Czech Republic - Economic update

The Czech economy entered the third quarter in good shape, confirmed by data for the manufacturing and construction industry as well as for the services sector (figure 1). Production in the manufacturing sector - the Czech Republic’s most important industry - increased by 6.7% year-on-year. This was mainly due to production of electricity, manufacture of metal products and the automotive industry. The results were also significantly affected by last year’s lower comparative basis and by the shift of company-wide vacations in some large enterprises. The construction industry has been expanding strongly this year (+14.2%). Nevertheless, residential development hasn’t fully recovered yet from the recession of 2008-9. Weak housing completion in a time of persisting strong demand continues to cause real estate market overheating and a further rise in apartment prices. On the other hand, through the policy of tightening rules and recommendations for providing mortgages starting early October, the Czech National Bank (CNB) indirectly seeks to eliminate part of demand for real estate. However, we will only be able to assess the effect of the central bank’s new macroprudential measures after they have been in place for a while. However, we expect pressures on real estate prices to ease as a result of the mortgage market cooling down in line with expectations.

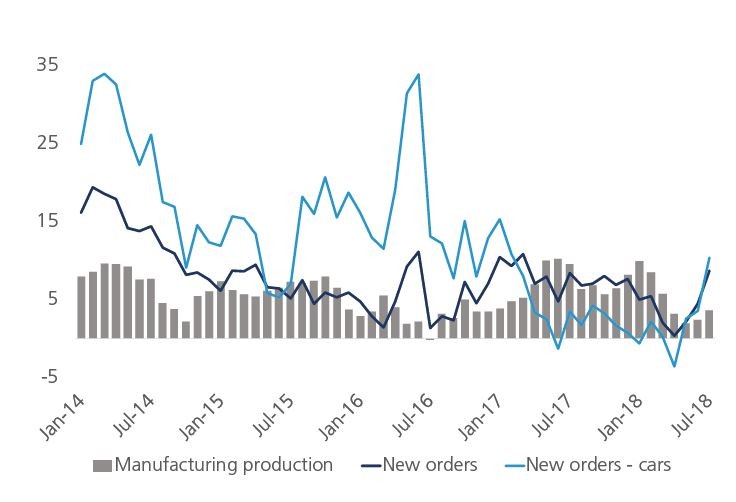

Figure 1 - Czech economy entered third quarter in good shape (% change yoy, 3 month moving average)

Although the beginning of the quarter was characterised by strong activity data, ‘soft’ sentiment indicators suggest that the Czech economy will slow down in the upcoming months. Probably the best sign is the PMI, which show that last month’s growth of new orders in manufacturing was the weakest in almost two years. On the other hand, however, cost and price growth on the part of both input and output remains under increasing pressure.

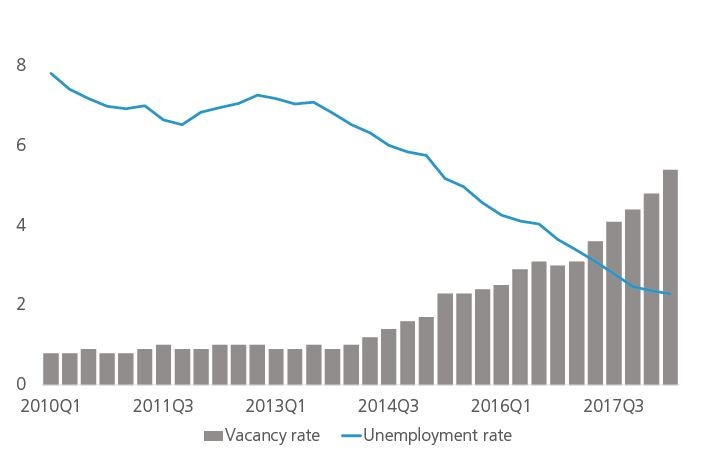

The developments in manufacturing suggest that the industrial sector has reached the limits of its technological and human potential, and room for further expansion will shrink without additional investments. Czech companies were not optimistic about labour market developments either. The unemployment rate remains at a historically low level while employment levels keep rising (figure 2). The number of job vacancies continues to increase and the job vacancy rate is the highest relative to other EU states. Hence, as a logical consequence of this labour market overheating, wage growth is accelerating. Moreover, wage pressures are pushed up further by double-digit wage growth in the public sector. However, the pass-through to inflation has been rather limited so far.

Figure 2 - More evidence of Czech labour market overheating (in %)

For the time being, the year-on-year inflation monitored by the central bank is ‘merely’ 2.5%. The level exceeds the CNB’s target of 2% inflation, but is still far from pointing to excessive inflationary pressures. Inflation developments continue to support the central bank’s policy of interest rate normalisation. This year, the CNB has raised its main interest rate four times, most recently in September to 1.50%. Moreover, the central bank clearly declared its intention to continue its policy of tightening monetary conditions going forward. We expect that the rather rapid rate hiking pace of the past year will be followed by a short pause during which the CNB will evaluate the initial results of its restrictive efforts. Nevertheless, the central bank’s monetary tightening relies heavily on the path of the Czech Koruna exchange rate (CZK). According to the CNB’s projections, the exchange rate will move towards 25.30 CZK per EUR by Q4 2018. This implies a 2% appreciation of the CZK compared to its current level. Unless this CNB scenario starts materialising shortly, the risk of another interest rate hike this year increases. However, this is not part of our base scenario yet. We still project no more rate hikes for this year and only one rate increase in 2019.