figure 4). As mentioned in last quarter’s publication, this likely reflects these economies’ strong starting positions, good containment of the virus, a limited drop in mobility, and the fact that exports have held up relatively well, despite the global recession. Other economies in emerging Asia did see more damage, including Thailand, Malaysia and Indonesia, where tourism receipts account for a significant share of exports and GDP.

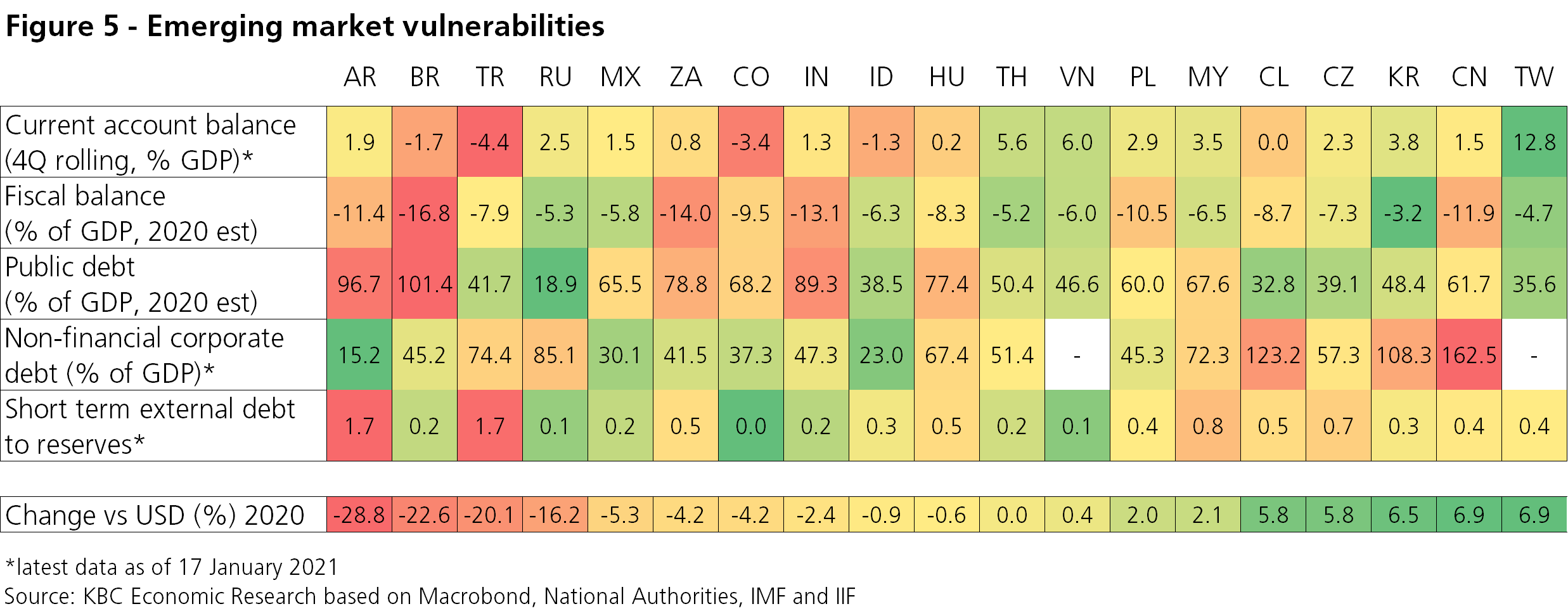

However, we expect positive spillover effects from the global growth rebound for all economies in the region, including those that suffered more during 2020. Furthermore, emerging Asia economies, including those of Thailand and Malaysia, tend to have more limited macroeconomic vulnerabilities (current account surpluses as opposed to deficits, narrower fiscal deficits, and smaller public debt burdens), especially compared to peer countries in Latin America (figure 5). The better fiscal situation for these economies means less pressure to quickly consolidate budgets in 2021 and more fiscal space to continue supporting the economy through what will likely be a somewhat rough start to the year. Higher current account surpluses also mean more breathing room to maintain accommodative monetary policy, even if there is a sudden shift in investor sentiment (based, for example, on a possible change in market expectations for advanced economy central bank policies). Thus, with the end of the pandemic in sight, the outlook for emerging Asia is once again cautiously optimistic.

China

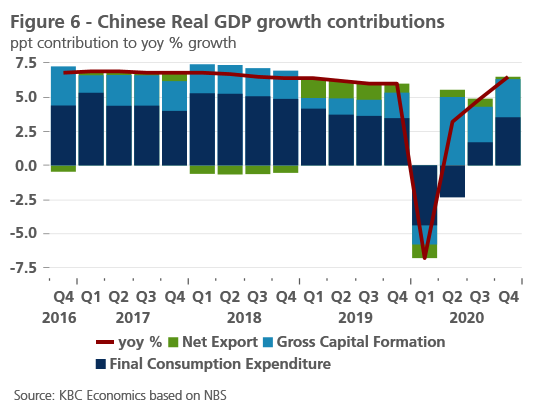

The recovery in China continues at a still swift pace amid some normalisation following the strong rebound in the second half of 2020. In the fourth quarter, real GDP grew a faster-than-expected 2.6% quarter-on-quarter (6.5% year-over-year), bringing annual average growth in 2020 to 2.3%. Notably, consumption contributed 3.5 percentage points to year-over-year growth, while investment contributed 2.8 percentage points (figure 6). Given that the swift recovery in China has been led by investment while consumption lagged, this further recovery in consumption is a positive signal for the momentum of the Chinese recovery going into 2021.

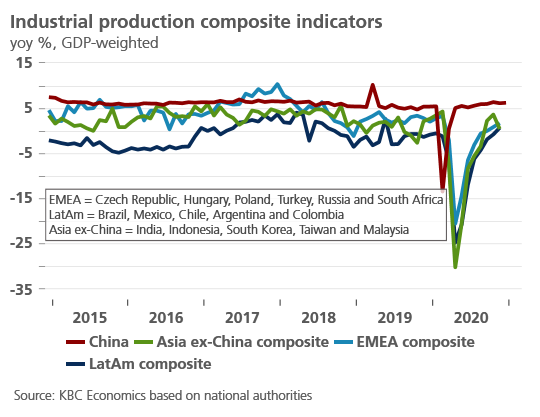

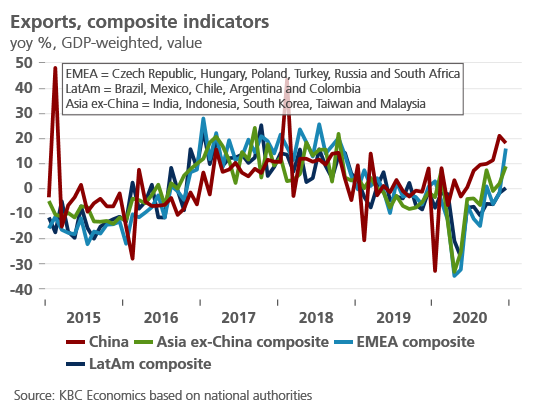

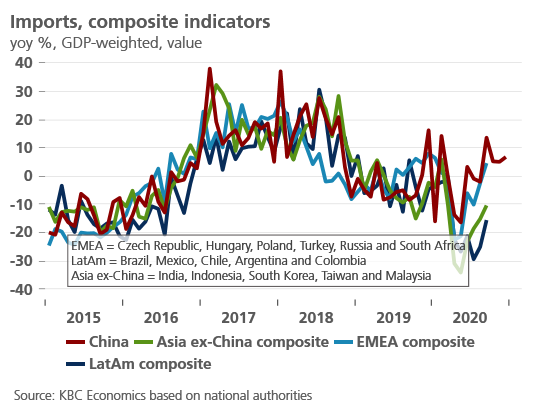

External trade data, particularly on the export side, also suggest that this strong growth momentum will continue into 2021, with exports (measured in USD) growing 18.1% yoy in December. The recovery in exports has outpaced the recovery in imports, which may be reflective of the two-speed nature of China’s domestic recovery (with investment and industrial production leading the way while consumption and retail sales lagged behind). However, just as the most recent GDP figures show that the consumption side of the economy is finally catching up, Chinese imports are also recovering and grew 6.5% yoy (measured in USD) in December.

With the recovery in China being well advanced compared to other major economies, the pace of growth on a quarterly basis should soon return to pre-pandemic trends. Given the relative weakness of 2020, this leads to somewhat mechanically strong annual GDP growth of 8.5% in 2021. In the longer term, and heading into 2022, we expect a continuation of the growth trends seen pre-pandemic – namely a moderate but continuous structural slowdown in the pace of economic growth as China transitions to a consumer-driven economy. For this reason, we pencil in a more moderate growth rate of 5.2% in 2022.

The relatively quick recovery in China, along with long-standing structural issues, may present a policy dilemma for the Chinese central bank (PBoC) in 2021, however. On the one hand, the swift recovery of the Chinese economy and limited monetary easing in 2020 has led to a strong appreciation of the RMB versus the USD since end-May (roughly 10%). At the same time, inflation in China has trended down steadily the past several months, and even dipped into deflation territory in November (-0.5% yoy). Most of this was led by a normalisation in food prices, which should fade out in the next few months. Core inflation, however, has also declined (to a lesser extent) and the strength of the RMB may continue to weigh on inflation in 2021.

On the other hand, the expectation for further policy easing is still limited. Credit risks in the Chinese economy remain high, particularly for highly indebted state-owned enterprises and in the real estate market. With these risks lingering, and the economic recovery expected to continue in 2021, the PBoC is likely to remain on hold in the medium term and rely instead on more targeted tools to address the appreciation of the RMB.

India

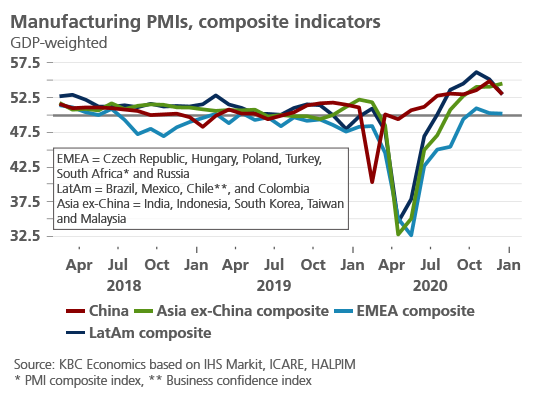

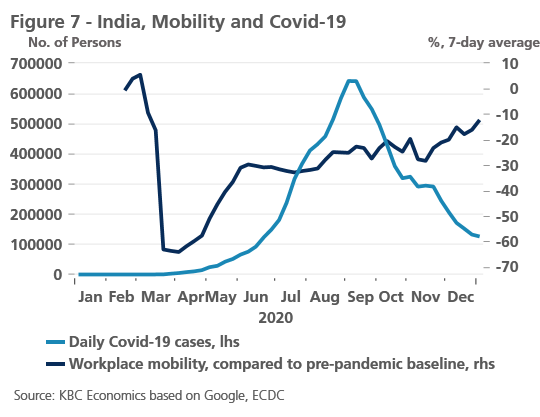

Among emerging markets, India saw one of the most devastating second quarters in 2020, when real GDP fell 26% compared to the previous quarter. Though Covid-19 cases continued to rise at a rapid pace through Q3 2020, setting India up for prolonged weakness, mobility instead started rising as well following a steep collapse at the beginning of the year. Perhaps of most significance for the recovery in India, however, is the fact that the country appears to have broken the link between rising mobility and Covid-19 cases (figure 7). New daily cases peaked at the end of August, while mobility has continued to normalise alongside a rebound in economic activity. As a result, India’s economy grew 22% quarter-over-quarter in Q3 2020 (-7.5% yoy), suggesting a V-shaped recovery is in the cards.

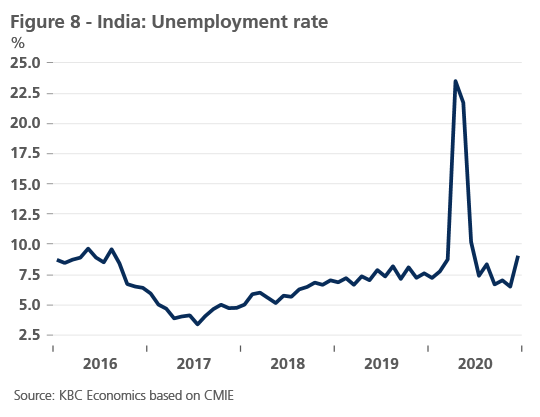

Short-term indicators also suggest that the recovery continued in Q4 2020, though with some headwinds. Industrial production, for example, returned to positive year-over-year territory in October (4.2%) but dipped back into negative territory in November (-1.9%). Sentiment indicators (PMIs) for December, however, stabilised in expansionary territory for both services (53.4) and manufacturing (57.2). Other headwinds, however, can be seen in the labour market, where the unemployment rate jumped from 6.5% in November to 9.1% in December. This is after the unemployment rate skyrocketed to 25.3% in April and then fell back down to the low reached in November (figure 8). This suggests that aside from the temporary job losses in the spring, there is some scarring in the Indian economy that is spilling over into the labour market. Overall, we expect the economy to contract 8.6% in fiscal year 2020, before growing 12% in 2021.

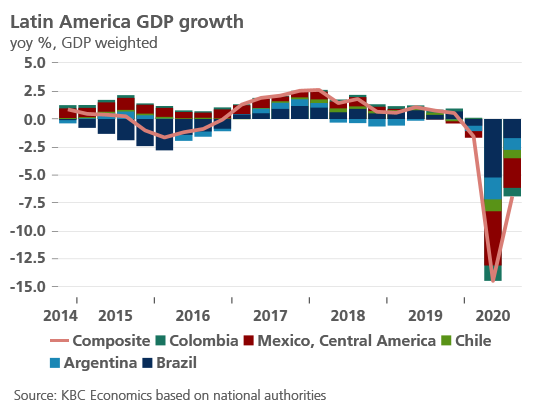

Latin America

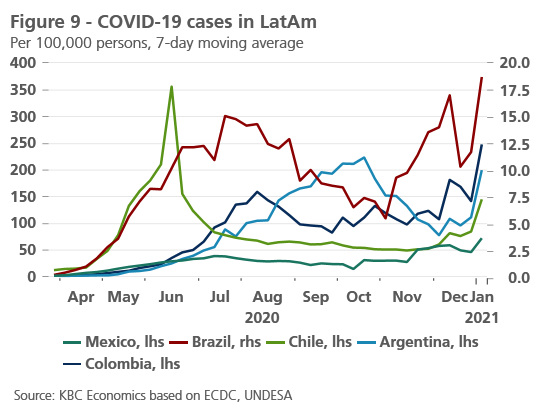

Many economies in Latin America have weathered a particularly bad fallout from the pandemic. As figure 4 above illustrates, Colombia, Argentina, Mexico and Chile have seen among the steepest declines in GDP growth between Q4 2019 and Q3 2020 compared to other emerging markets. Part of the reason for this performance is a weak starting point for many countries before the pandemic, and an inability to really control the spread of the virus at any point this year (unlike counterparts in Asia or EMEA). Furthermore, a new sharp rise in Covid-19 cases since the end of December suggests that the region may face a rocky start to 2021 (figure 9). While a number of countries in the region have launched or are preparing to launch vaccination campaigns, recent data out of Brazil that shows the Chinese Sinovac vaccine is only 50% effective at preventing mild cases is a setback for the region and Brazil in particular. Furthermore, many countries in the region will face a limited supply of vaccine doses this year. Thus, Latin America may be the laggard of the expected global recovery in 2021.

Complicating matters further is the limited fiscal space available for many countries in the region, as government deficits are already quite wide. This is particularly the case for Brazil, with an estimated fiscal deficit of 16.8% of GDP in 2020, according to the IMF. This is up from a deficit of 6% of GDP in 2019. The surge in government spending in Brazil last year may be one reason why the economic damage there has been more contained compared to other economies in the region (as of Q3 2020, real GDP was down 4% compared to pre-pandemic levels). While the recovery is clearly underway in Brazil, the need for fiscal consolidation will likely weigh on the pace of that recovery. Brazil’s public debt ratio is estimated to reach over 100% of GDP in 2020 (source: IMF) which is well above that of other emerging markets. As such, we anticipate annual average growth of only 2.9% in 2021.

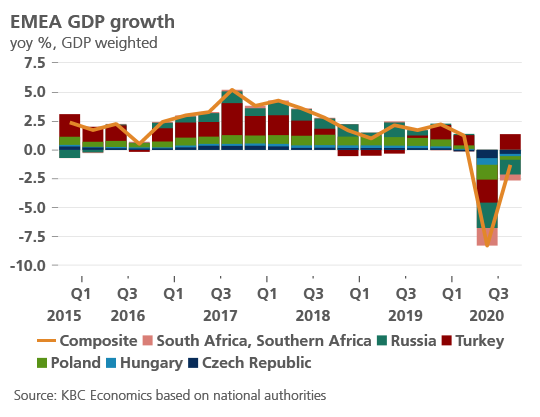

EMEA

Central and Eastern Europe

The Central and Eastern European (CEE) economies were negatively affected by another wave of the pandemic by the end 2020, which led to another tightening of lockdown measures (albeit less stringent than the spring). Services are again the most affected sector, while industry is in much better shape than in early 2020. With the exception of Bulgaria, industrial output has already recovered to pre-crisis levels in the CEE economies.

The so-called Kurzarbeit programmes remain in place across the region, though their implementation was affected by the deteriorating epidemic situation at the end of the year. Therefore, it is no surprise to see a decline in demand for labour across the region, which is reflected in redundancies and job vacancies. From February, when the pandemic was just beginning to be a topic, until November, the unemployment rate rose the most in Bulgaria (+1.3 pp) and Slovakia (+1.1 pp), while in Poland, the unemployment rate remained almost unchanged. In Hungary, the harmonised unemployment rate increased by one percentage point, and in the Czech Republic, by only six tenths.

Poland, whose labour market has been the least affected, has also been the least affected by last year's economic downturn. According to available data for the first three quarters, the Polish economy dropped by only 2.1% compared to Q4 2019. In contrast, in Bulgaria, the economic downturn has been almost three times as high. Hungary and the Czech Republic recorded a cumulative decline in GDP of more than 5%. However, the unemployment rate rose only slightly. The reason is the more favourable situation in industry, which plays an important role in both economies. (for more details on developments in Central and Eastern Europe, please see: Central and Eastern European’s labour markets: a limited impact from the pandemic).

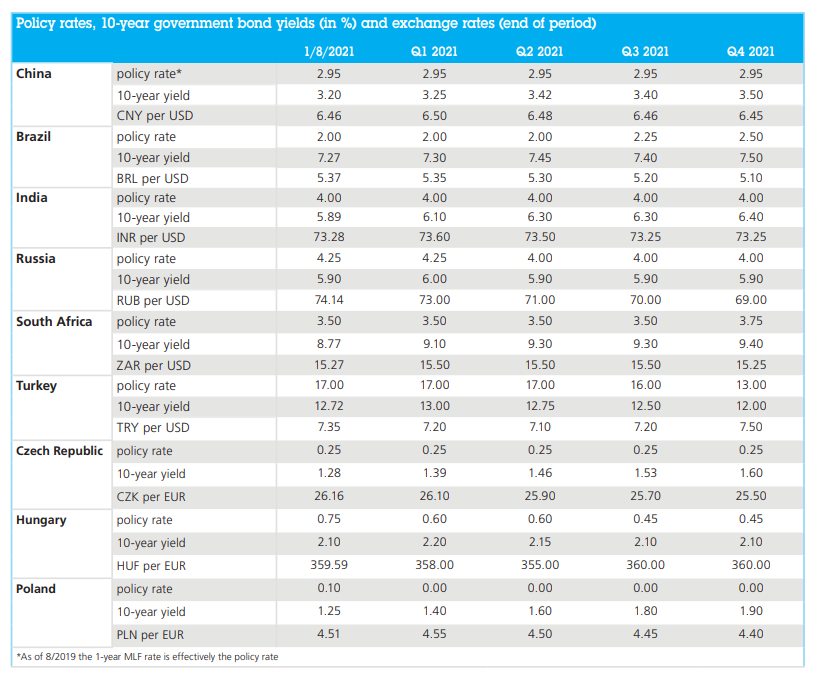

Turkey

The Turkish economy rebounded strongly in Q3 2020 following a substantial easing of lockdown measures over the summer months. A particularly robust bounce-back of private consumption and investment led to a massive 15.6% qoq growth, after a 10.8% qoq contraction in the previous quarter. As a result, output has already recovered above the pre-pandemic level, a notable outperformance of peer economies. Moreover, recent high frequency data, including industrial production and retail sales, suggest an ongoing expansion in the fourth quarter, albeit at a slower pace. Against this background, we expect positive annual real GDP growth of 0.5% in 2020, before the recovery picks up to 3.7% and 4.0% in 2021 and 2022, respectively.

There are two main reasons for a somewhat weaker growth momentum heading into end-2020. First, the deteriorating virus dynamics, causing the number of new Covid-19 cases to surge above 33,000 in December (almost a six-fold increase compared to the first wave peak). Second, a significant tightening of financial conditions, reversing the authorities’ effort to maintain activity by a rapid credit boom. The flip side of credit-driven growth was a widening current account deficit, a dramatic fall in foreign reserves, and a sharp weakening of the lira well above 8.00 USD/TRY.

These mounting macroeconomic imbalances triggered a pronounced shift to a more orthodox economic policy in November. The first step included the personnel reshuffling in both the ministry of finance and Turkey’s central bank (TCMB) towards a more technocratic leadership. Soon afterwards, the TCMB has delivered an aggressive monetary policy tightening, hiking the one-week repo rate from 10.25% to 17.00% in the space of two meetings. Furthermore, the central bank has markedly simplified its policy framework to provide more transparency. This has helped to calm the market and shifted sentiment, prompting a strong strengthening of the lira in late 2020.

We nonetheless remain cautious and think that more credibility-building effort is needed to demonstrate a profound and sustained change of course in Turkish policy. This is particularly the case due to the accelerating inflation pressures (headline inflation reached 14.6% yoy in December) and elevated inflation expectations, implying a need for a longer-lasting restrictive monetary policy. Conditional on the improving inflation outlook, we project a first moderate monetary easing in Q3 2021, with some risk tilted to a later start of the easing cycle.

Russia

The Russian economy has remained relatively resilient in the face of the Covid-19 pandemic. Following a modest contraction of 2.8% qoq in the second quarter, real GDP growth picked up by 0.7% qoq in Q3 2020 on the back of solid household consumption and private investment dynamics. Available activity data for the fourth quarter point to a mixed picture amid some tightening of the lockdown measures. Both retail sales and industrial output maintained solid momentum in October. However, November data weakened, indicating a challenging recovery path by the end of the year. As a result, we pencil in negative real GDP growth of 3.5% in 2020. Looking ahead, the Russian economy is projected to rebound by 3.2% in 2021 and 2.3% in 2022, well above the long-term potential growth.

On the monetary front, the Central Bank of Russia (CBR) has paused its easing cycle since mid-2019, leaving the key rate at 4.25%. The main reason has been a gradual pick-up in headline inflation to 4.9% yoy in December, driven by a lagged pass-through from the weaker rubble and higher agriculture prices. Assuming these temporary effects gradually abate, we expect another 25 basis point cut in Q2 2021, though the risk is tilted toward a no-change policy. To some extent, this is due to the uncertainties around the fiscal policy stance in 2021 and a possibility of a stronger-than-expected fiscal impulse, implying less accommodative monetary policy stance.

Furthermore, the rubble exchange rate remains a pro-inflationary risk to the inflation outlook. After a sizable depreciation in the third quarter, the rubble started strengthening against the dollar by late 2020, supported by rising oil prices and risk-on sentiment in global financial markets. Nonetheless, the lingering risk of additional US sanctions against Russia leaves the rubble vulnerable. There are currently several bills sitting in the US Congress (among others, DETER and DASKAA) that could potentially be passed into law with negative implications for the Russian economy. Ultimately, it remains to be seen how confrontational a stance the upcoming Biden administration will take against Russia.

South Africa

South Africa’s economy has been hit hard by the pandemic, with a drop in real GDP of 5.8% as of Q3 2020 compared to Q4 2019 (see again figure 4). However, given a number of structural disadvantages (including high inequality and poverty and limited fiscal space) and the fact that the economy was in a recession before the pandemic hit, South Africa’s economy has shown surprising resilience this year. After real GDP collapsed 16.6% quarter-over-quarter in Q2 2020, it rebounded 13.5% quarter-over-quarter in Q3 2020. Unfortunately, recent pandemic developments suggest that South Africa’s recovery will face strong headwinds at the beginning of this year. The emergence of a new, faster spreading strain of the virus has led to a new spike in Covid-19 cases and a steep drop in mobility as lockdowns were re-imposed. Given these most recent developments, together with long-standing structural issues, we expect only a gradual recovery in 2021, with annual average GDP growth of 3.7% (following a contraction in 2020 of 7.1%).

Tables and Figures