Emerging markets quarterly digest: Q1 2020 (en anglais uniquement)

Read the publication below or click here to open the PDF.

Emerging markets quarterly digest: Q1 2020

A few green shoots for emerging markets

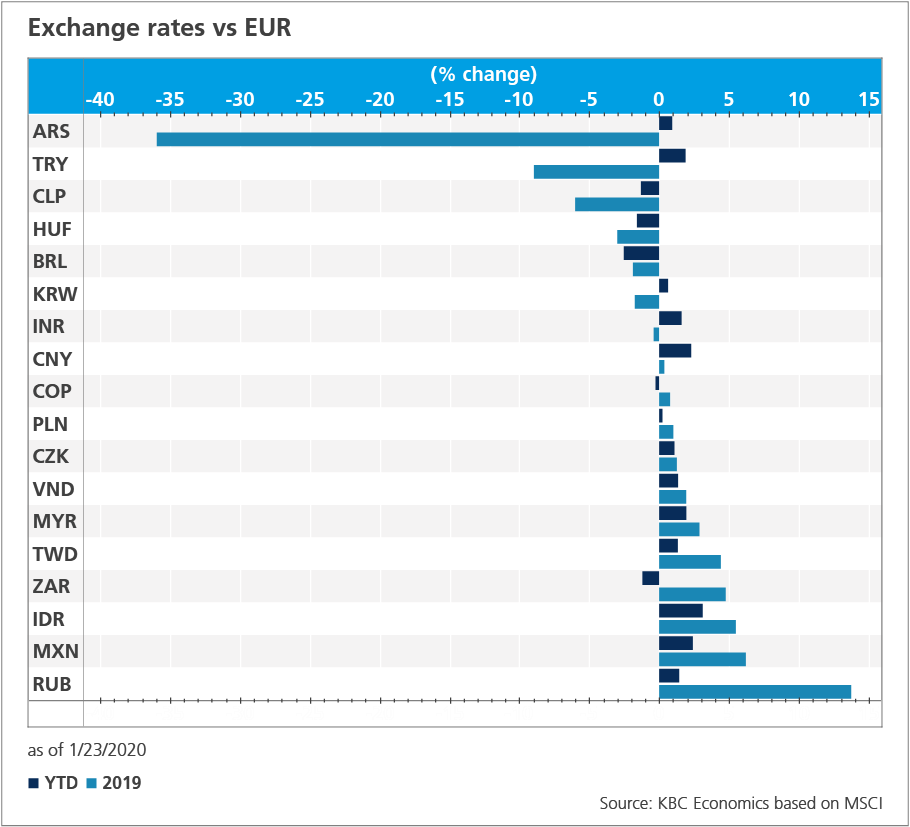

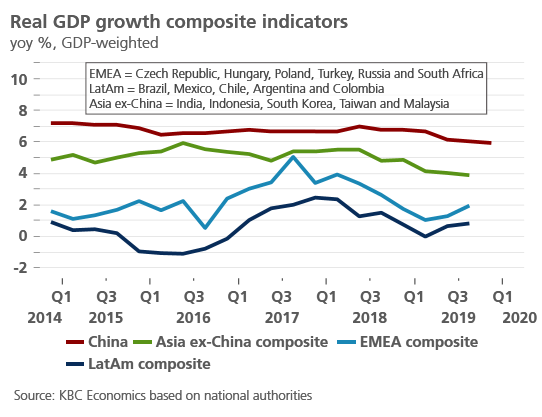

After the global economic slowdown in 2019, 2020 has started out on slightly more positive footing. Economic sentiment as well as activity data support a recovery in the global economy, though not all regions will evolve equally well.

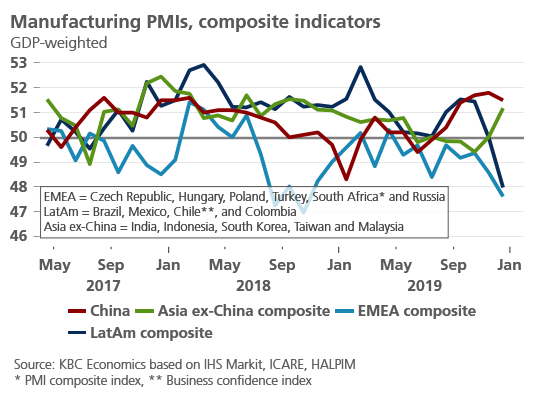

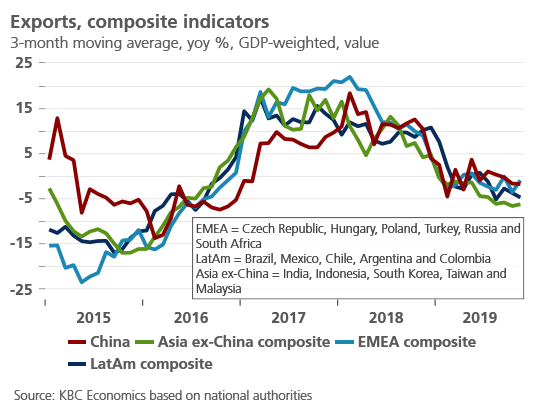

In emerging markets in particular, there are some notable green shoots popping up on the economic front at the outset of 2020. Better sentiment in manufacturing industries in a number of countries, signs of a gradual recovery in the euro area, still strong growth in the US, and a (temporary) easing of some of the risks related to the external environment are all hopeful signs of stronger growth for emerging markets at the start of the new decade. Indeed, the combination of moderately strong economic growth and easy monetary policy in advanced economies is often a positive one for emerging markets. Some downside risks do remain, of course. Though risks to the external environment, i.e. the US-China trade war and Brexit, have eased, those tensions are far from fully resolved. Furthermore, though the global growth momentum is stronger now than compared to recent months, in annual average terms, we still expect somewhat slower growth in the US, the euro area and China in 2020 compared to 2019. Country-specific factors will also play a role across emerging markets, with some economies experiencing a robust recovery while others face headwinds that span from credit crunches (India) to social unrest (Chile) to ongoing structural and external vulnerabilities (Argentina and South Africa). Overall, however, the outlook for many emerging markets is cautiously positive at the beginning of 2020.

Emerging Asia

A welcome reprieve for China

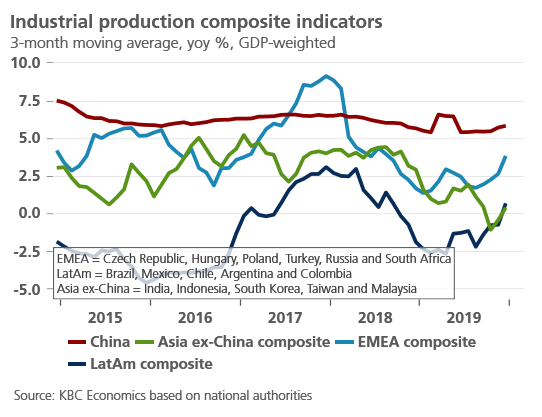

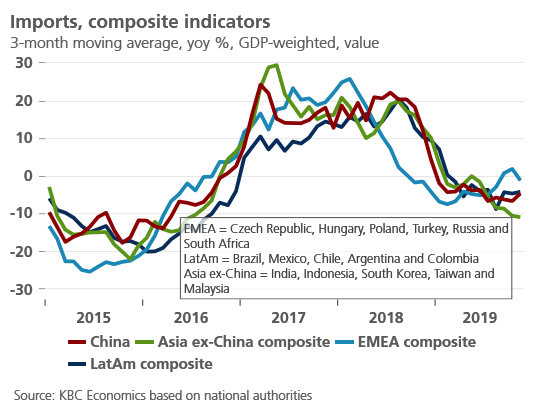

A string of positive Chinese data of late suggests that the government’s previous stimulus efforts are having some effect. China’s sentiment indiactors in manufacturing (PMIs) have recovered to expansionary territory while in the services industry they also remain strong. Industrial production growth is showing nascent signs of stabilization, as is fixed asset investment in the industrial sector. Particularly notable is the recovery seen in the automotive industry, which had been suffering from stricter emission rules and a generally slowing economy. Vehicle production bounced from a 21.6% yoy contraction in May 2019 to 8% yoy growth in December 2019. Growth in total social financing - a measure of credit in the economy - has recovered from lows reached at the end of 2018 and has stabilised at a somewhat lower (relative to recent years) but ultimately more sustainable level (10.7% yoy in November 2019). In the fourth quarter of 2019, real GDP growth remained stable at 6% yoy, according to official statistics, bringing China’s full year average growth in 2019 to 6.1%, as anticipated.

Other high-profile positive news for China includes the signing of a phase I trade deal with the US in January, which avoids a further escalation of tariffs and reduces some of the tariffs already in place. China, in exchange, has pledged to increase its imports of US goods and services by $200 billion over the next two years, which is more than the total amount China purchased from the US in 2017. It also made some commitments on intellectual property. The reduced uncertainty, however, is undoubtedly good news for an economy whose growth rate slowed from 7.0% in 2017, to 6.7% in 2018, to only 6.1% in 2019 (according to recently revised data). While the trade war was not the sole driver of the slowdown, it increased uncertainty, weighed on sentiment, and likely had some negative impact on China’s manufacturing industry and foreign trade.

Despite this good news, which should support growth in the first quarter, our overall, long term outlook for China remains unchanged, with growth steadily edging lower as China’s potential growth rate declines. Key drivers behind this outlook remain the many structural challenges facing the Chinese economy, including worsening demographics and the high indebtedness of both China’s corporate sector and households. This high indebtedness, in turn, poses risks to the financial sector and real estate sector, respectively. These factors complicate China’s transition to a more domestic and services-based economy. Furthermore, the phase I trade deal does not settle all of China’s international disputes, including the myriad of issues related to technology.

While we do expect some further limited policy easing in 2020, such easing will be measured in the face of elevated inflation driven by food prices and, more importantly, the aforementioned debt issues. The PBoC’s announcement that existing loans priced with old benchmark lending rates should be priced with the new benchmark rates is a further step towards interest rate reform and is a sign of the government’s goal of fixing the country’s monetary policy transmission mechanism. An important watch point will also be the government’s announcement of its growth targets in March, which will likely be revised lower to 6% for 2020 (from 6-6.5% previously), and likely even lower for the next several years. Overall, however, given the above factors, and ongoing external headwinds and risks, we expect GDP growth to slow to 5.7% in 2020.

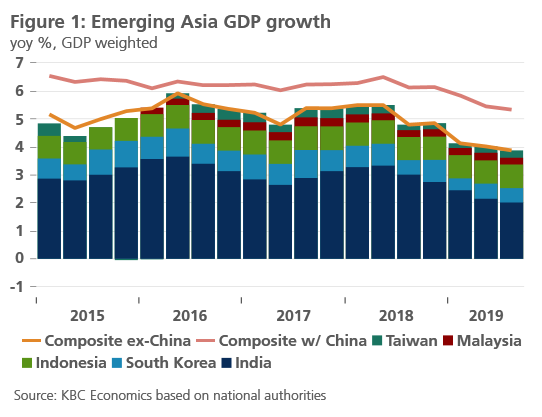

Heterogenous developments in 2019; cautiously positive outlook for 2020

The outlook for several other emerging Asia economies at the start of 2020 is also cautiously positive. A look at a composite GDP indicator (see figure 1) shows that much of the growth slowdown in the region came from China, India, and South Korea. The latter was particularly affected by a downturn in the semiconductor or high-tech chip industry. Malaysia, Indonesia and Taiwan, in contrast, have fared better, generally supported by still strong consumption. Furthermore, there are signs that chip sales have bottomed out, and a rebound can be expected in 2020, which will be advantageous to several economies in the region, especially South Korea. Possibly reflecting this, as well as a slightly more favorable external environment going forward, manufacturing sentiment (as measured by PMIs) in Taiwan, South Korea and Malaysia have all improved in recent months. In addition, low inflation throughout most of the region and the continued easy policy of major central banks like the Fed and ECB have given central banks in the region room to cut policy rates throughout 2019. This policy easing should help support growth in 2020.

India on shaky ground

As noted above, economic growth in India slowed substantially over 2018 and 2019. The qoq annualized rate of real GDP growth fell from 7.9% in Q1 2018 to only 4.2% in Q3 2019. Much of this slowdown can be attributed to falling private consumption and a credit crunch for private businesses. The latter manifested primarily in 2019 and was driven by a crisis in India’s shadow banking industry. As bank credit to non-bank lenders dried up, small businesses which rely heavily on non-bank institutions for funding saw their credit dry up too.

The Reserve Bank of India (RBI) has responded with five rounds of cuts to the policy repo rate. The central bank has lowered rates by 135 basis points since February 2019 to 5.15%. We expect one further 25 basis point cut in the first quarter of 2020 before the RBI pauses in the face of rising inflation. Though the easing has been slow to filter through to the economy, PMIs are showing first signs of stabilization at a level still above 50, signifying expansion. India’s GDP growth is typically measured over the fiscal year ending in March, and while annual growth is expected to reach only 5.1% this year (down from 6.8% the previous fiscal year) a modest recovery is expected thereafter.

However, this modest recovery is on shaky ground. For the most part, hard data have yet to confirm the stabilization seen in sentiment. Furthermore, while some uncertainty regarding Brexit and the US-China trade war has been lifted, improving the external environment for India, those risks are not completely resolved. On top of the complicated economic outlook, India is facing its own political turmoil. Protests have broken out recently in response to a controversial citizenship law that is seen as discriminatory against India’s minority Muslim population. The protests have erupted in several major cities, including the capital city of New Delhi, and have turned violent in several cases. If the unrest persists and damages the recovery in consumer spending, India’s economic slowdown could be prolonged.

Latin America

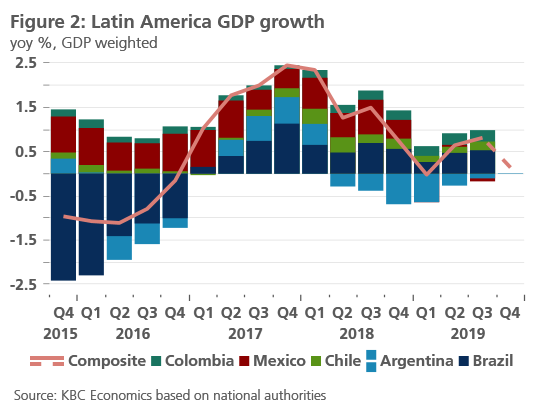

Latin American economies have also faced a difficult two years with growth slowing notably over 2018 and remaining very sluggish for most of 2019 (see figure 2). The recession in Argentina starting in 2018 played a substantial role in this, as did a flatlining of the Mexican economy this year. On the other hand, in both Colombia and Chile growth kept a strong pace throughout most of 2019.

In Brazil, meanwhile, growth picked up after a particularly weak Q1 2019, buoyed by investment and robust household consumption. Industrial production in Brazil recovered at the beginning of Q4 2019 and the outlook for growth next year is generally positive. Given low inflation, Brazil’s central bank has been able to lower its policy rate several times, altogether bringing the rate from 6.5% in July 2019 to 4.5% as of 11 December 2019. This easing should continue to support growthgoing forward. We expect Brazil’s real GDP growth to therefore reach 1.1% for 2019 – slightly lower than the 1.3% reached in 2018 – and then accelerate to 2.1% growth in 2020.

Latin Spring?

One major risk factor for some economies in the region, however, is ongoing social unrest and associated political developments. In Chile, retail sales dropped off precipitously in October as protests swept through the country. The demonstrations are a response to rising costs of living and inequality, and they are likely to persist as a referendum on constitutional reform in April approaches. Colombia has also faced a rash of civil unrest in recent months, with several national strikes sparked by proposed pension cuts. The protest movement there has now evolved to reflect widespread and longer-term dissatisfaction with President Duque and the Colombian government.

Beyond domestic political turmoil, there is also the risk that the region could be drawn into foreign political drama as well. In December, US president Trump announced he was re-imposing steel and aluminum tariffs on imports from Brazil and Argentina and then backed down from that threat. The possibility of re-imposing the tariffs remains on the table, however, and the fact that two of the region’s major economies appear to be new targets of Trump’s often destructive trade policies is an important development and risk. However, on a more positive note, the USMCA, the trade agreement between the US, Mexico and Canada that replaces NAFTA, has passed both houses of the US Congress. Hence, there may be both upside and downside risks for the region in 2020, with some economies likely faring better than others.

EMEA (Europe, the Middle East, Africa)

Mixed developments in Central Europe

At first glance it may appear that Central Europe is starting to feel more intense pressure from the German industrial recession. Industrial output declined in November by approximately 1% mom (seasonally adjusted) in Poland, Hungary and the Czech Republic. However, this moderation in industrial production comes as we observe first signs of bottoming-out in Germany’s industrial sector. Moreover, the overall impact of the German industrial recession on Central Europe has been somewhat limited and certainly country specific. While German manufacturing output has fallen by more than 8% between January 2018 and the end of October 2019 (recovering slightly in November), the situation in Central Europe is different. Especially in Hungary and Poland, manufacturing output is well above the levels recorded at the beginning of the German industrial recession. In contrast, the Czech Republic has seen a somewhat larger impact, though production levels have beenbasically flat since the start of the German industrial recession in spring 2018. Slovakia too seemed to have been more sensitive to developments in Germany, but industrial production data in Slovakia tend to be more volatile compared to the rest of the region.

The resilience of certain Central European industrial sectors can be partially explained by the lower sensitivity of the region’s manufacturing sector towards Asian markets (specifically China and South Korea) compared to Germany. This also helps explain why the region as a whole has been more immune to the spike in global trade uncertainty in 2019. In addition, more resilient domestic demand supported by more relaxed fiscal conditions can explain the higher resilience of Poland and Hungary compared to the Czech Republic. Polish and Hungarian governments have been running budgets with structural deficits around 3% of GDP, while the Czech structural deficit was expected to be only -0.3% of GDP according to the European Commission.

Looking ahead, we remain optimistic with regards to the regional growth outlook. Although the hard industrial data may deteriorate a bit further over the next few months, the bottoming-out of German sentiment and production data, the easing of both the US-China trade tensions and Brexit uncertainty, and the more encouraging regional leading indicators are the main arguments for our moderate optimism for the Central European economies in 2020.

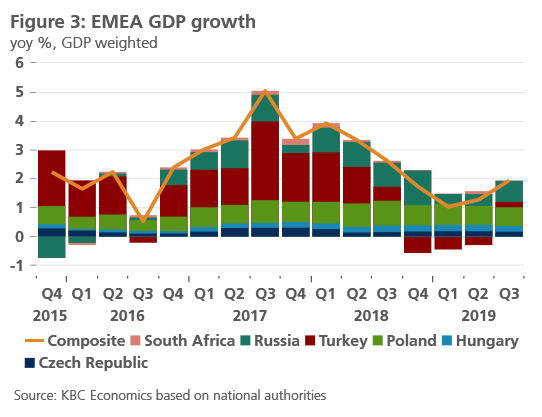

Russia

Following a weak start to 2019, Russian economic growth accelerated in the third quarter, helped by more accommodative monetary policy (figure 3). The Central Bank of the Russian Federation (CBR) has delivered rapid monetary easing since mid-2019 (amounting to 150 bps) on the back of subdued inflation pressures. With headline inflation remaining below the CBR’s inflation target, we see further, albeit more limited, room for monetary authorities to continue an easing cycle and expect the CBR to cut the key rate to 5.5% by end-2020.

Fiscal policy, on the contrary, has been only gradually turning to a more expansionary stance, following a post-crisis period of a prudent macro-economic mix aimed at rebuilding buffers. The implementation of national investment projects, which total around 3.0% of GDP annually for the period 2019-2024, has seen a very slow start and accelerated visibly only towards the end of 2019. We expect that budget spending will pick-up throughout 2020, supported also by newly announced plans for family-focused social spending. Although consumer spending is set to remain relatively sluggish, the supportive mix of fiscal and monetary policy should boost economic growth modestly in 2020 to 1.7%.

Turkey

The Turkish economy has rebounded from a recession triggered by a currency shock in mid-2018. In the third quarter, it posted its first positive year-on-year growth since Q3 2018, largely thanks to a combination of expansionary fiscal and monetary policy. While fiscal stimulus has encompassed tax cuts or food price discounts, monetary policy delivered an aggressive front-loaded easing. Since the appointment of the new governor in July, Turkey’s central bank (CBRT) has consistently surprised with larger-than-expected rate cuts that cumulatively amount to 1200 bps and brought the key rate to 12.0%. Furthermore, the CBRT has implemented macro-prudential measures to revive credit growth, especially from state-owned banks.loaded easing. Since the appointment of the new governor in July, Turkey’s central bank (CBRT) has consistently surprised with larger-than-expected rate cuts that cumulatively amount to 1200 bps and brought the key rate to 12.0%. Furthermore, the CBRT has implemented macro-prudential measures to revive credit growth, especially from state-owned banks.

The recovery in real GDP growth is set to pick up in 2020 to 2.5% as the Turkish authorities continue to prioritize growth over correcting existing imbalances. This, however, leaves the economy vulnerable and puts the long-term sustainability of primarily credit-driven growth into question. While fiscal policy is likely to remain loose, deteriorating the budget balance further, the central bank is set to cut interest rates further. Elevated inflation that is firmly entrenched in double-digit territory will limit the scope for monetary easing. Hence, we expect a more cautious stance and see the key rate at 10.0% by the end of 2020, with a risk of a more aggressive monetary stimulus amid lingering political pressures.

Another downgrade for South Africa likely

South Africa’s economy continues to be plagued by major structural issues that drag on economic growth and heighten vulnerabilities. Issues include infrastructure bottlenecks, unreliable electricity supply, labor market rigidities and severe inequality. Furthermore, some state-owned enterprises, in particular electricity provider ESKOM, continue to face enormous financial and operational problems requiring state bailouts. As a result of the weaker growth and higher expenditures, South Africa’s fiscal accounts continue to deteriorate. South Africa is now likely to lose the investment grade status of its sovereign debt in 2020 when Moody’s is expected to downgrade its credit rating. For this reason, the treasury’s Medium Term Budget Policy Statement (MTBPS) to be released in February 2020 will be an important signal for both investors and the ratings agencies. Despite weak growth in 2019 (expected to reach only 0.3% in annual terms) and inflation below the target, the central bank (SARB) remained on hold throughout the year given financing risks. However, as we expected, the SARB finally eased the policy rate in January to 6.25%, on the back of inflation that is well below the target and still sluggish growth. We currently don’t have any more monetary policy easing forecasted for 2020, but given downside risks to growth, additional easing is not off the table. Only a slight rebound to 0.8% growth is expected in 2020.

Middle East & North Africa

The short-term economic outlook for countries in the Middle East and North Africa remains generally subdued given vulnerabilities to slowing global growth, particularly in Europe and China, and still-unresolved uncertainties surrounding global trade and Brexit. Furthermore, geopolitical tensions and domestic political unrest will likely weigh on the region going forward. In particular, the recent escalation of the conflict between the US and Iran raises uncertainty for the region, although we do not expect an escalation to a full-blown military conflict. If the conflict between the US and Iran does escalate further, however, there could be additional economic impacts beyond just Iran. Investment and tourism in neighboring countries like the UAE, for example, could also suffer. There could also be a more sustained impact on the price of oil. Notably, however, oil prices have become much less sensitive to geopolitical developments in the Middle East. This mainly reflects a structural shift in the market as shale oil from the US now represents a significant portion of global oil supply. At the same time, subdued global demand and heightened uncertainties are keeping downward pressure on prices.

Tables & Figures

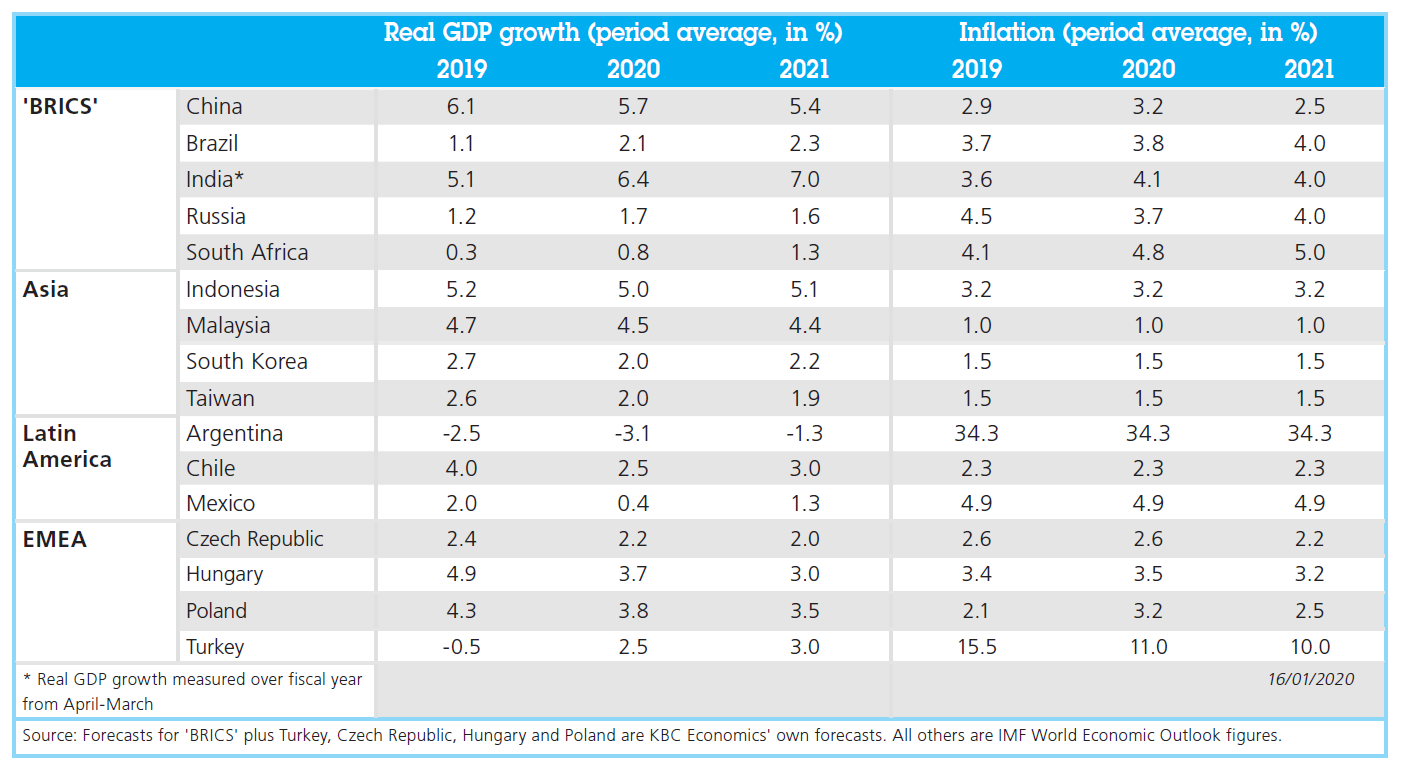

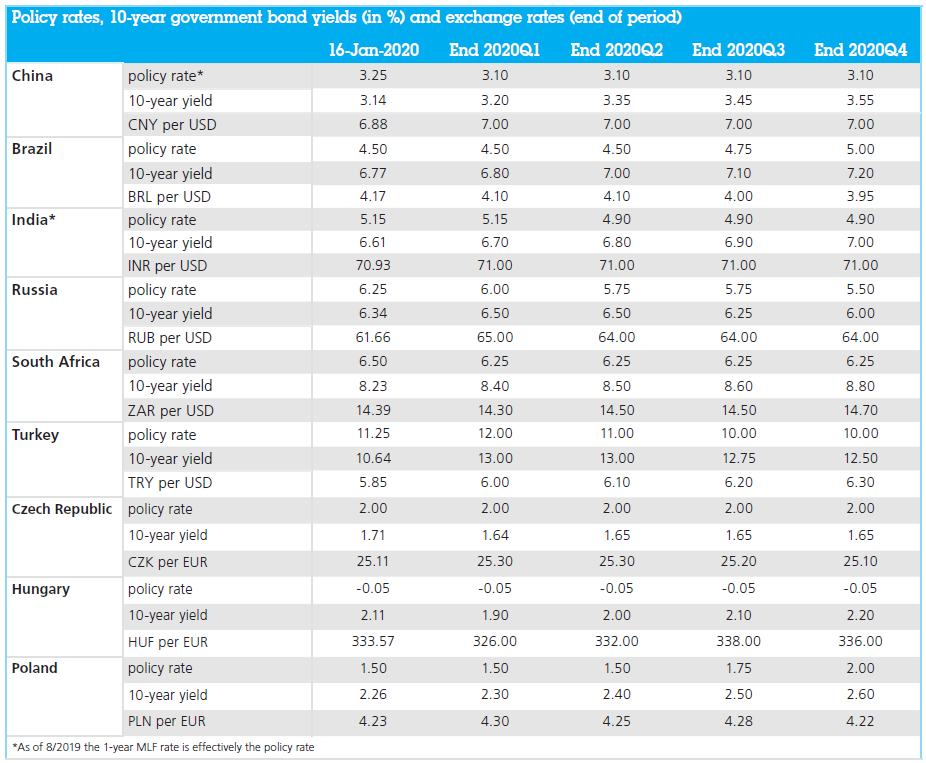

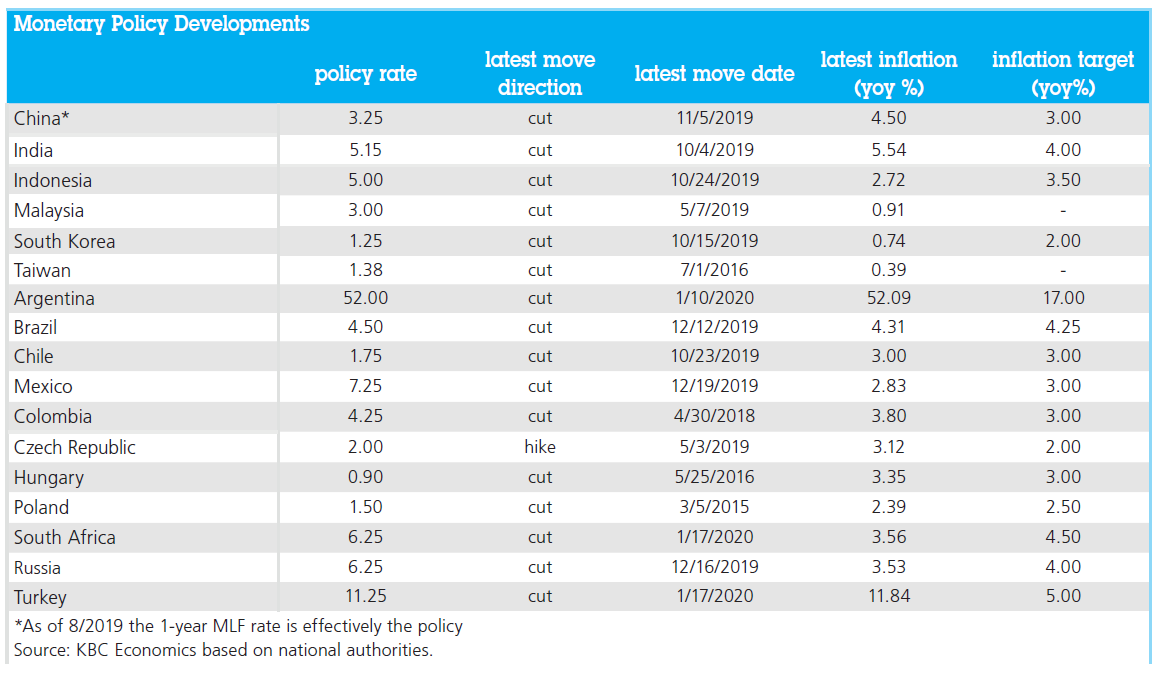

Outlook emerging market economies